My first car was a piece of crap. It always had problems. One really annoying problem I remember very clearly was that it would stall out every time I took it out of gear. In order to keep it from stalling, I would gently tap the gas when putting it into neutral to keep the engine turning.

The engine of the global economy – the banking system – is now completely out of gear. It’s in neutral. It’s idling. And it is about to stall out. People aren’t going to work, payments aren’t being made, money is not circulating, and everything is going to pot. In order to keep the engine of the economy from completely stalling out, the Federal Reserve hasn’t just tapped the gas. It has slammed the gas. Here’s just part of the announcement from the New York Fed yesterday, March 12. It’s OK to be wide-eyed and incredulous. I said this was going to happen, many times. And believe me, this is nothing compared to what’s about to come:

Today, March 12, 2020, the Desk will offer $500 billion in a three-month repo operation at 1:30 pm ET that will settle on March 13, 2020. Tomorrow, the Desk will further offer $500 billion in a three-month repo operation and $500 billion in a one-month repo operation for same day settlement. Three-month and one-month repo operations for $500 billion will be offered on a weekly basis for the remainder of the monthly schedule. The Desk will continue to offer at least $175 billion in daily overnight repo operations and at least $45 billion in two-week term repo operations twice per week over this period.

So that’s $1.5 trillion over the next two days plus another $1.5 trillion for the next three weeks plus $175 billion every day plus $45 billion twice a week. That’s, uhh…a flagillion or whatever. Who cares?

The effect was nothing. The RPMs just kept falling. Markets just kept crashing. The gravitational forces of the developing black hole are only gathering strength. So they will print more. Slam the gas even harder. There is no theoretical limit to how hard in a fiat money system. That’s all they know how to do. There is no turning back now. They must follow through with the essence of what they are – money printers.

Here’s the real problem though, as if all this wasn’t problematic enough. The longer we are in neutral, the harder the Fed and other central banks will have to press on the gas in order to keep interest rates at their current record lows. But you see, when I had that crappy car, I had to finesse the thing really carefully when I put it back into gear or the engine would lurch and I’d risk tearing the clutch. That happened a few times when I wasn’t gentle enough.

Now, unless this really coronavirus really is the zombie apocalypse, which I do not believe to be the case, then the virus will eventually go away and the global economy will kick back into gear. A few weeks of social distancing, maybe two to three months at most if it takes hot weather to finally stop the thing. But by then, every central bank will have printed, my honest guess, the equivalent of between $100 and $200 trillion in various forms and operations etc. No I am not exaggerating. I am taking a truly honest guess here. 2008 we know was $16 trillion thanks to one of the only good things Bernie Sanders ever did, which was that partial Fed audit back in 2011. This time, 10 times that, or $160 trillion, is entirely feasible.

When the global economy inevitably kicks back into gear from idling at, oh, 100 trillion RPMs or so, the clutch is going to rip, the engine is going to catch fire and the car is going to explode. I don’t want to make it any more graphic than that other than to say a brief word at the end of this article.

In the meantime, the gravitational forces of the black hole continue strengthening as the Fed feeds more and more liquidity into it, and markets around the world are crashing at all-time record speed. How are the gambling capital markets? Let’s start with the United States.

United States

May as well begin with MGM. Down 25% on the week for the stock’s 7th worst week on record. Not too bad, considering what everything else is doing. MGM’s balance sheet is not great. It’s not the disaster it was back in 2007 but it’s not clean either. It has over $11 billion in debt, which is now suddenly 150% of its market cap. The tide has come out and MGM may not be completely naked, but let’s just say it’s wearing an ill-fitting thong and you can see a bit too much.

Ark Restaurants (ARKR) though, related to MGM, they’re doing OK. I don’t know how the restaurant industry will do after this all passes, but it’s not (yet) in full panic at least.

