This is a guest contribution by Willem van Oort, founder of Gaming in Holland and Stefan Vermeulen works as a journalist for several (mostly financial) media. If you would like to submit a contribution please contact Bill Beatty for submission details. Thank you.

The intended privatization of land-based casino chain Holland Casino has taken a decisive step forward. Last week, the Dutch government sent a bill to Parliament containing a proposal to sell the state-controlled casinos. A deal will probably be concluded by late 2017. But how much can the Dutch State expect to get for Holland Casino?

Political background

Back in 2012, the new government coalition consisting of right-liberals (VVD) and social democrats (PvdA) decided the Dutch State no longer needed to keep its monopoly on running casinos. In their coalition agreement, VVD and PvdA agreed that Holland Casino would be privatized within a few years.

Back in 2012, the new government coalition consisting of right-liberals (VVD) and social democrats (PvdA) decided the Dutch State no longer needed to keep its monopoly on running casinos. In their coalition agreement, VVD and PvdA agreed that Holland Casino would be privatized within a few years.

Although politicians of both parties felt that gambling should remain strictly regulated on account of risks of addiction and fraud, this would no longer mean that Holland Casino would have to continue as a state-owned company. Even after privatization, risks associated with gambling could be controlled by giving out gambling licenses on very strict conditions, and by having a tough supervising authority.

Initial setback

The Dutch government initially intended to sell Holland Casino and privatize the Dutch casino market as early as 2017. These plans, however, suffered a major setback when Holland Casino posted alarming losses in 2012 and 2013.

In 2012, Holland Casino posted a loss of 0.7 million euros, which grew to more than 22 million euros in 2013. According to some experts, this made the Dutch casino chain one of the few loss-generating gambling enterprises in the world.

Holland Casino was suffering from a combination of tough economic conditions and increasing competition from illegal online gambling sites, the company’s board said. To the Dutch government this meant that the return on the sale of Holland Casino would likely be much lower than anticipated.

Rising profitability

But now the situation has changed. After major cost cutting, a restructuring and several changes at board level (the company’s new CEO Erwin van Lambaart started his job earlier this year), the outlook for Holland Casino is completely different.

Profits are rising: 12 million euros in 2014, 67 million in 2015. According to the board, this year’s results are forecasted to be even better. Because Holland Casino is expected to land a license to operate in the soon-to-be-regulated Dutch online market, profitability might grow even further.

It thus appears that the Dutch government could hardly have chosen a better moment to propose Holland Casino’s privatization to Parliament – and, as is currently being expected, to sell the company to a private buyer sometime during the second half of 2017.

How much is Holland Casino worth?

But what will the Dutch get for their national casino company?

But what will the Dutch get for their national casino company?

To answer that question, we first have to look at the EBITDA multiplier that potential buyers will use to determine their offer. Some industry experts argue a multiplier of 10 would be reasonable. On average, over the last three years (2013-2015) Holland Casino posted an EBITDA of 65 million euros, which would mean that Holland Casino could be worth around 650 million euros.

But that estimate could very well be too low. The average EBITDA of Holland Casino over these last three years is to a large degree negatively impacted by the bad results in 2013. Particularly in the fast-changing gaming industry, potential buyers tend to focus on the current and future operating results and profitability.

Assuming that the forecasts in Holland Casino’s 2015 annual report are correct and that this year’s results will be at least as good as last year’s, the average EBITDA between 2014 en 2016 becomes 88.5 million euros – which would mean a projected sale price of 885 million euros.

According to one industry expert, even that estimate could be conservative. “It all depends in what direction the earnings are growing. If the earnings are going upwards each year, using a multiplier of 10 times EBITDA seems pretty fair. But you also have to look at which proportion of EBITDA falls through to net income – it could deserve a premium.”

At Holland Casino, not only are earnings growing year after year, also a large part of EBITDA falls through as net income. With 105 millions euros EBITDA in 2015, net operating profit turned out to be over 67 million euros – a very healthy amount by any standards. (Most of this profit – 40 million euros – was used to strengthen the company equity.)

This expert suggests the sale price could very well turn out to be over 1 billion euros.

