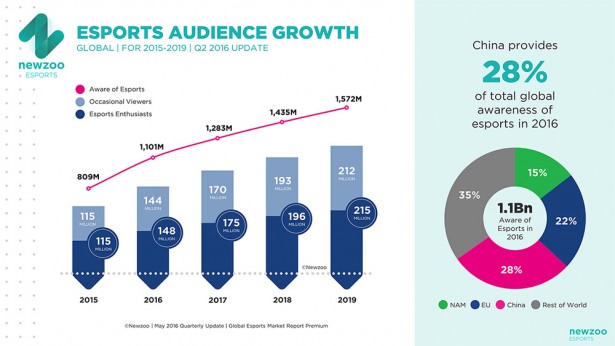

According to Newzoo’s latest quarterly update of its Global Esports Market Report, the number of consumers worldwide that are aware of esports will surpass one billion this year, up 36% compared to last year. One of the main contributors to this conclusion is Newzoo’s recent consumer research effort performed in April, spanning North America, Europe, Middle-East & Africa, China, Japan, and Korea. From the 16 countries studied, the average awareness of esports among gamers increased from 53.7% in 2015 to 65.7% in 2016.

Rise in Awareness Leads Esports Audience Growth to Exceed Expectations

The rapid growth in awareness exceeded Newzoo’s expectations for these regions that were researched. Explosive growth in coverage from global and local media, an intensified effort from game publishers, as well as the launch of an abundance of new leagues and events have accelerated the global exposure of esports beyond initial expectations. This jump in awareness in these key regions has, for a large part, also translated into higher audience numbers for both Occasional Viewers and Esports Enthusiasts. This is why, with its latest quarterly update report, Newzoo has adjusted its audience figures upward, from 131 million Esports Enthusiasts to 148 million. Combined with the 144 million Occasional Viewers (those who watch esports less than once a month and mostly tune in for a big event or watch along with someone else), the total audience will reach 292 million.

These results come from Newzoo’s Esports Audience and Revenue Model that is fed continuously by numerous data feeds, primary research and validated by a number of key players in the esports ecosystem. As the granularity of this model increases, more data is released to Newzoo’s subscribers. As of today, Newzoo’s esports clients can access granular esports data through its Esports Market Dashboard.

Publishers and Media Companies Increase Coverage of Esports

The explosive growth of esports awareness is not coincidental. It can mainly be attributed to three things: increased involvement of mainstream media and broadcasters, a huge effort by publishers to build their esports business and explosive growth in leagues and events organized on a global, regional, and particularly local scale.

Within the last 12 months, a huge amount of international and local media companies have either featured, or have actively started reporting on esports. Not only has esports proven to be a trending topic in the media business, but it has also given media companies an opportunity to attract a younger demographic. A similar movement has occurred with traditional broadcasters, who are launching esports events that are partly broadcasted on TV. Turner broadcasting, for example, now host its own leagues, undoubtedly with the intention to pull the younger demographic back to TV. At the same time, ESL is launching a 24/7 esports channel in Nordic and Baltic countries.

More and more publishers have also started to push their franchises as esports titles. They have seen the possibilities that esports gives to engage a player base and community outside of the game. Esports events are also being used more and more as a pre-launch marketing tool, giving players the tools (e.g. custom matchmaking, spectator modes, etc.) to develop community leagues themselves.

The surge in esports awareness has created momentum for local esports efforts. An increasing amount of local esports federations is pushing for esports to be recognized as a job, which helps esports athletes with regulatory issues, such as VISA applications. Esports leagues are also becoming increasingly local, with university leagues leading the way in creating offline local competitions.

Country Esports Audience Data Now Available in New Esports Market Dashboard

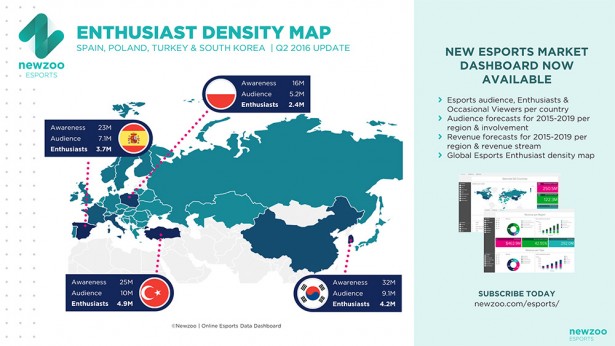

With the launch of Newzoo’s Global Esports Market Update, Newzoo also presented country splits with Esports Enthusiast and Occasional Viewer estimates for the first time. The below graph highlights some of the most interesting esports countries in EMEA and North-East Asia. It comes as no surprise that South Korea has a very high percentage of Esports Enthusiasts in its Online Population. The roots of esports lie in South Korea and while the scene has shifted from StarCraft to mostly League of Legends, esports remains as popular as ever. There are three notable countries in EMEA where the esports density rivals that of South Korea: Turkey, Spain, and Poland. In fact, Turkey has a slightly higher percentage of Esports Enthusiasts in its online population with 10.6%. The country hosts its own League of Legends league that caters to its 4.9 million Esports Enthusiasts. Spain fuels its Esports Enthusiasts with its own League of Legends competition hosted by Fandroid, while Poland is host to the biggest one-week esports event in the world: IEM Katowice. Estimates for more countries from North-East Asia, North America and Europe can be found in Newzoo’s newly launched Esports Market Dashboard, with a global top 50 countries ranking to follow later this year.

You can find our latest high-level esports numbers and graphs on our resource page.

Methodology: Newzoo’s Global Esports Audience and Revenue Model

The methodology for Newzoo’s esports data consists of three levels: 1) Data Input, 2) Predictive Modeling and 3) Result Validation. For Data Input, extensive primary consumer research in 26 countries across the globe sizes and profiles esports awareness and engagement across 100+ variables. Newzoo also continuously tracks and analyzes company revenues, live event audience figures, prize money, and video content viewer data. Predictive Modeling uses parts of Newzoo’s Global Games Market predictive model, which consists of several complex databases combining numerous data streams, financial analysis, primary research, as well as population and economic census data. Result Validation is done in two ways: through additional research and by validating numbers with key players in the esports space including game publishers, event organizers, esports teams, global streaming companies and local media companies.