The gaming stocks model portfolio was opened on January 19th. As 2016 comes to a close, let’s reassess and see where we stand for the year, and go through which current positions should be held, and which sold. No buys to be recommended today. Only realized gains and losses on closed positions will be calculated. Unrealized gains and losses on long term holds will be held into 2017, and possibly added to.

On January 19th, the model was opened with:

On January 19th, the model was opened with:

1) 7% position in MGM Resorts (MGM)

2) 3% position in Penn National Gaming (PENN)

3) 3% position in Eldorado Resorts (ERI)

4) 2% position in Boyd Gaming

5) 15% position in 888

6) 15% position in Paddy Power, now Paddy Power Betfair (PPB)

7) 10% position in Rank Group (RNK)

8) 5% position in NetEnt AB (STO:NET-B)

The rest is cash.

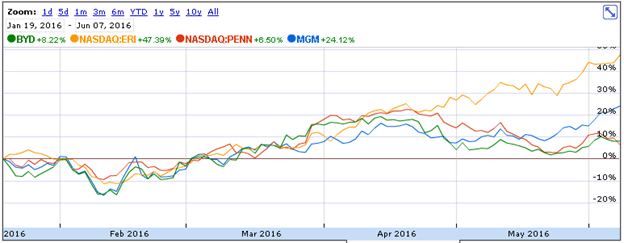

Positions in MGM, Penn, Eldorado, and Boyd were all sold on June 7. Here is a chart of those four stocks during the time they were held.

Eldorado rose 47.4%, MGM 24.1%, Penn 6.5%, and Boyd 8.2%. Taking position sizes into account, that translates to total gains of:

1) 1.42% on ERI

2) 1.68% on MGM

3) 0.16% on BYD

4) 0.19% on PENN

These translated to total portfolio gains of 3.45% by June 7. The logic for the short term buys was a monetary momentum play. Stocks had fallen badly into mid January for reasons that looked related to oil and maybe some margin calls. Money supply was growing and a low oil price has nothing to do with the performance of the gaming industry. It can only help it as costs of doing business go down, so we bought. They were not long term because none of them have the healthiest of balance sheets. Since then, Eldorado and Boyd have continued to rise both over 7%, but Penn has fallen close to 8%. The other positions were held, and continue to be for the long term.

Continuing on, we bought a 5% position in Amaya (AYA) on February 9th for $13.28 on the Nasdaq, and sold it on October 11th. We bought in February assuming a deal would be made by David Baazov to take the company private for a premium. That hasn’t happened yet, but we sold the stock because gains were sufficient and there was no need to get greedy on a company with an uncertain future as to who leads it and what it is, plus a debt overhang. Here’s the chart from February 9th to October 11th.

Since we sold it, Amaya has fallen 10.2%. Total gains here were 1.43% for the model, adding to 3.45% totals 4.88% gains locked in.

A 5% MGM position was reestablished on June 28th, along with a 3% position on Las Vegas Sands, the first and only Macau position to be cautiously taken on assumption of a rebound following unrelated and overblown Brexit trauma, and a healthy money supply growth situation. Both positions were sold on August 9th. The chart for both between those dates:

Total gains on LVS were 0.72%, and total gains on MGM were 0.78% locked in for a total of 1.5%, or 6.38% overall for all closed positions.

Take into account the 0.5% loss on Caesars PUT options, and that brings total realized gains down to 5.88%.

A 5% position was taken in Red Rock Resorts on August 30th. Since then RRR is up 4.2%. That cash can be better used elsewhere next year and may as well take profits now. With stocks at all time highs a correction is bound to happen soon regardless of fundamentals. Total gains are miniscule at .02%, but it’s better than a loss. Total realized gains now total 5.9%.

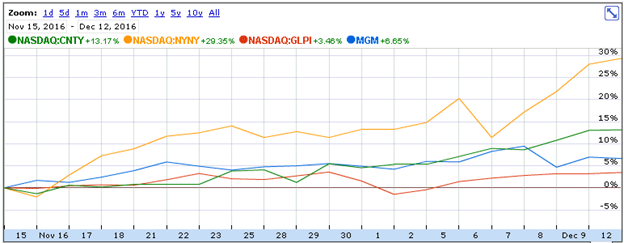

We had another busy day on November 15th after Trump took the White House, when we once again reestablished a 5% position in MGM. We also added 5% positions on US small cap gaming stocks including Century Casinos (CNTY), Empire Resorts (NYNY), and the Gaming and Leisure Properties REIT (GLPI). Here’s the chart since November 15th:

A nearly 30% gain in Empire Resorts is enough, so time to lock in profits there and move the capital somewhere else for later opportunities. A 13% gain in Century is also quite enough. GLPI and MGM can continue to be held for now. That brings total realized gains to 1.46% on NYNY, and 0.66% on CNTY, together 2.12%, totaling 8.02% realized gains for the model portfolio for 2016.

Finally, a 5% position was just taken last week in Nagacorp, anticipating successful expansion into Russia in the coming years. Nothing has happened yet with the Nagacorp position, and can continue to be held into next year.

As for long term holds, they are not doing as well. The only successful one so far is 888. A 15% position was taken January 19th, with 3% more added on March 22nd and another 2% added on June 28th. 888 is up 15.5% since January 19th, 13.91% since March 22nd and 9.39% since June 28thh.

Unfortunately, Paddy Power Betfair, Rank, and NetEnt are all down significantly. Depending on how next year opens, we may be adding to these long term holds to take advantage of lower prices. A 20% position in 888 is big enough.