This week, the United Kingdom, Macau, the United States, and Australia. The only safe place among these for anything other than short term trading is Australia.

The United Kingdom Chooses Monetary Fentanyl

Let’s start this review with the U.K. and a really horrible pun.

The following headline should scare the craps out of all those who gamble with paper money: Bank of England to directly finance U.K.’s Covid-19 spending. Here’s the key paragraph (emphasis mine):

In a statement to financial markets on Thursday, the U.K. announced it would extend the size of the government’s bank account at the central bank, known historically as the “Ways and Means Facility” (W&MF), which normally stands at just £370 million (€422 million).

This will rise to an effectively unlimited amount, allowing ministers to spend more in the short term without having to tap the gilts market.

Oh boy. This is the end game for paper money, right here. What this means is as follows. The normal route that newly-printed money takes to arrive into the economy is that the government offers bonds, primary dealers bid on them in the primary market, and then after the auction is over, the central bank bids for those bonds on the secondary market. The primary dealers get the new money first and put it into the capital markets or real estate or whatever. Now instead, what is going to happen is that the central bank, in this case the Bank of England, is going to just magically expand the British government’s bank account at the BoE directly. No gilts, no pesky markets to deal with, just magical money directly from the Fountain of Inflation. What’s the limit on the U.K. government’s bank account? There is none. They can spend whatever, and they are going to.

Oh boy. This is the end game for paper money, right here. What this means is as follows. The normal route that newly-printed money takes to arrive into the economy is that the government offers bonds, primary dealers bid on them in the primary market, and then after the auction is over, the central bank bids for those bonds on the secondary market. The primary dealers get the new money first and put it into the capital markets or real estate or whatever. Now instead, what is going to happen is that the central bank, in this case the Bank of England, is going to just magically expand the British government’s bank account at the BoE directly. No gilts, no pesky markets to deal with, just magical money directly from the Fountain of Inflation. What’s the limit on the U.K. government’s bank account? There is none. They can spend whatever, and they are going to.

This is how hyperinflation starts. This is how it happened where I live in Israel in 1984 when the Bank of Israel directly financed the Israeli government. It ended with the destruction of the shekel, hence we now have the New Shekel and everyone lost all their savings. Hyperinflation in the U.K. could set in very fast, because unlike other times when central banks have directly financed government deficits, the global economy is now completely shut down and there is no increase in supply of goods and services to help counteract the increasing supply of new money directly into the consumer sector.

And get this – the U.K. government is promising to “repay” all of what it spends by the end of the year. HA! I’ve heard that one before, just like when all central banks promised to bring their balance sheets back down after the 2008 financial crisis passed. Just like Richard Nixon promised to bring gold convertability back to the dollar after closing the gold window in 1971, just like FDR promised to get rid of income taxes on the middle class after World War II was over. Not happening, not a chance. The only possibility is that it’s all paid back in worthless quid.

The U.K. is done with the monetary opium, done with the morphine, done with the heroin, and it’s now going straight to truckloads of fentanyl . The U.K. is only the first to make this move. Other central banks will have to up their incest with their governments in the weeks and monthsahead. Otherwise currency exchange rates will get too out of whack.

I once again call on all fiscally responsible gaming firms in the U.K., – 888, William Hill, Rank primarily as the ones who have the best shot at surviving this crisis long term – to hedge their cash balances with gold swaps ASAP. Those that do not do this, will see all their cash balances evaporate to nothing in terms of real purchasing power and they will be in existential danger. I hope any gaming CEO or CFO reading this will take this advice dead seriously and do what needs to be done, now. If I can help save a single good company from extinction I’ll consider my column here a success.

What about Macau?

Here’s a paragraph from the South China Morning Post that should send chills down your spine:

The nation’s much-vaunted army of consumers are flinching as the coronavirus outbreak closes shops and causes job losses, hurting demand for new credit and ability to service older ones. A wave of delinquencies will test the resilience of Chinese lenders this year, with the economy expected to be at its weakest since the 1976 Cultural Revolution.

Quick reminder, the Cultural Revolution was a frenzied orgy of persecution led by the young generation trying to prove how violently they could love Mao. It led to the deaths of about 20 million people. It ended when Mao died in 1976 and the country woke up from a near 30-year nightmare.

