The dollar index is in dangerous territory and bitcoin may be sniffing it out. The 14-day relative strength index (RSI) for the index is oversold for the first time in at least 5 years. The 50 day moving average is starting to slope downward for the first time since the 2014 oil crash. The only good news for dollar bulls is that it just bounced off the 200 day moving average, just half a point above three-year support levels at 91.88.

The dollar is flirting with its last major support level post the late 2014/early 2015 advance. If and when that level breaks, the next support level is around 86, and after that 80.

Meanwhile, the dreaded bitcoin fork was much ado about nothing. The dollar price of bitcoin didn’t flinch throughout the whole ordeal. When it was clear the system wouldn’t implode, price spiked again to $3,400, a more than 25% rise pre fork. Now imagine what would happen to the dollar price of bitcoin if the dollar index plunges through its last support.

I see very little chance of the dollar rising from here. With the US economy at full employment, the Trump administration going all out tariffs blazing and slapping sanctions left and right, there are going to be more dollars for less goods pretty soon.

Where Did the Volume Go?

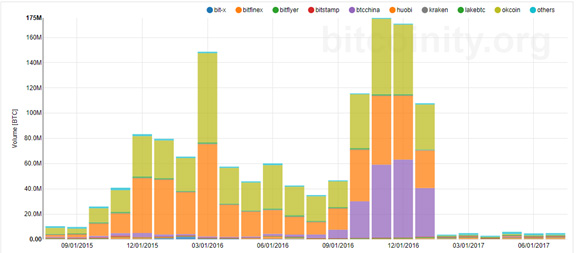

What may seem bearish for bitcoin though is the precipitous drop in trading volume on the exchanges.

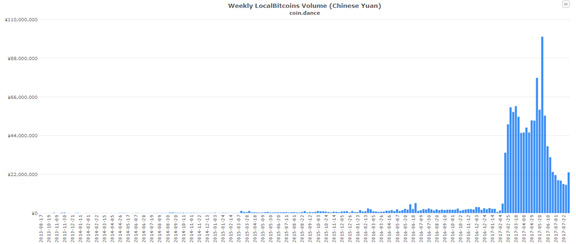

The drop can be explained though by traders avoiding exchanges in favor of peer to peer networks. Since China is monitoring the exchanges that turn bitcoin into Yuan and vice versa as a service, traders are using P2P matching sites like localbitcoins in order to trade away from the prying eyes of the Chinese government. Here’s the proof. The chart below is bitcoin trading volume on localbitcoins. Obviously, it spikes at the exact same time that trading volume on the exchanges plummets.

This is the equivalent of stock traders exchanging the actual paper stock certificates for cash between one another on Wall Street under the table instead of using a broker that records all buy and sell orders and reports it to the government. Physical stock certificates changing hands for cash is legitimate and counts as a trade. It’s just not recorded as volume, and It’s not a method that is used. A P2P network does nothing but match up buyers and sellers, and payment and receipt are done separately off the recorded volume charts and off the books.

If there were a tax on bitcoin capital gains, and I’m sure there will be at some point, you’ll see more of that exchange volume being transferred to P2P in order to avoid the tax. Cash transactions for bitcoin are untraceable, so what we’re really seeing is not a fall in bitcoin trading volume, but that trading volume going off the grid. And the complete failure of Chinese policies to curb bitcoin trading. Localbitcoins would like to take this opportunity to write a heartfelt thank you letter to Xi Xinping for his unintended generosity.

The higher the bitcoin price goes, the more of the economy goes off the grid, the less transactions become taxable. At a current market cap of $57 billion, we are not there yet, not even close. $57  billion is only three tenths of a percent of US GDP, and two tenths of a percent of the combined GDP of the US and China. GDP is a bad number, but it is the closest we have for measuring total fiat transactions in a given economy. When .3% becomes 5%, governments will start noticing their missing tax revenue. That’s an equivalent BTC dollar price of about $57,000 assuming zero GDP growth. So let’s say, conservatively, $60,000.

billion is only three tenths of a percent of US GDP, and two tenths of a percent of the combined GDP of the US and China. GDP is a bad number, but it is the closest we have for measuring total fiat transactions in a given economy. When .3% becomes 5%, governments will start noticing their missing tax revenue. That’s an equivalent BTC dollar price of about $57,000 assuming zero GDP growth. So let’s say, conservatively, $60,000.

We are a long way from getting there and I’m not predicting that any time soon. A sudden fall in the dollar index may get us to $4,000 or $4,500 though. I’m only saying that $60,000 bitcoin will be the point when the bitcoin market cap starts eating into GDP in a noticeable way, and politicians will understand that they can’t get their hands on these transactions. That’s when serious and damaging regulation of bitcoin exchanges will begin. The response by bitcoin traders in the US will be the same as what is happening in China now. Trading will go underground and into P2P networks, if they aren’t made illegal and firewalled by Washington DC.

Let’s reflect though, for just a moment, on the bitcoin fork. My favorite thing about it was, once gain, the silence surrounding the move. Not that there weren’t arguments with miners yelling at one another over what to do and why. There just weren’t any politics involved. It was all a technical matter with opinions differing on what would be the best move for the currency. No civil war or violence. Just a peaceful fork and we all get on with our lives.

Imagine if politicians wanted to split the dollar into two currencies and all the blithering economists spouting nonsense about how they think this would affect women, or gays, or transgenders, or the working class or the poor. Or imagine if a State wanted to secede from the Union like bitcoin cash seceded from bitcoin. The politics would just be deafening and I for one would be tempted to take a powerdrill to my skull to drown out the noise. With the bitcoin split, since I’m not a miner or developer or software guy, I didn’t have to listen to any of it. It was great.

And what happened after the big scary secession/spilt/fork? Nothing. Everything is fine. The private sector solving its own problems without government intervention. It’s really a beautiful thing.