The skinny-dipper-in-chief in the US gaming market is Eldorado, which bit off way more than it could chew with Caesars. Now it’s paying the price. It’s down 37% yesterday and now 78% below its all time highs of $70.74 just last month. I bet they’re having serious Caesars buyer’s remorse. (Carl – I told you not to push that deal!) Maybe it’ll be called off. That’s being hinted at in the media now. Maybe they’ll cut the cord and Caesars will sink on its own as it should have before that horrific bankruptcy hide-the-assets farce a few years ago.

IGT has now fallen 11% below its last bear market bottom in March 2009. It has not made money since 2016. I do not believe IGT will survive this. The company is now levered 512% and it still has over $5 billion in goodwill on its balance sheet. Scientific Games is probably also complete toast, down 26% yesterday, levered more than 1000% now and still with over $3 billion in goodwill on its balance sheet that will probably be written off soon.

Penn, Boyd, and the regionals…eecch. I can’t even look. It’s too brutal.

Macau

Macau is slowly coming back to life. Reportedly half of gaming tables are back in operation. Entry restrictions from the mainland look like they will be eased soon. BJK is now below its 2015 lows back during Beijing’s let’s-harass-the-VIPs campaign. A small, quick, speculative bite here for a short but significant bounce could work here, but in two tranches in case this is not the bottom. I’d use options here to play this with pocket change. You could make a nice chunk of change but don’t go all out, again 5% max total positioning. If the virus makes a surprise comeback when things open up, Macau will find new lows. It could get real ugly if that happens.

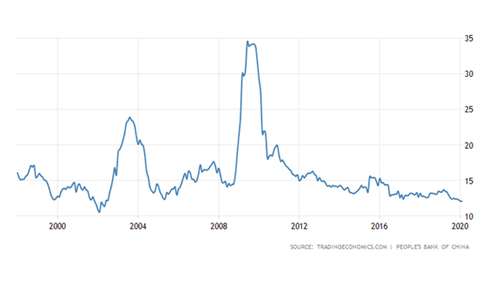

The bigger picture is that the yuan will eventually get killed in real terms and the VIPs will lose their fortunes when the currency markets go haywire, but that’s a few months away when everything kicks back into gear. For now, here’s an interesting chart to look at with China. Loan growth in the banking system has flat-lined, a trend established long before the coronavirus was a thing.

United Kingdom

Possibly the only good thing about the coronavirus is that at least Brexit is out of the news for a while. William Hill has found new all time lows, trading very volatile this morning and dividend yield now past 10%. I believe it will survive but I do not know where the bottom is. That will have to wait for the central banks to print many more trillions.

888 may have found a bottom at 8 year lows, finally. Hard to tell anything in this environment. The stock is up strongly this morning but also very volatile. The only thing I’m sure about is that 888 will survive this. It may get beaten up more, but it’ll pull through.

GVC is finally puking, stock cut in half since last week. If GVC survives past 2021 I’d be surprised. The only way to stop companies like this from evaporating completely is for a central bank to buy its stock directly. But then they’ll know where its business is and they won’t like it. It’s not out of the question though. The company makes no sense to me and never has. It has more goodwill on its balance sheet than its market cap and that will probably be written off soon. Leverage is now reaching 100%. Watch for dividend cuts. GVC has not been profitable for years and that is not going to change any time soon. Investors will no longer tolerate this. The leveraged buyout game is over and done with. Finished. No more. Watch for possible insider panic selling. My guess is that 888 will eventually swoop in and grab some cheap assets, thanking the Almighty that its offer for bwin.party way back when fell through.

Rank has been cut in half in three weeks but unlike GVC it actually makes money and has no debt. It will survive and soak up nutrients from the companies that die, as well. Hold it if you can afford to.

Australia

One thing I can say about Australia is that it has proven its relative safety. Crown is down “only” (what a word!) 30% since the global selloff accelerated late last month. Tabcorp has broken its trading range but that’s still “only” a 30% loss. I expect Australia to decouple from other markets when the currency chaos really begins in a few months. Australia is resource rich and can back its currency in a pinch if it needs to, meaning if it starts to see hyperinflation. If you want to sleep moderately well these days without trying to trade this earthquake, buy Australia.