The internet has far too many benefits to list. It’s now so ingrained within our society that it’s hard to imagine life without it. But for all it’s glories, the rise of the world wide web has enabled new forms of crime to emerge.

The internet has far too many benefits to list. It’s now so ingrained within our society that it’s hard to imagine life without it. But for all it’s glories, the rise of the world wide web has enabled new forms of crime to emerge.

Laundering money, identity fraud and other forms of scams have been given a new lease of life by the impersonal way in which many now conduct many of what were once face-to-face transactions. Buying insurance, claiming insurance, transferring money and even gambling can all be done from the comfort of your own home, nearest cafe or preferred mode of public transport.

Combating fraud in all of these transactions is big business across the internet with Iovation, Verify and Experian among a raft of companies looking out both consumers and website operators alike. While they do manage to weed out a significant number of potential fraudsters, the nature of the internet has always meant that those who are that way inclined have been able to get one over on their victims.

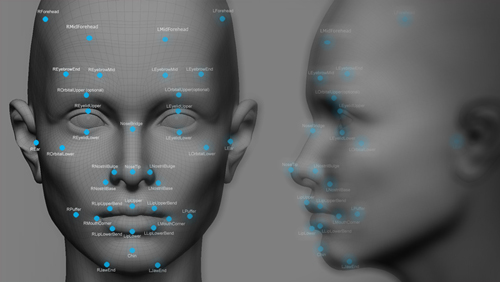

But the fight against these crimes could now be about to receive a boost in the form of facial recognition technology. Facebanx, subsidary of live streaming and video chat company OhHi Technology, has developed this technology to allow sites to reduce fraud and ID theft.

After having initially created the technology with stopping multiple insurance claims in mind, Facebanx’s CEO Matthew Silverstone explains how he came to realise that this technology could actually have just as much of an impact elsewhere.

“We’ve realised that the payments and the gaming industry are perhaps our two biggest markets,” he says.

“We’re talking to pretty much all of the household names [in gaming] about our software at the moment.”

Despite not initially having been created with online gambling companies in mind, Silverstone is not only speaking to operators directly but also payment processors and software companies about licensing the technology. With some companies, these discussions appear quite advance.

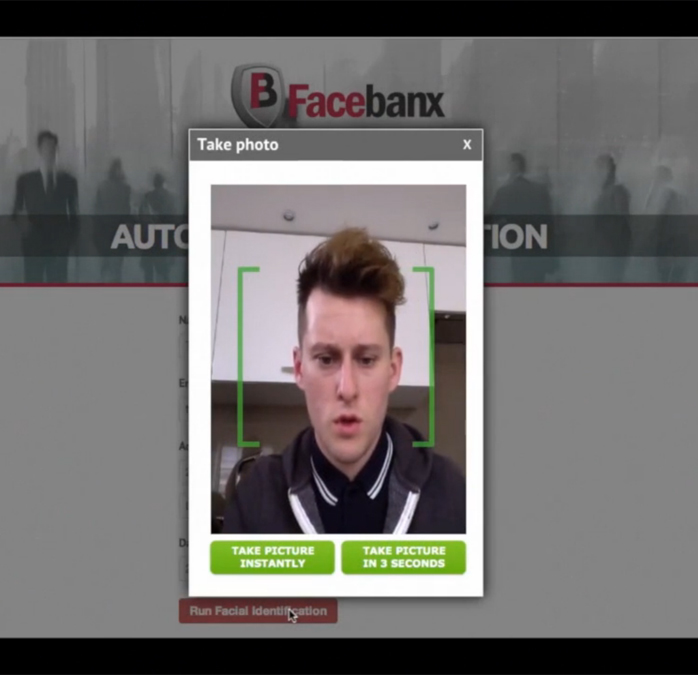

Silverstone explains: “What we’re looking to do for one of the big online gaming companies is that when you register or re-register, as well as registering your details normally you’ll be able to put your I.D. in front of your device’s webcam or camera which will be scan and capture the data.

“We’ll then compare your webcam face to the I.D. photo and the software will use this to prove that you’re the passport holder and a real person. There’s pretty much a 99% certainty that this methodology will be able to confirm that this person is who they say they are.”

Improving the User Experience

As well as the clear anti-fraud benefits for the operator, these type of processes will also make the customer’s experience considerably easier and quicker. Rather than having to scan in I.D., email it to customer support and wait for confirmation – a process which can take days – the technology can run through the process described above in 30 seconds making signing up and getting verified a far more user-friendly experience.

There is even the potential for this face recognition to completely replace the username and password system currently used across the board. It almost seems like a natural progression with players able to log in instantly just by pointing a webcam or their device’s camera at their face.

This would be quite a dramatic change but it is just one of the ways in which Facebanx’s technology could be used, as Silverstone explains.

“Operators could use it as a sign on to sign in to a game every time or it could be that they just use it during registration so that they know who the customer is and then they don’t need to do it again,” he says.

“Random testing or targeting specific areas where fraud is common are also other options.”

Fitting into iGaming

Fraud prevention is already a contested space within online gambling with Iovation and Experian being among the market leaders. But rather than competing with these already established companies, Facebanx’s software will piggyback on top of their products to add an extra layer of protection.

There are few places where this protection will be more important than in regulated US states where fraud isn’t the only relevant issue. With ring-fenced nature of the state regulated markets that we’re likely to be seeing more of soon, ensuring that only citizens of the accepted jurisdiction will also be of importance. Silverstone explains that Facebanx’s technology will be able to help in this area too.

He says: “There are a lot of issues in the US with licences being given out and the problem is that if you live out of state then you shouldn’t be able to log in and access whatever gambling products are available.

“The problem is proving this and you can do this by comparing their driving licence data with the data online. The driving licence has this address and once you’ve got this address you can confirm who they are.”

On a wider scale, this technology also presents the opportunity for operators to collaborate in order to cut down on I.D. and scams designed to take money from sites. Silverstone explains that it’s something that insurance companies are seriously looking into doing and would certainly benefit the industry in the long run.

He says: “Games Theory shows you that the more people that use a product, the more everyone benefits. If the gaming industry wants to share data such as facial data, you can stop multiple frauds taking place across several different gaming companies.”

While this isn’t quite a call to arms yet, this new technology could end up being almost as dramatic for online gambling. The ball is very much in the court of operators as they have to decide to what level they take the fight on fraud.