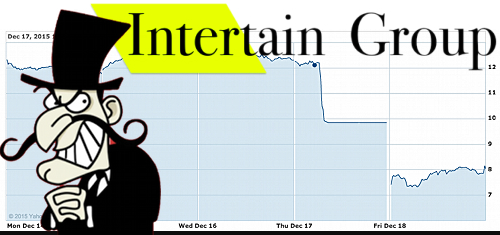

Canadian online gambling operator Intertain’s shares lost more than one-third their value in two days following the release of a hedge fund’s highly critical report on the company.

Canadian online gambling operator Intertain’s shares lost more than one-third their value in two days following the release of a hedge fund’s highly critical report on the company.

On Thursday, Spruce Point Capital Management (SPCM) released a 120-page report (read it here) on Intertain that took major issue with the company’s performance to date and future outlook, cast aspersions on the backgrounds of senior management figures and basically suggested Intertain was a Ponzi scheme.

To get a sense of the report’s tone, consider this passage, in which the authors express concern that Intertain “could exist primarily as a vehicle that enriches insiders and advisors, while leaving shareholders left holding a collection of mature gaming assets, saddled with C$758m of debt and financial obligations.”

The report is laced with similarly salacious quotes, including concerns about the company “flipping through three auditors like pancakes” or “the mountain of debt placed on its largely intangible asset base” while speculating that “Intertain is highly likely to roll snake eyes.”

Some of the critiques – including one of Fitzgerald’s choice of attire for an interview on a Canadian business TV network or the inclusion of a painfully awkward photo of Fitzgerald and a Cannacord Genuity banker failing to connect on a high-five courtside at a Toronto Raptors game – miss the mark.

Others seem more justified, such as the lack of KPI’s in Intertain’s earnings reports or the “undisclosed and contentious” Management Incentive Plan under which CEO John Kennedy Fitzgerald and CFO Keith Laslop collect a fee equal to 2% of each of their mega-acquisitions – which amounted to over C$17m (25% of which is paid in cash) for the pair in 2015 before shareholders raised a fuss in August – plus the significant finder’s fees paid to unknown individuals for each acquisition.

Trading in Intertain’s shares was halted on Thursday after the stock plummeted. Trading resumed on Friday but the shares continued to fall before staging a minor rally to close out the day.

In response to the share slump, Intertain issued a statement on Friday slamming the “misleading and self-serving” report while accusing SPCM of having built a short position in Intertain shares and therefore “stood to realize significant gains” from the stock’s decline. Intertain says it intends to “closely review the allegations” and will take “any and all actions necessary and appropriate to protect the interest of the Company and its shareholders.”

With Christmas just around the corner, it seems hedge funds are trying extra hard to make it onto Santa’s ‘naughty’ list. Swedish online betting company Betsson issued a statement on Friday in response to what it claimed was a short seller’s attempt to connect its July acquisition of Georgian betting operator Europe-Bet to an individual accused of corruption and money laundering charges.