Online betting site Moplay has told customers that the money in their accounts may be unrecoverable as its parent company faces insolvency.

Online betting site Moplay has told customers that the money in their accounts may be unrecoverable as its parent company faces insolvency.

Last week, Addison Global Ltd had its gaming licenses suspended by both the Gibraltar Gambling Licensing Authority and the UK Gambling Commission (UKGC) after a key shareholder reportedly backed out of financial commitments aimed at keeping the company afloat.

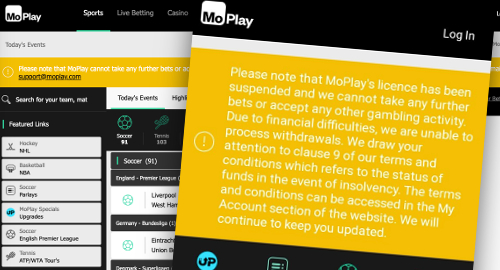

While the Moplay site initially informed customers that the impact was limited to taking any further bets or accepting “any other gambling activity,” the wording was changed this weekend to say that “financial difficulties” meant the site was “unable to process withdrawals.” The message directed customers to “clause 9 of our terms and conditions which refers to the status of funds in the event of insolvency.”

Said clause notes that customer funds “will be held separate from company funds in a mixture of bank accounts and reserve funds which we hold with our payment processors. However, if there was ever a situation where we became insolvent, your funds would not be considered separate to the other company assets and you may not receive all your funds back.”

While the message promised to keep customers informed of any further developments, it seems a bad bet that any customers who failed to have their withdrawal requests processed before this weekend will ever be reunited with their deposited funds.

Addison Global’s senior management reportedly resigned en masse shortly before the suspension of the company’s Gibraltar license, although some reports indicated that the team was continuing to work with the aforementioned shareholder in a bid to keep the business afloat.

Moplay’s apparent implosion will put further heat on the UKGC, which has made consumer protection a key plank of its responsibilities. The UKGC recently came under fire from parliamentarians who felt the regulator was too cozy with some of its licensees, with an All Party Parliamentary Group going as far as to declare the UKGC “unfit for purpose.”