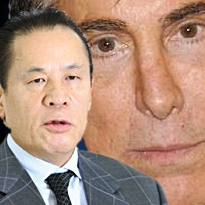

In a surprise weekend attack, Wynn Resorts has struck back at its largest shareholder, forcibly buying out the stake held by Japanese businessman Kazuo Okada and ‘requesting’ that he immediately step down from the company’s board of directors. Wynn will also ‘recommend’ that Okada be removed from the board of Wynn Macau. In a statement released Sunday, Wynn said it will redeem Okada’s 24m shares (held by Aruze USA Inc.) for $1.9b, a 32% discount from the $2.7b the shares would be worth based on Friday’s closing price. To cover the cost of the move, Wynn will issue a $1.9b promissory note with an annual interest rate of 2% maturing in 2022.

In a surprise weekend attack, Wynn Resorts has struck back at its largest shareholder, forcibly buying out the stake held by Japanese businessman Kazuo Okada and ‘requesting’ that he immediately step down from the company’s board of directors. Wynn will also ‘recommend’ that Okada be removed from the board of Wynn Macau. In a statement released Sunday, Wynn said it will redeem Okada’s 24m shares (held by Aruze USA Inc.) for $1.9b, a 32% discount from the $2.7b the shares would be worth based on Friday’s closing price. To cover the cost of the move, Wynn will issue a $1.9b promissory note with an annual interest rate of 2% maturing in 2022.

Okada, the head of pachinko giant Universal Entertainment Corp., had recently sued Wynn for access to internal documents regarding a $135m donation the company had made to the University of Macau last July. Okada had also butted heads with Wynn chairman/CEO Steve Wynn over Okada’s decision to construct his $2b Manila Bay Resort casino project in the Philippines. According to the Wynn statement, the Manila Bay project prompted Wynn’s Compliance Committee to launch an investigation into Okada’s dealings with Philippines officials.

The year-long investigation, conducted by former Nevada Gov. Robert Miller and ex-FBI director (and current FairPlayUSA lobbyist) Louis Freeh, allegedly turned up $110k of illicit cash payments and gifts made over a three-year period to “two chief gaming regulators” at the Philippines Amusement and Gaming Corporation (PAGCOR) that were directly overseeing Okada’s activities. Wynn claims it was “deeply disturbed” to learn of these payments, “the nature and amount” of which they claim Okada and his minions tried to conceal. Wynn claims the payments violated the Foreign Corrupt Practices Act (FCPA) – for which Wynn itself is currently under investigation by the Securities Exchange Commission over its Macau university donation – leading the board to (unanimously, apart from Okada) deem Okada “unsuitable.” This alleged unsuitability is what allowed Wynn to forcibly redeem Okada’s stake at “fair value.”

Okada has yet to publicly respond to any of Wynn’s allegations, but the Wall Street Journal reported that Okada told investigators he learned of the payments after the fact and that two Universal employees had subsequently left the company after Okada ordered his own investigation into the matter. Wynn maintains that Okada is/was the only Wynn director “who has continued to refuse to sign the Company’s Code of Conduct” or participate in mandatory FCPA training for directors. Wynn also allege that Okada told them gifts to regulators are permissible in Asia (although this doesn’t jibe with their claim that Okada tried to conceal the alleged payments). Wynn has filed a lawsuit against Okada, Aruze and Universal for breach of fiduciary duty and related offenses, and intends to share the results of its internal investigation with regulators in other gaming jurisdictions, including Macau and Nevada. The company has scheduled a conference call for Feb. 21 at 9am EST.

Unrelated to Mr. Okada’s woes, Paris Hilton claims to have won $30k playing blackjack at Wynn Las Vegas on Friday, which just happens to be her 31st birthday. No word on whether Wynn plans to issue a promissory note to cover this shortfall.