Sports betting exchange operator Matchbook has had its UK gambling license ‘temporarily’ suspended for as yet undetermined reasons.

Sports betting exchange operator Matchbook has had its UK gambling license ‘temporarily’ suspended for as yet undetermined reasons.

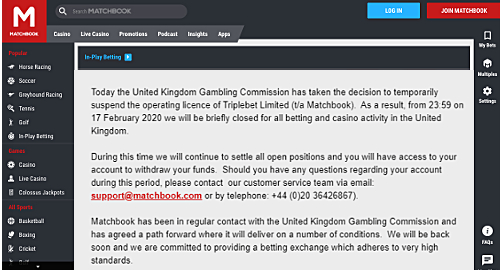

On Monday, Matchbook’s UK customers reported receiving emails informing them that the UK Gambling Commission (UKGC) had “taken the decision to temporarily suspend the operating license of Triplebet Ltd (t/a/Matchbook). As a result from 23:59 on 17 February 2020 we will be briefly closed for all betting and casino activity in the United Kingdom.”

Matchbook said it has been in “regular contact” with the UKGC and had “agreed a path forward where it will deliver on a number of conditions.” Despite Matchbook’s announcement, the UKGC’s official license register still shows Triplebet’s licenses as ‘active.’

Matchbook promised to “be back soon” and assured its UK customers that they would retain access to their online accounts for fund withdrawals and the site would “continue to settle all open positions.”

The reasons behind the suspension remain unclear but Irish media reported last month on a UK legal judgment involving Matchbook subsidiary Eurasia Sports, which held a license issued by the Alderney Gambling Control Commission for the site 3et.com, which promises “unrestricted betting” to high-value punters.

The defendants in that case, which dates back to 2015, were a number of high-rollers from Peru who were recruited for Eurasia by an Irish firm known as Xanadu Consultancy. The defendants were major betting whales who wanted to “bet considerable amounts quickly” via Eurasia, which offered some of these bettors credit of up to US$1m at a time without any security.

This system unraveled when some of the whales couldn’t or wouldn’t honor their markers, but promised to bring in other whales to keep Eurasia’s betting cash flowing. Eurasia then alleged that these whales had conspired to defraud the company by submitting checks that bounced and making false claims about having paid their gambling debts to other defendants, leaving the company out some $12.6m.

The UKGC has put its licensees on notice regarding their VIP clients after a report determined that VIPs were overrepresented in UK problem gambling statistics. The UKGC also recently announced plans to prohibit the use of credit cards for gambling.