With former Amaya CEO officially stepping down from the company this week amid some truly inane Canadian insider trading charges wafting in the background, it is a good time to reassess Amaya shares. Baazov continues to be hounded by the Quebec authorities (read financial mafia) for allegedly sharing information about insider deals with his *gasp* family and friends. As if no CEO actively involved in some negotiation or other ever gave his relatives and friends an oblique stock tip, as in “Hey, look over my shoulder while I put in this huge order in for more stock of X in my brokerage account, which I casually told you over the dinner table that we were in discussions with about things I cannot disclose, wink wink.”

What a crime. Maybe the way it’s worded above is “legal”. Who really knows anyway.

Mainstream sites on Baazov’s latest move all quote good earnings this past quarter, with particularly impressive growth in the Sportsbook & Casino segment. This is true, but they all stop there. First the positive case for Amaya, and it can easily be made. First, the company is in discussions with a number of operators, including Baazov himself, for taking the company private again. This would of course involve a premium over the current market price. If it doesn’t happen it shouldn’t be too much of a downside because as it is now, the company is doing well.

Mainstream sites on Baazov’s latest move all quote good earnings this past quarter, with particularly impressive growth in the Sportsbook & Casino segment. This is true, but they all stop there. First the positive case for Amaya, and it can easily be made. First, the company is in discussions with a number of operators, including Baazov himself, for taking the company private again. This would of course involve a premium over the current market price. If it doesn’t happen it shouldn’t be too much of a downside because as it is now, the company is doing well.

The long term danger for the company is its debt load of $2.38 billion, almost all of which is due 5 years from now or longer. So there is no immediate debt danger on the horizon for them. But if interest rates start to rise, and they cannot get any lower than they already are, then we’ll start to see that rise discounted against Amaya’s market cap even though it shouldn’t affect its balance sheet directly all that much over the next 5 years.

Its strongest segment, poker, was flat, but new CEO Rafi Ashkenazi explained that away due to soccer matches. Let’s give him the benefit of the doubt there, OK. The Casino & Sportsbook segment was way up, almost 90% year over year, or an absolute difference of $28 million. Total revenues were up $26.5 million, so virtually all of its net growth came from that segment. At first glance, this means Amaya is successfully diversifying and becoming a more balanced company, and investors will see this and instinctively hit the buy button. If Ashkenazi is right and the Poker segment will see growth from here due to less soccer more poker, then we’re looking at another good quarter coming up, though less soccer will cannibalize somewhat from sportsbook.

These considerations alone warrant Amaya a hold. As we have a 5% position in Amaya from back in February that is up 15% so far, those following the model should keep it but not add to it, and don’t take your eyes off it. It is far from a buy and hold. Here’s the not so good part.

While earnings do look good overall and growth looks likely in the quarters ahead, the fact is that where most of the growth is coming from is quite unstable. I’ve railed on Malta before for the size of its banking sector and that has not changed. Assuming PokerStars will grow on its own, most of Amaya’s Casino & Sportsbook segment growth, which is where all of its top line growth has come from this past quarter, has come from Malta, Italy, and Spain, three countries that are not exactly the epitomes of financial stability.

66% of Amaya’s Sportsbook & Casino segment revenues are from Malta, $38.6 million of $59.6 million in total revenue. Though the revenue does not actually come from Malta but only booked as from Malta due to licensing, the money is ultimately stored in its banking system, meaning it is still all dependent on the health of its banking sector. Only 33% came from other countries. Malta grew a whopping 82% year over year, with Italian revenue growing an incredible 437%. Revenues are still quite small there at $6.38 million, but Italy now accounts for the second biggest geographic contributor to Amaya’s Sportsbook & Casino top line. Third in line is Spain at $6.15 million, up from $4.07 million last year for a growth rate of 51%.

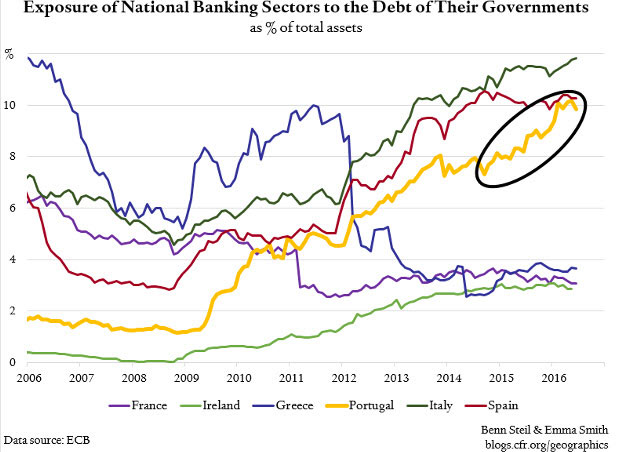

Italy is also the #3 market for poker as well at over $18 million. Spain is #5 behind the UK at just over $10 million. Malta accounts for 28% of the poker total at $60 million. As many are already aware, Italy is experiencing a major banking crisis and its debt problems have not eased by a long shot. The graph below from Zero Hedge, sourced from the European Central Bank, shows the top two European PIIGS countries whose banking sectors have the highest exposure to respective government debt are none other than Italy and Spain.

(The graph is intended to highlight Portugal, though that is immaterial here.)

This means that when the debt bubble bursts in those two countries, and it will eventually, the banking sector will fall with it and markets will shrink by necessity. If you look at peak banking exposure to sovereign debt in Greece in 2011, we all know what happened to their banks since then, and Italy and Spain are both higher than the Greek peak at this point.

Malta is not on the list here, but the problem with Malta is in the sheer size of its banking sector rather than its exposure to sovereign debt. When banks in Italy and/or Spain collapse, the effect on Malta will be indirect but serious. This puts all of Amaya’s major markets in the same basket essentially, so on a deeper look, it is really not as diversified as a cursory glance of its impressive earnings suggests.

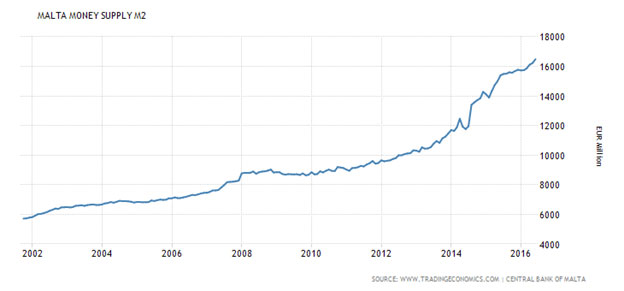

For now though, the money is flowing into Malta in torrents, to as long as Spain and Italy hang on, Amaya will continue to do well. Here’s the Euro supply in Malta, exploding higher since 2014.

Since Malta has no central bank, this money supply explosion does not mean that Malta is printing Euros. It just means that the banking system is getting bigger and bigger because more and more companies are stuffing their capital there. More and more of the Euro supply is being directed to Malta, which bodes well for business there at least. As long as this continues, Amaya is a hold, but watch it carefully, and follow banking developments in Italy especially closely with the finger on the sell trigger.