Nigeria’s online sports betting sector is enjoying a boom as the nation grows more comfortable with the concept of online commerce.

Nigeria’s online sports betting sector is enjoying a boom as the nation grows more comfortable with the concept of online commerce.

Reuters reported that Nigeria’s 190m residents had been loath to adopt the type of digital payment solutions that had become commonplace in other African countries like Kenya. This reticence was reportedly the result of a general mistrust of online banking and glacially slow internet speeds.

But the situation has undergone a dramatic improvement over the past two years, according to Nigerian Inter-Bank Settlement System (NIBSS) data. There were 29m digital financial transactions in 2017, more than twice the 2016 figure, while there’d already been 10m transactions in just the first three months of 2018.

The total value of these transactions has grown apace, rising from NGN132b (US$367m) in 2016 to NGN185b in 2017 and NGN61b already in Q1 2018.

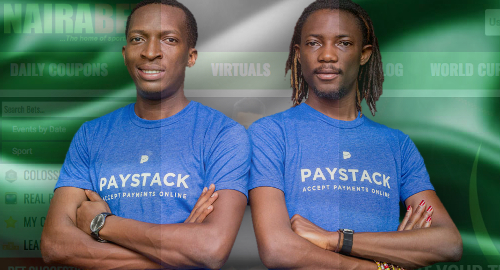

Key to this growth has been the arrival of new payment providers, including Paystack and Flutterwave, both of which launched in 2016. They offered an alternative to Interswitch, the dominant payment platform that had been around since 2002.

Akin Alabi, founder of Nigeria’s second-biggest online betting operator NairaBET, said Paystack became his site’s most used payment option within one month of adding it as an option last year. Nairabet claims to have 2m regular users, a number that has grown fourfold in the past five years.

The demands of the gaming industry will likely keep these new processors on their toes in terms of innovation. Seun Anibaba, a gaming regulator in Nigeria’s commercial capital Lagos, said operators “will go with whoever is faster, whoever can connect to their platform with less issues and glitches.”

Lere Awokoya, manager of European online betting operator Betway’s Nigerian division, credited “the growth in the number of fintechs, and the government as an enabler,” for helping to encourage Betway to launch in Nigeria.

Other non-African operators have also shown increased interest in Nigeria’s large and betting-mad market. Russia’s 1xbet and Slovakia’s DOXXbet have put down Nigerian roots in recent years, while Italy’s Goldbet has a 50% stake in Nigeria’s largest betting operator Bet9ja, which claims a 60% share of the local market.

However, while Nigeria’s digital wave may be growing into a tsunami, Bet9ja chairman Kumle Soname cautioned that retail operations remained a solid business, due to some Nigerians still not being quite ready to take that online leap.