William Hill for the last few years has had its advantages and disadvantages as a company to own. As ever, it still has its plusses and minuses. At this point though, it is healthy enough and its share price low enough that downside is limited, upside is possible though I wouldn’t count on it, but its dividend is very good at 5.2%. This makes it a very good income play, with the addition of possible capital gains to boot.

If you want to own William Hill then, it should be principally as an income stock, with any capital gains being reinvested long term. That way if it trends nowhere you’ll up your income, and if it trends lower you’ll up it even more. If it trends higher you can always sell. Bottom line, if you’re 10 to 20 years from retirement, this is a prime gaming stock to own and should reward you regardless of the direction it goes in over the next decade or so, provided you don’t trade in an out and don’t expect any capital gains. They may come, but buying the stock for that is beside the point.

If you want to own William Hill then, it should be principally as an income stock, with any capital gains being reinvested long term. That way if it trends nowhere you’ll up your income, and if it trends lower you’ll up it even more. If it trends higher you can always sell. Bottom line, if you’re 10 to 20 years from retirement, this is a prime gaming stock to own and should reward you regardless of the direction it goes in over the next decade or so, provided you don’t trade in an out and don’t expect any capital gains. They may come, but buying the stock for that is beside the point.

Why only an income play? First of all the stock is prone to extreme swings for a large cap, established company. From 2003 to 2005 shares tripled. Then from 2007 to 2009 they lost 70%. That loss was not just a result of the 2008 fiscal crisis. If it were, shares would have recovered by now and posted new highs. They haven’t. On a long term basis, we are almost exactly where we were 15 years ago in terms of share price. An expert trader able to perfectly time the tops and bottoms would be rich now. The other 95% of us who think we can pick tops and bottom perfectly, would have probably lost money on William Hill long term or at best broken even. The other 5% who are good, disciplined investors, would have bought William Hill, held it, reinvested dividends and been way up by now.

Price movements for William Hill, always a good company but never a spectacular one, teaches us one of the more important lessons in investing. The business is 10% making a fundamental decision before you buy and become emotionally invested, and the other 90% is just controlling emotions that grate against that initial decision after you buy. The same holds now. It’s a good company. It will probably continue its ups and downs. So if you want it, buy it, hold it, reinvest the income and cash out when you retire.

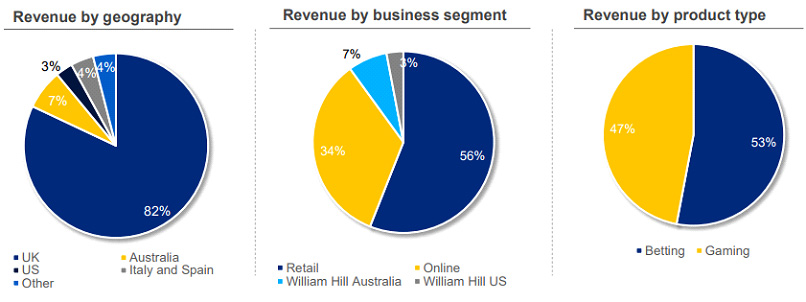

Exhibit A on why William Hill is generally safe is these pie charts from its latest investor presentation:

The first chart is actually key. It looks lopsided but in this case that’s a good thing. 82% of revenue is generated inside the UK. That minimizes hard Brexit risks stemming from reduction in trade with any country still inside the European Union, at least direct risks. Australia is irrelevant to this metric and has its own protectionist issues disguised as consumer safety nonsense. The United States is a separate matter. Italy and Spain, headlined as big growth factors for the bookie, are dead markets walking and William Hill will take a hit when they fall, but it won’t be fatal. It’s only 4% of total revenue.

As for the internal UK issues generated by Brexit, I have always believed, and continue to believe, that getting out of the EU is a long term positive for whoever decides to leave. If there is a hard Brexit, Hill will fall along with all other British stocks, but there will be a recovery when the world realizes a political union is really not that important. The added push in that direction is the Trump Administration. Before the end of this guy’s term, protectionist measures will be implemented in the US. When the economy responds negatively, Europe will realize that protectionism is economic self-immolation. That and Europeans don’t like Trump. If he does something they’re more likely to do the opposite, increasing the chances of an amicable Brexit.

The other two pie charts show a healthy split between online and retail, and a nearly even split between gaming and betting. More or less, the company is basically balanced. As of the latest interim report, Sportsbook wagers are up 11%. Revenue declined 1% but that’s just a snapshot. It’s the wagers that matter long term. Gaming volumes grew 10%. Double digit volume growth is always a good thing. Generally speaking then, we’re moving in the right direction here, even if there are no fireworks. Online revenues are up 5%, not amazing but OK to good.

As for balance sheet, debt to equity is only 33%, pretty good for a world gone mad on debt. They shouldn’t have any trouble paying that off as long as they don’t go much deeper.

It should be added that a weakening pound is bad for William Hill because it raises the cost of doing business and weakens consumer purchasing power in the UK. But mid to long term, the pound looks to be in pretty good shape relative to its peers the euro and the US dollar. The dollar looks to be on the edge of a cliff and could collapse at any time. It will, eventually. The Euro will probably fall next when rising interest rates in the US follow in the Eurozone. The weakness in the pound, relatively speaking, has to do with Brexit jitters and not much else. When Brexit finally actually happens, there will probably be a rush into the pound after an initial selloff, and from then on the currency will probably trend higher against the dollar and euro. This will be wind at William Hill’s back. It will both cut business expenses and increase British consumer purchasing power.