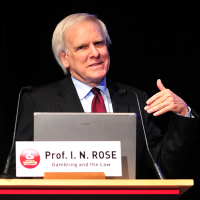

Were you aware that a casino is considered a financial institution? (Then why did the bastards turn down my mortgage application? Oh, right… I’m skint. ) Card clubs and other gambling facilities are also considered financial institutions under US law. Prof. I. Nelson Rose, a leading authority on gambling and the law, examines the relationship between casinos and US financial watchdogs in his latest blog entry, What Happens In Vegas… Is Reported to the IRS.

Were you aware that a casino is considered a financial institution? (Then why did the bastards turn down my mortgage application? Oh, right… I’m skint. ) Card clubs and other gambling facilities are also considered financial institutions under US law. Prof. I. Nelson Rose, a leading authority on gambling and the law, examines the relationship between casinos and US financial watchdogs in his latest blog entry, What Happens In Vegas… Is Reported to the IRS.

Rose traces the roots of the modern relationship back to the passage of the Bank Secrecy Act in 1970, when ‘financial institutions’ such as casinos were tasked with filing reports on all cash transactions over $10k in a 24-hour period. But the US Treasury didn’t stop there, saddling gaming operators with the extra responsibility of filing Suspicious Activity Reports Casinos (SARC) whenever they suspect, or felt they should suspect, that a transaction involved illegal activity. To make matters worse, the threshold for filing a SARC can be as low as $3k.

Casinos file these reports once a month, but the IRS is hoping to speed up that process. Agents are now holding regular informal meetings with casino staff, seeking more immediate feedback on suspected shenanigans, regardless of the dollar amount changing hands. For a player whose big payday attracts attention, this could lead to a painful audit, and that’s if he’s lucky. Remember that while the US gov’t is undeniably interested in collecting every tax dollar it feels it’s owed under the law, it also has a mandate to ferret out suspected terrorism financing. If your name’s on a SARC today, will it be on a no-fly list, tomorrow? Probably not, but do you want to take that chance?

Players and operators need to know their responsibilities under the law. Prof. Rose has the answers you’re looking for at GamblingAndTheLaw.com.