Online gambling operator The Stars Group (TSG) is learning the hard lesson that, unlike pure poker firms, sports betting operators occasionally get taken to the cleaners.

Online gambling operator The Stars Group (TSG) is learning the hard lesson that, unlike pure poker firms, sports betting operators occasionally get taken to the cleaners.

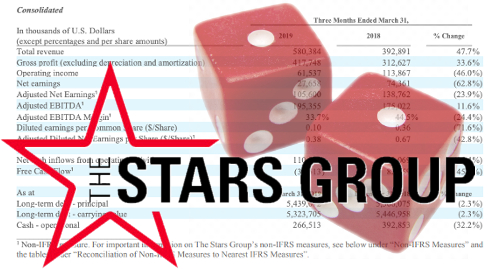

On Wednesday, the Toronto/New York-listed TSG reported overall revenue of US$580.4m in the three months ending March 31, a 47.7% rise over the same period last year. But operating income fell 46% to $61.5m and net earnings fell 62.8% to $27.6m.

TSG blamed the shortfall on a variety of factors, including unfavorable currency exchange rates, negative growth in ‘disrupted’ markets – i.e. grey/black markets that have ramped up payment-blocking measures, like Russia – and a rash of punter-friendly results, particularly at TSG’s UK-facing Sky Betting & Gaming (SBG) business.

Most UK-listed operators that endure occasional margin swings simply cite it as a factor and move on, while the TSG report/call treated the reduction as an event akin to a Deep Impact meteor strike. One almost expected the presentation to feature some Schoolhouse Rock animation in which a talking betting slip explained ‘how a wager becomes revenue’ just so no one missed the idea that luck had most definitely not been a lady to TSG in Q1.

Anyway, SBG’s betting margins fell 4.2 points to 5%, which negated a 16.3% rise in stakes and pushed UK betting revenue down 37.3% to £57.9m. UK poker was also in the dumps, falling 10.6% to £2.5m while casino revenue improved 23% to £69.3m. Overall UK revenue was down 12.2% to £138.1m, resulting in an operating loss of £19.7m.

The bad news surrounding TSG’s UK operations also included the announcement that longtime SBG chairman Richard Flint was stepping down at the end of June to pursue other ventures, including an online dog-food business. (Credit to TSG for resisting the urge to claim that a dog ate their profits.)

Keen to find a silver lining, TSG emphasized that it had spent a fortune promoting SBG to UK race bettors pre-Cheltenham, and that these efforts had resulted in “tremendous” engagement, with 90% of targeted customers active so far in Q2.

TSG’s ‘international’ segment fared better with bettors, as margins were essentially flat while stakes shot up 23.4%, pushing betting revenue up one-fifth to $20m. But poker revenue fell nearly 13% to $214.1m, gaming was off 7.3% to $98.9m and ‘other’ revenue plunged by 40% to $7.5m.

TSG blamed most of its international woes on currency fluctuations, as well as on “local restrictions on some methods of payment processing and on certain methods of downloading TSG’s poker applications.” (See Russia, Norway, Switzerland and Poland, but mostly Russia.)

In Australia, TSG’s dramatically enlarged operations – now grouped under the BetEasy brand – reported revenue of US$61.2m, a 459% year-on-year rise. Gross profit was up 388% to $37.3m but the costs of consolidating TSG’s various Aussie acquisitions under the same banner resulted in an operating loss of $1.14m for the quarter.

TSG’s analyst call was missing CEO Rafi Ashkenazi, who was apparently suffering from the flu. Also missing was any discussion of TSG’s recent blockbuster deal with FOX Sports on a US-facing sports betting partnership, although TSG said it would offer further details in another three months’ time.

TSG’s former flagship brand PokerStars received scant mention on the call, except the somewhat grim forecast of “low single-digit” growth in poker revenue on an annual basis going forward.

TSG’s shares are currently down around 3% in early Wednesday trading, but TSG said it expected its bottom line to improve in Q2 as its UK margins return to ‘normal,’ even if history teaches us that this assurance is far from assured. And while TSG claims to have witnessed some ‘stabilization’ in its ‘disrupted’ markets on a sequential basis, the company expects those disruptions will likely keep TSG’s international revenue on a slight downward trajectory for the foreseeable future.