Kevin Kelly, founding editor of Wired magazine, said something profound about innovation. The nature of an innovation,” he said, “is that it will arise at a fringe where it can afford to become prevalent enough to establish its usefulness without being overwhelmed by the inertia of the orthodox system.” Innovation is a big risk. It might not work. It might waste capital, and so it is never adopted by the mainstream outright, which has to compete mainly through volume and size rather than cleverness. Innovation is almost always tested first on the fringes of an industry, and once its usefulness becomes obvious, only then will it be adopted by the mainstream.

This reality presents a disturbing problem in today’s world. The fringes of almost every industry are under attack. Lockdowns, shutdowns, capacity limitations, they are all taking a sledgehammer to small business all around the world as Big Business like Amazon, Apple and Google take over. Small business though is the incubation grounds for human progress. As more of our lives come under the purview of these behemoth businesses – and I cannot think of a single person who does not rely acutely on all of three of the above companies – humanity increasingly resembles a hive. There are a few queens, and the rest of us are drones.

It’s not just tech. Daniel Oliver of Myrmikan Research notes that before the pandemic response was unleashed, two thirds of American restaurants are supplied by a single company, Sysco Foods. Four companies control half the food retail sector. Since 1950, the number of chicken producers has fallen 98%. Nearly 90% of soft drinks are controlled by 3 companies. None of this is natural or inevitable though, and that’s a good thing. It all has to do with the exceptionally low cost of capital, extremely low and even negative interest rates that small business has no access to because they do not have the economies of scale in order to qualify for wholesale funding.

We all know the same thing is happening in the gaming industry as well, the most obvious example being the strongest European market, the United Kingdom. Consolidation and rollup in the gaming sector has proceeded at an alarming pace over the last 5 years as real interest rates have fallen to negative. Still, in a paradoxical way, gaming has an inherent advantage over almost any other industry when it comes trends of capital concentration. That is, Big Government is not a perfect friend to Big Gambling as it is with, say, Google, Facebook, Apple or Amazon.

Big Gambling and Big Government have a love/hate relationship that alternates depending on when it is convenient for the latter to whip the former. Government tends to attack gambling even at the obvious risk (one might argue certainty) of killing the goose that lays the golden egg. Just look at Nevada governor Steve Sisolak hobbling casinos even further by extending 25% capacity limits into January. The silver lining, not to be confused with justification, is that this attack pattern does help smaller firms remain competitive and independent. We can find similar features in gambling’s sister “vice” industry, alcohol, which also has a love/hate relationship with Big Government. Craft beer sales continue to eat into Big Beer’s market share, as innovation has blessedly taken hold after decades of Budweiser dominance.

Back to gambling, there remains significant doubt that even if restrictions are completely lifted against all casinos tomorrow, that Las Vegas can quickly recover. One ominous data point is that in China, for example, the restaurant and catering industry still saw a 0.6% decline in year over year sales despite COVID-19 no longer being a major issue. Not to mention Macau, which is still pretty much dead in the water. Daily average gross gaming revenue for October and November is still down 72% year over year.

Never in the modern history of gambling has the importance of investing in smaller, financially fit and more innovative firms on the fringe been more pronounced. I do believe, despite the doom and gloom, that at the end of this destructive process, the proverbial phoenix will rise from the ashes and the entire global gambling industry will be re-imagined. It is truly innovate or die at this point.

Yes, the skeletal superstructure of the old regime is still intact, though it is wobbling and theh meat is decaying off the bones. The skeleton will collapse when monetary conditions return to historically normal levels, meaning when it actually costs money to borrow and size becomes a liability rather than an asset. Empires will have no choice but to break up and the new owners will start experimenting again in their separate labs.

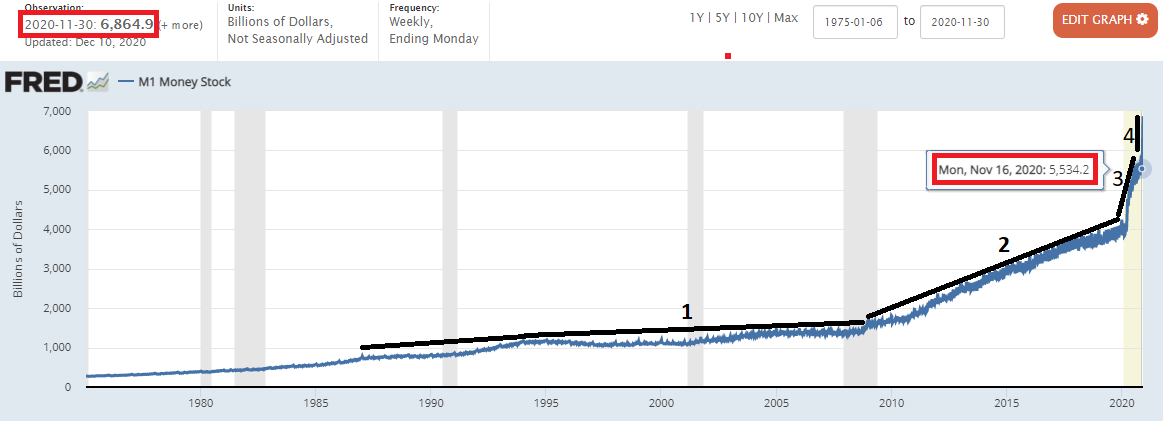

How close are we to the climax of this inexorable process? As ever I cannot give an exact timeline, but I can show you something extraordinary that has taken place just over the last two weeks.

Below is the total supply of physical circulating cash plus all dollars in all checking accounts in the U.S. banking system, not seasonally adjusted. Note the two dates in red boxes. $6.865 trillion as of November 30 versus $5.534 trillion on November 16. That’s an increase of $1.33 trillion, or 25% of the entire narrow money supply since 1975, in the space of two weeks. Historians talk about the Fourth Turning? Well, it looks like something’s definitely turning here.

The good news though is this. We do not have to worry about Big Business taking over the entire planet, of Big Gambling taking over the entire gaming industry, even though it looks that way at the moment. We do not have to worry because once this process climaxes, it will become expensive to borrow money again. Big Business, and Big Gambling, too, will have no other choice but to break up into smaller units. We will once again have a respectable fringe where independent minds can flourish. The process of getting there is going to be rough though, so hang on tight.