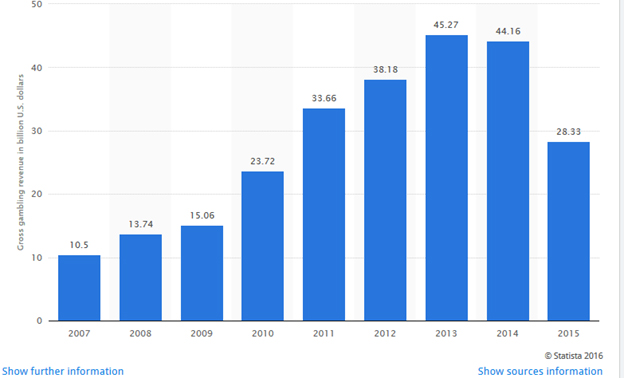

Word is spreading that Macau may have finally bottomed out. In terms of top line gross gaming revenue, that may be. Monthly gross gaming revenue for February came out to MOP$19.52 billion, down only 0.1% from January, so essentially flat. In terms of investing money in Macau, that’s a whole different matter, even assuming revenues have finally bottomed. Two things need to be kept in mind. First, this chart of annual gaming revenue in Macau going back to 2007 shows that from 2007 through 2008 and up until 2013, there was always annual revenue growth in Macau. That does not mean by any stretch of the imagination that you wanted to be holding Macau stocks in 2007 through to 2009.

Some of the more extreme examples why not:

- Las Vegas Sands (LVS) – Lost over 99% from 2007 highs to 2009 lows, still 64% below 2007 highs

- Wynn Resorts (WYNN) – Lost 91.5% from 2007 highs to 2009 lows, still 50% below 2007 highs

- Melco Crown (MPEL) – Lost 90% from 2007 highs to 2009 lows, still 29% below 2007 highs

- Galaxy Entertainment – Lost 89% from 2007 highs to 2009 lows, but up 181% from 2007 highs

Ironically, Galaxy, which has lost the most since topping in January 2014, is one of the only good long term Macau holds since 2007. The rest would have lost you a lot of money, even counting any dividends.

The point is, as you can see from the chart and Macau stock movements, top line growth in gross gaming revenue for the area as a whole does not at all correlate with stock prices. So while Macau may have bottomed, that does not mean it is time to buy yet. The question for investors is not whether gross gaming revenue has bottomed, but whether it can grow from here or if it will stay treading along the bottom for a while. My guess is it will stay stagnant for some time.

There are three major issues that need to be cleaned up before Macau becomes a good buy again. First, Beijing needs to let up on VIP guests and stop its money laundering crackdown scheme. This has already been discussed many times. Second, China needs to finish the bust phase of its business cycle, which is heating up. A bust phase and a crackdown on VIPs together does not make a good recipe for growth, even if Macau has bottomed. Third, just like the oil market crashed when the US nearly doubled its production capacity from 2011 to 2015 brewing a price war with OPEC, so too do we need to watch out for excess gaming capacity in Macau disrupting markets.

There is going to be a lot of extra capacity added to Macau this year and next. Melco just opened Studio City, Wynn is opening a new resort in June, and Las Vegas Sands is building The Parisian. Taken together, they add 25% to total gaming tables in the whole territory. When supply goes up and demands stays the same, price goes down, which is not a very good thing in a potentially bottoming environment.

There is going to be a lot of extra capacity added to Macau this year and next. Melco just opened Studio City, Wynn is opening a new resort in June, and Las Vegas Sands is building The Parisian. Taken together, they add 25% to total gaming tables in the whole territory. When supply goes up and demands stays the same, price goes down, which is not a very good thing in a potentially bottoming environment.

As for the bust phase, that affects mass market revenues more than VIPs who have their own problems. Melco, which caters specifically to mass market clients, will by affected by this, and it looks like the bust is getting worse. Here’s an interactive map of labor strikes in China this year, which are reportedly up 96% from last year, and 1,361% since 2011. The reason for labor strikes is obviously money, but that’s like saying the reason for airplane crashes is gravity.

Look one layer deeper, and strikes only happen when workers are not getting pay raises in line with their rising costs of living. In most cases it’s not that they suddenly get a pay cut and then strike, or a mood sweeps over them and they suddenly want more money. It’s that things start costing a lot more money but the factory isn’t raising wages fast enough or at all. In other worse, increasing strikes are a sure sign of increasing price inflation, whether or not the People in charge of the People’s Inflation Statistics are reporting inflation honestly or not. Even according to government statistics, the inflation rate is back up to 2.3%, the highest in 2 years. This is up from 1.3% in October, and the fourth month in a row of higher price inflation.

Price inflation combined with a slowing stock market and generally slowing economy is the penultimate sign of stagflation. It also means that the People’s Bank of China cannot do much to support stocks, because doing so will at this point quickly bleed into the consumer sector and exacerbate price inflation.

Back to the junkets and the VIPs, still nothing doing there. In February, the British Journal of Criminology published a research paper detailing how junkets are dominated by the Chinese Mafia. Surprise surprise. That’s not going to stop until Beijing gets rid of all capital controls to and from Macau so that junkets become redundant and useless. That’s certainly not going to happen any time soon, so the money laundering crackdown will remain in place. So much for that. Ironically, Beijing’s note that they would introduce “helpful policies” to help stimulate Macau were focused mostly on increasing supply there, easing building permits and such, which may even end up hurting the casinos already there by watering down revenues.

One relative bright spot in Macau is Melco, which despite it all, actually had both a sequential and year-over-year increase in mass market table games revenues for the fourth quarter of 2015. That is quite an accomplishment given the current environment, and it continues to point to the fact that Melco will be the stock to buy once the Chinese economy has cleared out all of its dead weight. Melco, in an attempt to convey its financial health, actually issued a special dividend worth $350 million to shareholders during the last earnings announcement.

Model Portfolio Update

Since January 19, short term holds:

- MGM up 5.44%

- Eldorado Resorts up 4.45%

- Penn up 2.41%

- Boyd up 5.13%

All these positions should be exited once the S&P 500 reaches 2100.

As for the Caesars short position (0.5% in $5 CZR March 18 PUT at $0.10), this needs to be monitored very carefully by the hour now. According to a tweet by Maria Chutchian, a corporate bankruptcy reporter for DebtWire, the critical examiner report is due either before 8:30am CT, or after 3:00pm CT today. If it’s in the morning, Caesars shares will respond in the premarket. If it’s after 3pm, the market will already be closed and you’ll have to wait for tomorrow to close positions. If CZR moves anywhere below $4.70 on the announcement, sell half the position as you’ll be up about 300%. If it moves below $4.40 or so, sell the rest.

If the report is good news though, the position will quickly become worthless, so there will be no need to do anything other than let it expire on Friday and take the 0.5% loss.