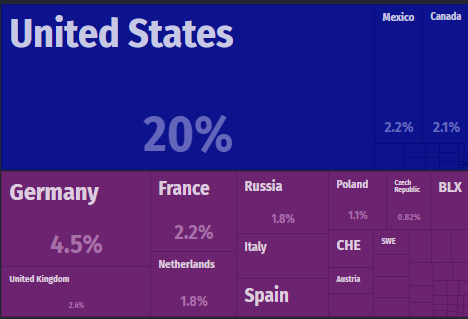

China is an exporting economy, and its main trade partners are out of commission. The Chinese VIPs are super rich because they head the export economy. The United States and Europe, account for about 50% of exports. No exports, no forex, no imports either. Mass market numbers fall, VIPs fall, it’s a disaster. Here is the 2017 Chinese export data:

That doesn’t mean Macau stocks will tank immediately. They are likely to ride upcoming good COVID-19 headlines for the next few weeks as investors assume that once the pandemic is over, everything goes back to normal. Everyone is pandemic-focused now, but it’s a mistake. Nothing is going back to normal. Economic reality is about to slam into China with profound force.

After the current bounce, I expect some Macau casinos like Wynn and LVS to proceed down closer to 2008 lows, which are much, much lower than where we are now. For Wynn that was about $20. For LVS, it was $1.38. Yes, we could get down there again. According to GGRAsia, nobody from the mainland is traveling to Macau, and GGR could be down 37% this quarter. Once the Macau ETF (BJK) cross back above $30-32, scale out with a hard deadline of May 1 to exit all Macau positions.

United States Gyrates

Money supply numbers are in for this week and we’re up another $419 billion. Money has never been pumped at so high a rate for this time of year. We’re past merely breaking records and going straight to cartoonville. The Fed’s balance sheet has just passed $6 trillion. There’s much, much more coming. My original guess when this started getting serious was a total $100 trillion or so printed until the dollar was destroyed. I stand by that.

The trick will be riding the bounce and getting out before the dollar falls through the floor. Penn closed the week up 53%. Eldorado flew nearly 70%. MGM, less a momentum stock like the other two, is up only 25% and actually fell on Friday. Two weeks from now, call option positions on these stocks should be closed. I expect the worst of COVID-19 to be over with next week in the US, at least the first wave, followed by a big buying spree in stocks. After this it would be best to be out of all US gaming stock positions.

The COVID-19 curve in New York is starting to flatten. As it does we will probably see a few further jumps in stock prices but after the economy reopens, inflation is going to freak investors out. Be out before that happens.

20% of whatever cash balances you have should be held in gold to hedge against loss of purchasing power. My recommendation is the Perth Mint Physical Gold ETF (AAAU) as the safest one. 1-2% in Bitcoin SV, and the rest in fiat cash for immediate needs.

Australia On Top of COVID-19

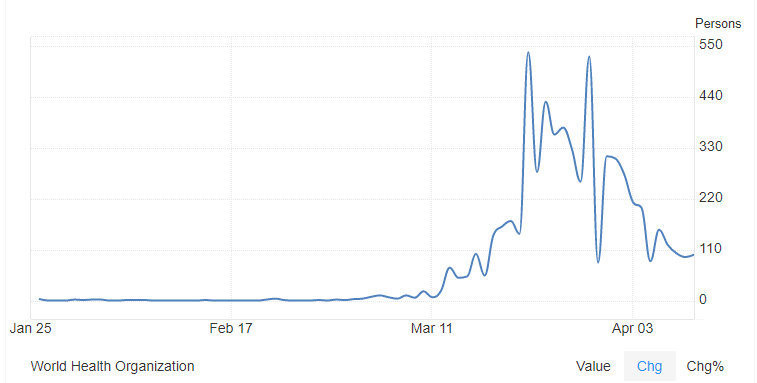

Australia (besides Russia) is just about the only jurisdiction I’m not too worried about long term. Australia appears to already have COVID-19 under control, as per the new cases chart below.

Crown Resorts is a long term buy and hold. Even if it takes a long time to completely recover, it pays dividends in Aussie dollars, which whether officially or not, are backed de facto with the hard resources underground in Australia that will be in very high demand soon. Tuck it away for the next 5 to 10 years and reinvest dividends if you’re young and take the income if you’re older. The turmoil will continue to hurt Crown in the short term but it should be OK long term even if hyperinflation hits the rest of the world. The casino’s debt is very low relative to peers.