Trading is very much like gambling. If you just love the thrill of it, you’ll rely on superstitions or gut feelings or intuition or whatever you make up in your head and the house will always win. That’s why the gaming industry exists. But if it’s your business, you’ll play the odds, use your head, and eventually come out on top. Those who make money consistently through gambling are not truly gamblers. They are more like traders. Skilled players in a game of odds that they know how to turn to their own advantage.

Trading is a game of skill. Traders stand to make (or lose) a lot of money in the near future as volatility heats up. Buy the dips and sell the rallies short term and you might make some nice gains. Investing though, is a game of confidence and patience. If you’re freefalling without a parachute, you will hit the ground. It might take awhile but there is no other alternative. If you see it happening you can invest in, say, lots of pillows. Meanwhile, you have to deal with all the talking heads who say everything is fine. That you’ve been in freefall for years and nothing bad has come of it. That the law of gravity may be true but by the time we hit the ground we’ll all be dead anyway. That maybe there is no ground at all after all. That the U.S. Federal Budget Deficit as at its highest ever ($779 billion) outside of recession or war reported by the Treasury Department yesterday, but that’s just normal and will keep going on forever.

Trading is a game of skill. Traders stand to make (or lose) a lot of money in the near future as volatility heats up. Buy the dips and sell the rallies short term and you might make some nice gains. Investing though, is a game of confidence and patience. If you’re freefalling without a parachute, you will hit the ground. It might take awhile but there is no other alternative. If you see it happening you can invest in, say, lots of pillows. Meanwhile, you have to deal with all the talking heads who say everything is fine. That you’ve been in freefall for years and nothing bad has come of it. That the law of gravity may be true but by the time we hit the ground we’ll all be dead anyway. That maybe there is no ground at all after all. That the U.S. Federal Budget Deficit as at its highest ever ($779 billion) outside of recession or war reported by the Treasury Department yesterday, but that’s just normal and will keep going on forever.

Did anyone notice how rates ticked up again to session highs in the final hour of trading in the U.S. as equities fell back down to session lows?

So you wait. Sometimes for years. And you start to second guess yourself. Are we really falling? What if we’re just floating? What if the law of gravity isn’t real? What if the talking heads are right and everything is just fine? Unlike a trader who can more easily admit he was wrong on some technical read and try again, an investor, if he wants to change an approach, must fundamentally change worldviews.

When I began this column 4 and a half years ago, I began with an article on the China bubble. It turned out to be the tip top of Macau stock prices. The BJK gaming ETF, whose top holdings are mostly Macau stocks, was at an all time high which it has not recovered since, and I don’t think it will for a long time. I’m not a great market timer and I won’t claim credit for “calling the top” there. It was just a coincidence, because what I was predicting there still has not happened yet.

This bubble is not just Macau, and it’s not just China, and it’s not just the U.S. It’s the entire global economy. It’s everywhere. It’s so ubiquitous that it’s invisible to most people. Do fish know they are surrounded by water? We live inside the bubble so it’s hard to see what’s outside.

No matter where you look though, no matter where you turn, debt is absolutely everywhere exploding and never, ever subsiding. Whenever there is any talk of slowing down public spending anywhere, let alone actually cutting debt, riots break out. If you even try to say debt must be reduced in real terms, not merely accumulated at a slightly slower rate which is heartless enough in itself, you’re considered a draconian extremist “austerity” monster who just wants to see poor people starve to death.

Stocks are at or very near a top. U.S. gambling equities were one of the warning signs in 2007, and they’re warning again now. Here’s a very rough metric for this. In October 2007, the ratio of the total dollar supply to the S&P 500 was 4.8. It is now 4.8 again. That’s not a hard ceiling, but it is a signal.

The stronger evidence that we are at or near a top is that equities are falling together with bond markets in this latest plunge. It happened again yesterday at the close. In 2008 as in every bubble since 1981, the bond markets were the safe haven. Not anymore. The S&P 500 has fallen 4.2% over the last month and 10Y interest rates have risen even faster, up 4.7%.

Let me preempt and say that no, we are not approaching the end of the world and we’re not headed for a zombie apocalypse and you don’t have to build a bunker. Stocks probably won’t fall has hard as they did in 2008, certainly not gaming stocks. But they won’t trend higher either, and the risk is much heavier to the downside. The collapse, when it comes, will be in the bond markets. Equities will probably just languish from here as inflation creeps higher, eating into real returns while locking nominal values range-bound. We’ll see intermittent climbs in equities like lightning flashes, but during those climbs, bond markets will keep deflating. During plunges we’ll only see weak flights to safety back into bonds that won’t make up for the previous losses. While stocks will zig and zag sideways, bonds will zig and zag trending down, while inflation will trend inexorably higher.

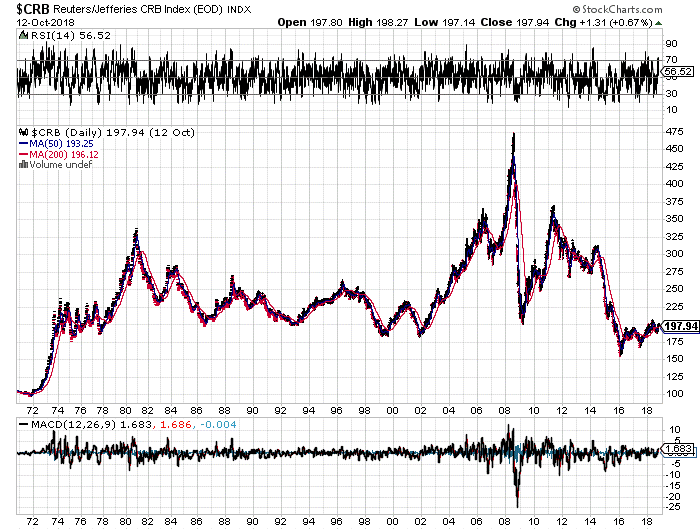

Why inflation? Because the only markets not extremely stretched are the commodity markets. The Reuters Jeffries CRB index, which measures commodity futures, is at the same level now as it was in October 1973 just before the Saudi oil embargo and the 1970’s energy crisis. No joke.

And gaming stocks are once again playing the canary in the coal mine, just like they did in 2008. If they somehow continue their uptrend, then we have a stay of execution, but it doesn’t look that way. Many U.S. gaming stocks topped 4 months ago, warning that something is wrong. Some like MGM topped right at the very beginning of the year. Penn topped in July. Boyd in late January. Some of the small to mid-cap growth stocks like Monarch and Dover Downs are still doing OK but they’ve stopped moving higher as well. If the large caps fall, the small and mid caps will follow.

MGM reports earnings on October 30th, in just two weeks. Remember the MGM economic indicator? By measuring visitor volumes, table games drop and slot handle, we can gauge the health of the broader U.S. economy. Last quarter table games drop was up 4% and slot handle 1.5%. Let’s see what comes in at the end of the month.