2017 was the year of the boom. Everything went up and fundamentals were only a bonus. Almost all gaming markets went way up, along with almost everything else in the world. 2018 is not likely to repeat this by a long shot. Here is what we are likely to see this year and what should be done about it.

Cryptocurrency Craze Will Calm, Culling Coins and the Cocky

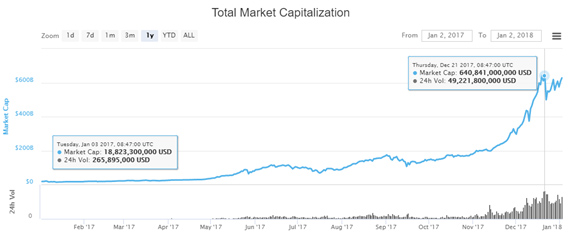

First and foremost, when economic historians look back at 2017, it will be labeled the year of the cryptocurrency craze, first and foremost. The advance completely blew away any other in recorded human financial history since tulip bulbs. From January 2 to December 19, 2017, the total market cap for all cryptocurrencies traded went up from $18.5 billion to $642 billion. That’s an absolute inflow of $623 billion.

For true believers this heralds the dawn of a new monetary age. Maybe it does, eventually, but it probably won’t take root in 2018. In order for that to happen people have to start using digital currencies as bona fide money in retail transactions, not as speculative holdings where they can log in to their wallets and count their paper gains in fiat. The vast majority of people who bought into the rally have no intention of using any of their digital currencies as money, and even the most ardent bitcoin investors still count their holdings in terms of fiat currencies. What this incredible rally really signifies is that there is a lot of loose money out there looking for something to fall on. It found something and it fell.

There are a lot of sub-par digital coins out there that have no business being used as money, whether they are too expensive to transfer, too slow to confirm, or both. Just like most dot com companies fell in 2000, the lowest quality digital coins will probably fall in 2018, and this is likely to damage even the good ones. But the best ones will survive so long as governments allow them to, and markets will regroup around the most serious contenders that can actually be used as money.

There are a lot of sub-par digital coins out there that have no business being used as money, whether they are too expensive to transfer, too slow to confirm, or both. Just like most dot com companies fell in 2000, the lowest quality digital coins will probably fall in 2018, and this is likely to damage even the good ones. But the best ones will survive so long as governments allow them to, and markets will regroup around the most serious contenders that can actually be used as money.

If 2017 was the year that the world became aware of peer-to-peer electronic cash and became infatuated with this new species and went on some wild exciting dates, 2018 will be the year of “serious dating” where the world will decide which of this new species it wants to keep around in a possible marriage. Cryptos and their investors will have a “big talk about their relationship” and try to settle down, work things out, start a family, stop clubbing and drinking and such.

Bottom line, for 2018, play it safe with cryptocurrencies, and only hold those with the fastest and cheapest transaction processing. The expensive ones are likely to fall hard when holders realize they are mostly useless as money, practically speaking.

More Legalization

2018 began with California, the largest state in the Union, legalizing recreational cannabis. This is likely to benefit Las Vegas with a little bump as more Californians are likely to take some happy stoned trips to the Strip, but I doubt it will be too significant. The bigger picture is that legalization means less resources wasted in locking peaceful users in government cages for no reason other than to exert State power. This means more wealth will be available for things that people actually want and need, than otherwise.

In addition to California’s legalization, there is the impending FDA review and probable approval for GW Pharmaceuticals’ Epidiolex scheduled for June. This would be the first whole-plant derived cannabis product approved by the FDA, which would force the DEA to address the issue of rescheduling cannabis out of Schedule I, which could in turn force Congress to readdress federal marijuana laws. Though this does not directly affect the gambling industry, legalization breeds legalization. Expect more successes in gaming legalization in the US in 2018.

Inflation

2018 will likely be the year of the return of significant price inflation. Once government inflation indexes rise above 3.5% or so (we are now at 2.2%), it will start to become obvious. If people have $623B available to speculate on cryptocurrencies, that means much more is available to bid up prices in the consumer sector. Eyes will be on central banks to see if they will tighten the monetary spigots even more. They will have to, and then the US Federal budget will start getting squeezed with interest payments that Congress will have a hard time meeting.

They’ll have to borrow more or cut to pay them. Since a budget surplus hasn’t happened since the end of World War II (even under Clinton the national debt still went up), we can be sure that cutting will not happen. Eventually, possibly in late 2018, we’ll start to see a positive feedback loop form where interest rates rise and force more borrowing to pay the interest, which raises interest rates which forces more borrowing and so on.

Nobody wants to be invested in any financially risky companies when this starts happening. 2018 looks to be the year where people should start getting their investment affairs in order. Lighten positions considerably on riskier firms that hold significant amounts of debt, and hold companies with low debt burdens. 2017 was the year of growth, but 2018 will be the year of capital preservation.

Brexit Buying Opportunity

The one major buying opportunity for 2018 I see is in the UK. It looks like Brexit will finally happen in 2018. When it does, it will rock gaming stocks and every other UK industry for a time, but this should present some good buying opportunities before investors figure out that not being tied to the EU is actually a good thing long term. Not being tied to the Eurozone certainly went well for the UK during the many Greek fiascoes, so same here. When Brexit happens, buy the bookies with the lowest leverage. William Hill, Rank Group, Paddy Power Betfair, and 888 are in the best financial shape and should outperform the more leveraged companies in times of stress. Plus, some of them have decent dividends. If any of them fall on Brexit, they are buys.