2018 will be over in two weeks. For many that will bring a sigh of relief. It was a good year for legalization, and a bad year for regulation and  taxes. The door was opened to legalized sports betting in the United States with the Supreme Court overturning the Professional and Amateur Sports Protection Act. Hemp farming was just legalized as well in the 2018 Farm Bill, albeit in an $867 billion spending embarrassment that also happens to keep the US-sponsored war on Yemen going, unfortunately.

taxes. The door was opened to legalized sports betting in the United States with the Supreme Court overturning the Professional and Amateur Sports Protection Act. Hemp farming was just legalized as well in the 2018 Farm Bill, albeit in an $867 billion spending embarrassment that also happens to keep the US-sponsored war on Yemen going, unfortunately.

In the United Kingdom, Fixed Odds Betting Terminals were rendered impotent, which will push some of the more dangerous aspects of the gambling industry underground into black markets, making them even more dangerous than before while also destroying shareholder value. Point of Consumption taxes were raised as well. Meanwhile, nobody figured out a way forward with Brexit at all, and with the vote pushed off to January, it looks increasingly likely that a Hard Brexit is inevitable. I wouldn’t bet on it though because front page politics is a staged show like professional wrestling, just more boring, but if a no deal Brexit does happen and UK equities crash, it would be a good upside trade opportunity for UK gaming stocks.

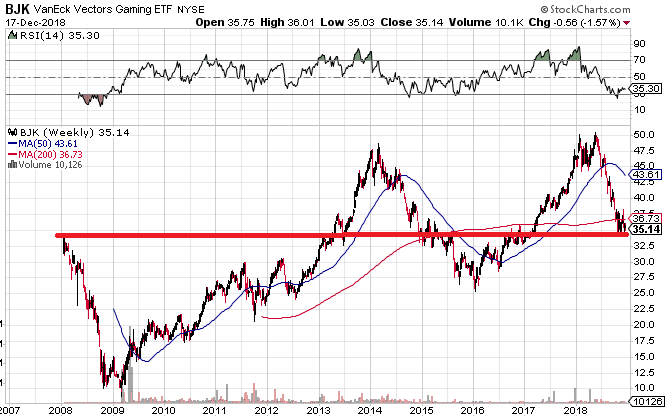

In Macau it looks like we have another wipeout in progress, already close to the magnitude of 2014 but without the serious revenue declines, yet. Gross gaming revenue hit October 2014 highs in October and have continued 8.5% higher in November, healthy numbers on paper but Macau stocks don’t seem to notice. Whether you want to believe Chinese government numbers is up to you, but long term charts suggest that whether they are true or embellished, the official Macau top line and stock prices do not correlate well. Macau gaming stocks move like stampedes in either direction and can never seem to calm down or consolidate. They are right near 52-week lows now and on the borderline of a 7-year-old pivot point (see red line below). Macau bounced slightly off this line last month but we’re testing it again. If we break through, and that looks likely, the next stop is about 23% down from here. Ironically, the BJK gaming ETF is sitting at the same levels that it was at when it was founded in 2008.

The accelerating trade war between the United States and China is behind this, and it only got worse as the months progressed. Don’t expect it to end until Donald Trump is replaced. The headlines about a trade truce don’t mean anything.

There was more bad news out of China this year though, but not something that most investors pay attention to. The establishment of a sick and extremely dangerous social credit scheme will reward citizens for approved behaviors and punish them for being naughty. The spirit of Mao is behind this and it will be devastating for the Chinese economy, even worse than the trade war. Those in charge of ranking are not disclosing how points are distributed, so it’s about as transparent as a black hole. Punishments include keeping you off airplanes and trains, crippling your internet speed, banning you from schools, banning you from certain jobs, banning you from hotels, even kidnapping your dog. This is straight out of the Great Leap Forward/Great Famine and the corruption and abuse that will infect this system once it is fully operational will generate total horror stories off a well-oiled assembly line. If anything it shows that Beijing has absolutely no grasp of the importance of human liberty and its role in productivity. Nothing can prosper under such a system, let alone the Macau gaming industry. The stricter it gets, the worse business and the quality of life in general in China, and Macau, will get.

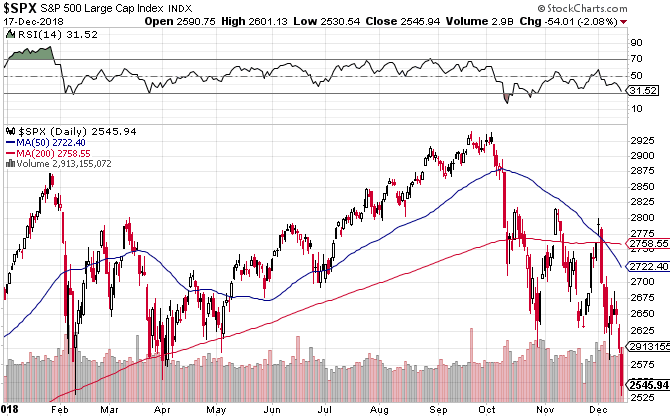

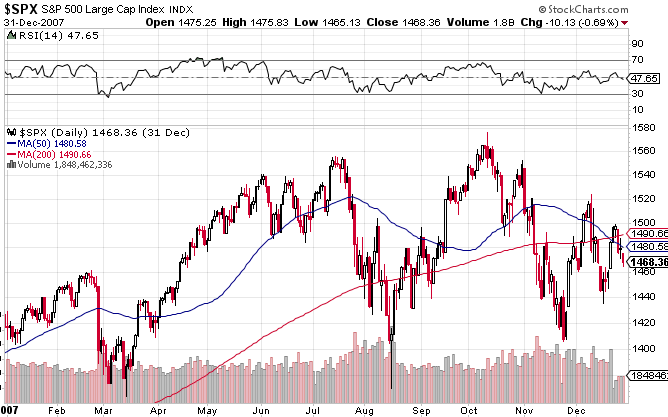

As for the United States, 2018 was 2007 all over again for equities. Take a look at these charts of the S&P 500, one for 2007 and the other for 2018:

In both years we had a climb at the beginning of the year followed by a quick semi-crash, another climb to new highs and then wobbly movement by the end of the year. The only significant difference was that 2007 saw an August crash and 2018 didn’t. The end of the year is typically strong during bull markets. A weak November and December out of nowhere is a bad sign.

The final rate hike in this rate cycle that began in 2015 is likely being discussed at the FOMC as this is being written. Tomorrow the Fed will probably hike rates for the last time before the next recession becomes official. Recession bellwethers like regional gaming stocks have already lost close to half their value. Penn crashed this year from $37 to $20 despite increased earnings and revenues. Boyd is also down almost 50% despite strong top and bottom lines this year. MGM volumes are starting to level off, and February’s earnings report from Las Vegas’ #1 employer will likely signal the beginning of the 2019 recession. The overturning of PASPA is huge, but it won’t push US gaming stocks higher in the face of what’s coming. It will only make the eventual recovery quicker and easier than otherwise, but it can’t stop the Fed-created business cycle.

5-10 years from now, we will probably look back at 2018 as the inflection point from boom to bust. When the bust is finally official, the world will engage in a quantitative easing overload and price inflation will break out, 1970’s style. If you scaled out early this year, count yourself lucky. Shorting the rallies could make you some extra cash in the coming months, but best to do this with put options so you’re not risking too much capital. Keep cash levels high, and once the Fed reverses course and starts cutting rates again, that will be the time to slowly scale back in.