UK online gambling activity continues to pull back from its pandemic high, although partly because bettors are redirecting their action to newly reopened betting shops.

UK online gambling activity continues to pull back from its pandemic high, although partly because bettors are redirecting their action to newly reopened betting shops.

Figures released Friday by the UK Gambling Commission (UKGC) show all online gambling verticals reporting gross gambling yield (GGY) declines from June to July, with poker, virtual sports and eSports falling hardest as real-world sports were recalled to life.

Online slots GGY totaled £162.9m in July, down 2% from June, while other online casino products slipped 5% to £66m. Real-event betting dipped 4% to £209.3m, while virtual betting dropped 15% to £8m, eSports wagering was off by one-quarter £2.6m and online poker slid 23% to £9m.

In terms of the number of online bets placed, only real-event sports posted positive growth, rising 5% to 267.2m. The number of active real-event sports bettors grew by 3.7% while slots were basically flat and all other verticals reported negative growth.

UK betting shops weren’t allowed to reopen until mid-June, making month-to-month comparisons problematic. But over-the-counter wagering generated GGY of £62.5m in July, self-service betting terminals brought in £23.1m and gaming machines added £81.6m.

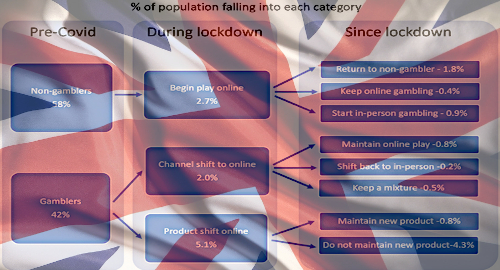

Turning to consumer data, the UKGC found that 2.7% of UK residents who didn’t gamble before the pandemic lockdown decided to try online gambling during their forced hibernation. But two-thirds of these virgin gamblers resumed their non-gambling status once the lockdown was lifted.

Among gamblers, only 2% transferred their affections online when retail options halted. More than half of these new online gamblers opted to continue some level of digital activity post-lockdown. Some 5.1% of existing gamblers made some kind of online product shift during the lockdown – from sports to virtual sports, say – but around four-fifths of these dilettantes gave up these experiments once their usual gambling preferences were restored.

Shattering the UK media myth of hordes of crazed Britons blowing the rent money on gambling during the pandemic, only 13% of gamblers reported boosting their spending under lockdown, while 24% reduced their gambling outlay.

Post-lockdown, 73% of gamblers said their spending had undergone no change from pre-pandemic levels. Nearly one-third of gamblers (30%) said they would likely reduce their gambling spending over the next three months compared to just 4% who anticipated spending more. Those who planned to spend less cited financial uncertainty as their principal motivation.