This week, the S & P 500 – an index of 500 of the most important publicly traded US stocks – rose past 1400 for the first time since June 2008, before the harrowing days of the credit crisis.

This week, the S & P 500 – an index of 500 of the most important publicly traded US stocks – rose past 1400 for the first time since June 2008, before the harrowing days of the credit crisis.

The US stock market has moved steadily higher in 2012, defying critics who question why the market has doubled in three years. European debt worries, soaring gas prices, weak consumer confidence, and the prospect of a divisive US presidential election between two relatively unappealing candidates have done nothing to slow down the bull market.

Gambling stocks have benefited from the improved market; the BJK exchange traded fund, which comprises a number of gambling stocks from around the world, is up nearly 20% year-to-date and up some 35% from its lows in early October.

The recent strength in gambling stocks, however, makes them a prime candidate for short sales by investors who believe the market rally will end in the near future. Selling a stock short entails borrowing shares of that stock, selling them into the open market, and then predicting that the stock price will fall, allowing an investor to repurchase them at a lower price, keeping the difference as a profit. The purpose of the trade is to select stocks that are predicted to fall in value, and to take advantage of the decline in price. A short sale is simply a bet against a stock.

As an example: an investor sells short (or “shorts”) 100 shares of ABC stock at $10 per share. He borrows the 100 shares, selling them for a credit of $1,000. If ABC drops to $9, the investor can then purchase 100 shares for $900, return those shares to the original holder, and earn $100 on the trade.

Short selling is a risky maneuver for a number of reasons. First, the loss on a short sale is theoretically infinite. Buying 100 shares of ABC at $10 per share means an investor can lose $1,000. Shorting 100 shares of ABC at $10 shares can result in a loss greater than the initial investment. If ABC goes to $30, the investor must then repurchase the shares for $3,000, creating a $2,000 loss on what appeared to be an initial investment of just $1,000. Secondly, shorting stocks requires payment of interest to the lender (as with any loan); in this low-interest rate environment, these costs are obviously lower, but can still provide a headwind against potential profits. The amount of interest depends on a number of factors: the investor’s account size, short position, and the security shorted. Securities in high demand from short sellers can have a “hard to borrow” fee, reflecting brokers’ difficulty in finding actual shares of the stock to borrow. (An excellent recent example was Groupon (GRPN), which many investors tried to sell short. That stock trades at just $18, below its $20 initial offering price, but many short sellers have likely seen little gain off their trades, owing to those “hard to borrow fees” and interest on the loan.) Thirdly, selling short entails betting against a market that, generally (though clearly not always), moves upward.

But the most important issue with short sales is timing. The renowned economist John Maynard Keynes famously said, “Markets can remain irrational a lot longer than you and I can remain solvent.” It is not enough to be right that a stock will decline; it is also important to be (relatively) right as to when a stock will decline. An acquaintance of mine correctly predicted the collapse of the housing bubble in the US, and shorted one million dollars’ worth of housing-related stocks. Unfortunately, he did so in late 2005, and finally capitulated on the trade in 2006, down some $700,000. Housing stocks would collapse soon after, with a number of his selections going bankrupt (the Holy Grail of short selling); the trade was right, but the timing was wrong.

The timing issue is especially relevant in the gambling sector, where, as I’ve noted previously, stock valuations are so correlated with broader economic sentiment. As I wrote two weeks ago, investors can tease out broader economic effects by using pairs trades – offsetting the short position with an equal long position in a similar stock – but this, like every investing strategy, has tradeoffs. Most notably, returns are likely capped, as the correlation between two stocks – say, as in one of my examples, Wynn Gaming (WYNN) and Las Vegas Sands (LVS) – limits the likelihood of big gains. Because paired stocks are predicted to move in the same direction, pairs trades are generally designed for lower returns.

Of course, those trades also provide lower risk. Again, short selling is a high-risk strategy. But it does have some benefits. A correctly timed short sale – particularly in a volatile sector such as gambling, where stocks can fall 10 or 20 percent in a matter of days – can offer substantial profits. On a portfolio-wide basis, a short position also offers benefits, by limiting the effect of the overall market on an investor’s returns. If an investor is 20% short, and 80% long, a large decline in the broad market will have less effect on his portfolio then if he were 100% long. (Indeed, the ability to go long and short is what puts the “hedge” in the term “hedge fund”; theoretically, good hedge fund managers should profit whether the overall market is up or down. Unfortunately, the SEC requires that direct investors in a hedge fund have a net worth of at least one million dollars. So, if you’re not a millionaire, you’re stuck investing your own hard-won capital based on the advice of a stand-up comedian.) And, to be honest, selling short can be fun. It’s a contrarian bet that keeps investors sharp and can honestly provide a bit of a thrill. It’s much like betting the “Don’t Come” line in craps: sometimes, it’s enjoyable to be the turd in the punch bowl. Toward that end, here are two interesting short plays in the gambling sector:

1. Isle of Capri (ISLE).

Given the seemingly unrealistic optimism about the US economy, I would recommend a short in any of the US-facing casino operators, but ISLE looks to have the weakest fundamentals and the best short-term case for a short sale. I covered ISLE briefly in my piece covering pairs trades, recommending pairing a short position in the stock with a long position in a company with exposure to the fast-growing Macau market, such as WYNN or LVS. But, at this point, ISLE’s profile seems to offer enough potential reward to make a pure short sale worth the risk.

