It was back in 2008 that Apollo and TPG combined forces for a leveraged buyout of Caesars, then Harrah’s. The timing was at once horrific and very lucky. It was horrific because the world was already in the midst of its worst recession since 1929. But it was also very lucky because the deal was made on the cusp of the most prolonged period of extremely low interest rates the world has ever seen, enabling Caesars to service its obscene debt load for just long enough to eke out some convoluted deal that kept it going. Without those extremely low rates, no incarnation of Caesars could have possibly survived.

Caesars miraculously made it through by playing a very distorted and frustrating game of money-shuffle. Eventually, after throwing all the dead weight overboard and quite frankly destroying the finances of many of its initial backers in the 2008 deal, Caesars kept going. But consider the following question. What if the next recession is not accompanied with ultra-low interest rates, as was the recession of 2008?

Caesars miraculously made it through by playing a very distorted and frustrating game of money-shuffle. Eventually, after throwing all the dead weight overboard and quite frankly destroying the finances of many of its initial backers in the 2008 deal, Caesars kept going. But consider the following question. What if the next recession is not accompanied with ultra-low interest rates, as was the recession of 2008?

I almost never make unqualified statements. As is the general practice in the financial prognostication world, I pepper my statements with words like “likely” and “probably” and if I’m feeling especially confident I add in a “very” or an “almost certainly”. But here I will make an unqualified absolute statement. The next recession will not be accompanied by falling interest rates. Not a chance.

Penn National Gaming and Pinnacle Entertainment are discussing a merger. The two regional casino firms are already partners in many ways, not the least of which is the fact that Penn’s REIT spinoff Gaming and Leisure Properties (GLPI) owns most of Pinnacle’s real estate assets. It’s not that a merger doesn’t make any sense – it does. This is no AOL-Time Warner nonsense when mergers were taking place for the sake of merging. It’s just that however you crunch the numbers, a merged Penn-Pinnacle will be extremely leveraged at the very time that the world will be on the cusp of the next major recession, this time with rising interest rates instead of falling ones.

Let’s say talks go very well, regulators give the go-ahead, boards approve, and everything goes through in a year. Before we crunch the numbers on the companies themselves, here are things to consider from the outside.

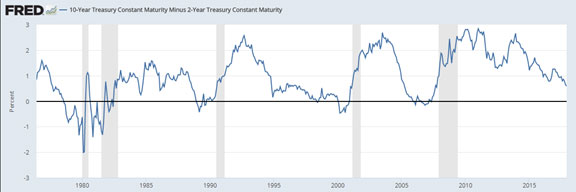

The yield spread is falling fast. The graph below shows long term rates minus short term rates since 1976. As you can see, every single recession was preceded by a negative yield spread.

Judging by the graph, it looks like we are about a year away from an official recession. The longest time period between two recessions was March 1991 until March 2001, exactly 10 years. We are now 8 and a half years since the last one, which gives us a year and a half at most. The timing from official dip into a negative yield spread until recession has been pretty consistent since 1980.

But it doesn’t even matter if the next recession hits in a year or two years or even three (doubtful). Assuming a Penn-Pinnacle merger goes through at any point in that timeframe, there’s going to be big trouble for the combined firm.

Sadly, it could very well be that a merger is still, despite all this, the best move the two companies can make given the circumstances. Since they already work together so closely, they may as well become one company and combine forces on their client lists. The results will most likely be more revenue than either could achieve on its own. The problem is the combined balance sheet, which will look ugly.

Let’s crunch the numbers. Penn has a market cap of $2.62B. This is after the stock has more than doubled over the last year. Penn has $4.87B in debt. $1.33 in unprotected borrowings and credit facilities, $3.46B in triple-net lease obligations to GLPI. That’s 186% leverage, taking into account an equity doubling since October 2016. Much of that is stock market bullishness because even though Penn has been improving, it hasn’t been smashing any records by any means. The stock price doubling is the markets speaking, not Penn blowing everyone away. Take away the equity gains over the last year, and leverage is closer to 400%. I’m not saying that equity gains are nothing, but rather putting things into a conservative perspective regarding how leveraged Penn could possibly become, just on its own mind you, if and when the current bull market comes to an end.

None of Penn’s debt is safe. Almost all of it is variable rate. $1.55B is due in 2018/2019. The only way they can pay that is by rolling it over, and when they do it will be at higher rates. Worse, according to their latest 10-K, total money owed at this point is $12.25B. Contact an accountant as to how this number is different from total long-term debt. This is just what the last annual report says, and after Caesars, I wouldn’t put it past any gambling firm to play tricks with their accounting to lower what investors see on the front end balance sheet snapshot and hide what they don’t want them seeing deep in the footnotes of the triple-digit-page recesses of some SEC document nobody wants to look at.

All of this is before we take into account what a combined balance sheet with Pinnacle’s liabilities will look like.

If the merger were to take place today, Penn would take on another $4.2B in debt plus financing obligations on its own triple-net lease deals. Pinnacle, like Penn, also has virtually no protection against rising interest rates.

Here is the bottom line though. Stocks look like they are still bullish. Today’s premarket action looks a bit shaky and it looks like we are in the end stages of this bull phase considering the yield spread. Given the current environment, it looks like a merger makes sense and that it will go through. From even a short term technical perspective, if you’ve owned Penn since last year, you’re sitting on 100% gains or more. Sell at least some of your position now in case the deal doesn’t go through. If it does and Penn jumps on the news, sell the rest of it.

Pinnacle shares are doing even better. The same strategy should be used for holders of Pinnacle stock. Sell some now in case the merger falls through, and sell the rest when we have the final word on the deal. Considering the leverage these firms will have to deal and that neither of them are protected, and that the next recession is at our doorstep, this is no time to try to squeeze the next few pennies out of such huge gains. Move on to the next trade with a much more financially secure company.