Melco Crown (MPEL) continues to have the best fundamentals of the major Macau casinos, and the new Studio City can make those fundamentals even better. Of course stock values no longer reflect fundamentals anymore since loose money has turned investing into a casino itself. Luckily one can track how loose money is at any given time in order to make adjustments. My contention remains that whenever Macau does bottom, which it may have already done, Melco’s stock will be the fastest long term gainer in Macau.

Melco Crown (MPEL) continues to have the best fundamentals of the major Macau casinos, and the new Studio City can make those fundamentals even better. Of course stock values no longer reflect fundamentals anymore since loose money has turned investing into a casino itself. Luckily one can track how loose money is at any given time in order to make adjustments. My contention remains that whenever Macau does bottom, which it may have already done, Melco’s stock will be the fastest long term gainer in Macau.

This has proven to be the case so far. Ever since that faux announcement of “help” from Beijing, Melco is up 42%, Galaxy 34%, Las Vegas Sands 33%, and Wynn 36%. On the way down it was the second best performing of those four behind LVS, which isn’t saying much though because it still lost two thirds of its peak value. From the March 2014 top to now, LVS is still winning by 13 points, but that should change if the final bottom is in, and Melco should overstake LVS in terms of stock gains in the next year or so.

As a reminder, last year I wrote:

The new Studio City is positioned to attract the mass market, and intelligently so. While the VIP market is a great windfall, it cannot be relied on long term due to government. The marketing for Studio City may be cheesy by American standards but it looks like fun if you have a funhouse-mirror view of Hollywood culture. Rides, a really big Ferris wheel, and what Melco calls a “4D simulation ride” with a Batman theme are all meant to ooh and ahh mass market Chinese tourists with an avalanche of Americana spiked with a heavy dose of Chinese glitz. (Unless Melco has successfully found a gateway into time travel, I do not know what a “4D simulation ride” is, exactly. Suggestions can be added in the comments below.)

From a monetary standpoint, the higher the Yuan goes, the more successful Studio City will be. If indeed its success depends on the mass market, then the higher the Yuan, the greater the purchasing power of the middle class, the more they can afford to hang out in Studio City on 4D Batman rides. Notwithstanding August’s huge devaluation relative to the dollar, the Yuan has been in a raging bull market since 2005, up 27.5% in a decade. That bull market may yet become even more pronounced because the People’s Bank of China is on a tear selling US Treasuries.

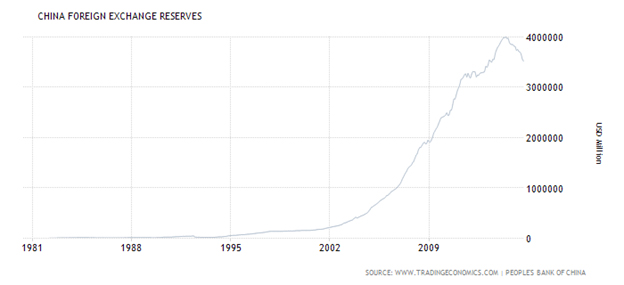

How much of a tear?

$480B in 15 months, 12% of its entire forex holdings, which are mostly US Treasury securities, AKA US Government bonds. At this rate, the PBOC will have liquidated its entire $4 trillion in US Treasury holdings in 10 years. When dealing with numbers like this and their possible impact, it’s like dealing with distances between stars in the vacuum of space, but in any case if the Yuan has been rising against the dollar since 2005 despite its amassed dollar hoard, then imagine how the Yuan will perform when Treasuries are being sold? It hasn’t affected bond yields yet, but it will if it continues much longer.

The macro picture is that this selling, if it continues, will be the trigger that finally drives interest rates much, much higher and changes the global economic landscape, possibly forever. For China this will be good for the middle class in the long run because they will earn much more on their savings with which they can go party in Macau, but it will be bad for the super rich who make money in the stock market and bond trading.

This is an added reason why aiming at the mass market makes sense. Because the super rich, the ones that benefit directly from inflation at least, are about to lose a lot of money and the middle class is going to gain from it. That will decrease the VIP market still further, giving the edge to casinos that are already turned towards the mass market.

All of this dislocation will certainly create a disturbance before we find equilibrium, but how this all impacts Melco won’t be too serious in the long run. Its debt is under control at 40% of market cap (considering its depressed market cap of late that is pretty good) and half of that debt is protected against interest rates. As for the bumps along the way, the Chinese economy will have to be restructured which will lead to temporarily high unemployment as labor and capital resources shift, but once readjustments are made (hopefully with minimum government interference) then Macau’s mass market should be on much surer footing for the long term.

All the Chinese authorities need to figure out is that it is not necessary to debase your own currency just so you can add a few points to your export trade. This is mercantilist Keynesian thinking and it doesn’t make any sense, because there is no difference in terms of human utility between a good going abroad for X amount of money or the same good staying within an arbitrary political border for the same X amount of money. Focusing on export numbers rather than living standards of the actual population is like counting hits in a baseball game instead of runs.

If your currency goes up, domestic demand replaces foreign demand. The higher the Yuan goes, the richer the Chinese will be, the better positioned Melco Crown will be in its turn towards the mass market, and the more successful Studio City will be.