Details are emerging about the cornerstone investors in MGM China Holdings Ltd.’s upcoming $1.5b initial public offering. Sources told Reuters that hedge fund manager John Paulson plans to sink $75m into the joint venture of Pansy Ho and MGM Resorts International. Former MGM board member Kirk Kerkorian’s Tracinda Corp. wants up to $50m. Two Asian property developers, Poon Jing of Asia Standard International and a family trust controlled by Walker Kwok of Sun Hung Kai fame, are in for up to $40m and $25m respectively. The IPO is set to go off June 3, with some 760m shares made available at a share price range of HK$12.36-15.34 (US$1.59-1.97). Each of the cornerstone investors has pledged not to sell their shares for at least six months.

Details are emerging about the cornerstone investors in MGM China Holdings Ltd.’s upcoming $1.5b initial public offering. Sources told Reuters that hedge fund manager John Paulson plans to sink $75m into the joint venture of Pansy Ho and MGM Resorts International. Former MGM board member Kirk Kerkorian’s Tracinda Corp. wants up to $50m. Two Asian property developers, Poon Jing of Asia Standard International and a family trust controlled by Walker Kwok of Sun Hung Kai fame, are in for up to $40m and $25m respectively. The IPO is set to go off June 3, with some 760m shares made available at a share price range of HK$12.36-15.34 (US$1.59-1.97). Each of the cornerstone investors has pledged not to sell their shares for at least six months.

This weekend’s launch of Galaxy Macau has given Steve Wynn some things to ponder. Wynn plans to open a second Macau property by 2015, but some last minute redrafting may be in the works. “I saw a couple things at Galaxy the other day that made me take another look at some stuff I had drawn myself.” Sadly, that’s as much detail as Wynn would provide, but we expect Steve went straight home, got out his crayons and put on a pot of coffee. Or tea, perhaps? Wynn made a point of noting that “we think of ourselves very deeply as a Chinese company in many respects.” Not surprising, given the two-thirds share of profits the Macau operation provided Wynn Resorts last quarter.

But why stop at China? With 95% of Macau’s tourists arriving from across Asia, Galaxy Entertainment chairman Lui Che Woo describes Galaxy Macau’s main selling point as ‘World Class, Asian Heart’ – international-caliber standards with the “heartfelt service culture and unique flavor of Asia.” This pan-Asian approach is “especially critical for success in a market where Asian travelers are so dominant.” Of the resort’s three hotels, Galaxy controls one, while Singapore’s Banyan Tree and Japan’s Okura have the others. That latter name might surprise, given the currently tiny percentage of Japanese that visit Macau, but with Japan viewed by many throughout the region as tastemakers, the hotel’s appeal may lie closer to home.

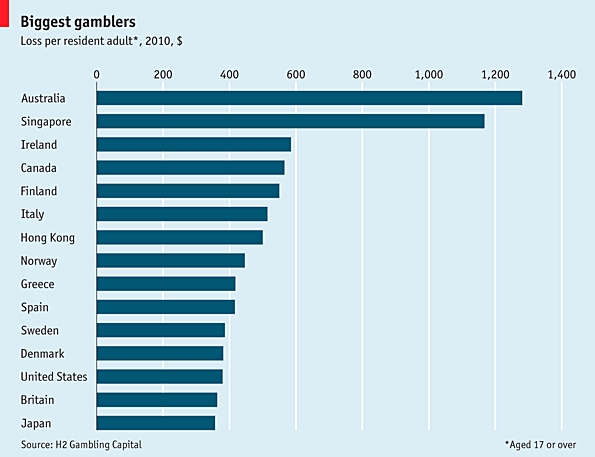

Believe it or not, Macau failed to make the grade on H2 Gambling Capital’s list of the world’s biggest gamblers. The list was based on net spending on each nation’s legal forms of gambling divided by number of residents over 16 years of age. (Macau relies on gambling tourists, rather than residents.) Looking at this graph from The Economist, Australians clearly have some explaining to do. The novelty of Singapore’s year-old integrated resorts helped boost its ranking, while emphasis on the forms of gambling blessed by the state likely counts for America’s lowly ranking. Anyone else find it interesting that Britain now ranks behind its former colonies (including America) on this list?