Why Holland Casino could end up being cheaper

Another Dutch industry insider, however, pointed out that after privatization Holland Casino will have to pay corporate tax, rated at 25 percent, just like every other private company. Currently, as a state-owned company, Holland Casino does not pay corporate tax. This will probably push the sale price down a bit.

Furthermore, multipliers for casino sales in Europe are generally lower than in the United States. Past sales in Europe, but also in Canada, reached only single digit EBITDA multipliers.

“Every large European gambling company is interested”

All in all, a valuation of Holland Casino somewhere between 800 million and 1 billion euros seems reasonable. Or maybe even a bit higher indeed, because after speaking to several industry insiders, one thing seems clear: there appear to be quite a few parties interested to buy.

All in all, a valuation of Holland Casino somewhere between 800 million and 1 billion euros seems reasonable. Or maybe even a bit higher indeed, because after speaking to several industry insiders, one thing seems clear: there appear to be quite a few parties interested to buy.

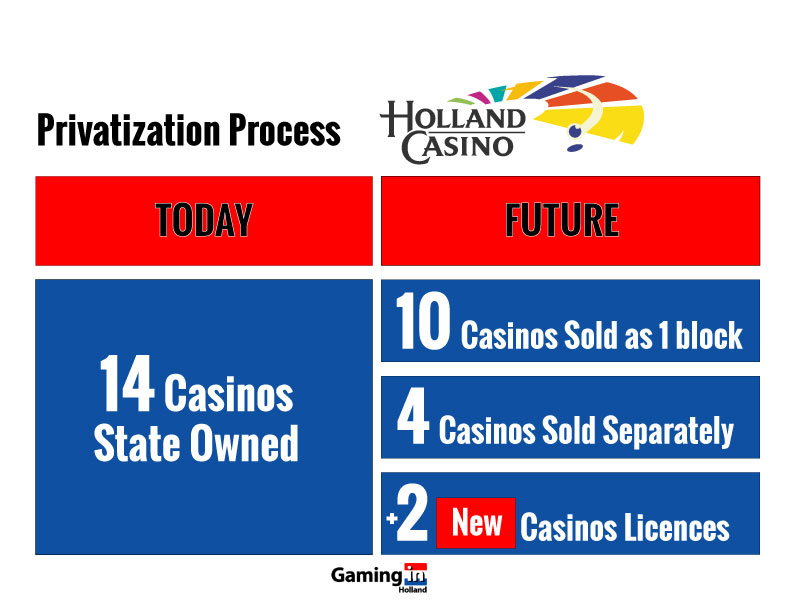

Out of the fourteen casino licenses currently owned by Holland Casino, ten will be sold to one party, while the four remaining licenses will be sold to other buyers. In addition, two new licenses will be issued.

“Every large European gambling company is interested,” one source said. Austria-based Novomatic, which is currently attempting to acquire Australian poker empire Ainsworth for 500 million dollars, is mentioned as one of the top takeover candidates. Other parties mentioned are the British Rank Group and Aspers Casino.

Of course, when the auction turns into a takeover battle, the price for Holland Casino will go up.

What is the Dutch State looking to get out of it?

In a recent interview with Dutch daily de Volkskrant, Holland Casino’s CEO Erwin van Lambaart declined to comment on the expected sales price. “We cannot say yet. To our shareholder [i.e., the Dutch State], the financial benefits are not the only thing that matters. It is also about continuing the policy of prevention [of gambling addiction, fraud, etc]. Also, every buyer will have its own strategic considerations with regard to how much they are willing to pay.”

A spokesperson for Holland Casino did not respond to a request for comment on Tuesday.

Do you want to know more?

Stefan Vermeulen works as a journalist for several (mostly financial) media. He worked as an investigative reporter for Quote and Follow The Money for years, and recently published a book on Heineken: ‘Heineken na Freddy. Also on twitter: @stefanverm

For more information, please contact Gaming Consultant Willem van Oort, founder of Gaming in Holland, the leading iGaming community in the Netherlands.

The sale of Holland Casino will also be a major topic of discussion at the upcoming Gaming in Holland Conference. See you in Amsterdam on June 7-8?