As I noted in that piece, over the last twelve months, over 35% of Isle of Capri’s net revenue has gone to pay off gaming taxes and interest on its massive debt. That debt – over $27 per share after subtracting the company’s cash – is suffocating for a company that closed Friday at $6.27 per share. All of ISLE’s relatively impressive cash generation must pay off interest on that debt. Indeed, in fiscal year 2011 (ending in April), the company generated $65 million in free cash (defined as cash from operating activities minus capital expenditures: money spent on property purchases, upgrades and maintenance). That figure is substantial for a company whose market value is just $244 million. And yet, the company accrued $90 million in net interest expense for the year, leaving Isle of Capri still some $25 million in the hole.

Buying a stock entitles a stockholder the right to a portion of a company’s profits. As such, equity holders in ISLE must wonder: how long will it take for those profits to trickle down? Nearly all of the cash flow over the last three years has gone to interest payments to the company’s bondholders. Meanwhile, net debt is down only slightly since 2007, meaning that debt service will continue to gobble up the company’s free cash flow for the near future.

Nor does there seem to be any route to growth for ISLE. Revenue is down on a company-wide basis from pre-crisis levels, and down sharply at several locations over the last five years. Isle of Capri’s properties are in highly competitive regions, such as Kansas City, St. Louis, and the struggling Mississippi market, while its brand does not have the value of many of its competitors – Isle of Capri is often the third or fourth strongest casino in the region.

And yet, ISLE is up 34.3% in 2012, and up 50% from its lows in early December. Why? Why would a company that has earned just eight cents per share over the past year, that cannot return cash to shareholders, and that has so little potential for growth see such a sharp move upward? The answer is simple: ISLE has been swept up in the bullish tide for the broad market, and gambling stocks in particular. But the stock’s bull run seems unlikely to last. ISLE’s stock price has stalled over the past few weeks, showing the lack of confidence by potential buyers. With full-year earnings not due until June, and little else to move the stock, it seems a good bet to decline, particularly if the broad market run-up finally slows down. Risky stocks are the first to fall when fear returns to the market, and ISLE’s debt load and lack of growth are scary indeed.

2. 888 Holdings (888.L) and Bwin.party Digital Entertainment (BPTY.L)

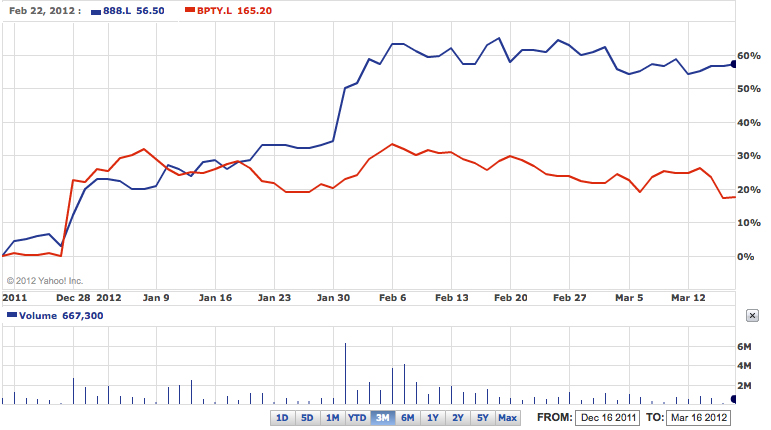

On the other side of the business – and the ocean – from ISLE are 888 Holdings and Bwin.party Digital Entertainment, two online gambling providers. Both stocks have performed well since the December 23rd Department of Justice opinion that appeared to have paved the way for legalized online poker in the United States:

The key word in the preceding sentence, however, is “appeared.” 888, through a partnership with Caesars Entertainment (CZR), and Bwin.party, through its tie-up with MGM Resorts (MGM) and Boyd Gaming (BYD), were both poised to enter the US market. Investors cheered the early news, with strong 2011 earnings from 888 adding further fuel to its stock price in late January. But it “appears” that online poker in the US is farther off than the early optimistic predictions after the DOJ opinion. Potential legalization measures in both Iowa and New Jersey look unlikely to pass, leaving Nevada as the sole state with any real possibility of regulated, legalized online poker. Hopes for online poker advocates now rest on California and the federal government, neither of which should relied on for any investment, in any industry. Even Bwin.party co-CEO Jim Ryan believes 2012 legalization is unrealistic, backing the projection made by our own Calvin Ayre.

In the meantime, both 888 and BPTY have stalled out, leaving investors to wonder how much support will arise if their stock prices begin to tumble. Both stocks – owing in large part to the regulatory uncertainty they face not just in the US, but in Europe – are highly volatile, and perhaps more fit for trading than for long-term investing. In this case, the trade is simple – a short sale in either stock is a bet that bad news, or even no news, will arise before good news. Given the lack of opportunities in the US in the near-term, it seems unlikely that either stock will have a positive catalyst going forward. If the market realizes that its initial euphoria was unfounded; if continuing economic worries on the Continent hurt the already mature gambling market there; or if a weaker broad market leads to a flight from high-risk stocks, 888 and BPTY will be hit, and, if history repeats, hit hard.

Shorting 888 and BPTY are high-risk trades, even by the standards of a typical short portfolio. Legalization efforts in a new state, progress in Nevada, or even the rumor of a deal between Senate Majority Leader Harry Reid and Republican Jon Kyl can spike these stocks. But, barring unforeseen developments, investors in the online gambling platforms are, in the short term, betting on politics. Even worse, they are betting on politicians in Washington and Sacramento, two capitals of dysfunction, to get their shit together, to put it bluntly. In an election year, it would seem wise to take the other side of that bet.