The temptation to buy and sell and respond to daily market movements all the time can be overwhelming. It becomes stronger and stronger the more information we are exposed to. As most of CalvinAyre’s readership is comprised of gamblers and gamers or at least fans of the industry, it makes sense that active trading would have appeal. It’s basically a giant worldwide poker game with everyone betting against everyone else. The best can make millions. Most end up losing. When you win, it means you outsmarted everyone in the world all at the same time. There’s a power trip in that. But when you lose, it can ruin you if you lack bankroll discipline. Poker has bankroll. Trading has position size.

If you’re not a good poker player though, it’s still possible to play this game at a slower pace and improve mental health for it. For those making this effort, you’ll have to be able to trust your own judgment in very broad strokes. Where do you really think the gaming industry is going in say 10, 20, or 30 years out? If you can make that judgment and stick to it even in the face of extreme volatility, then chances are you’ll turn out just fine, more mentally balanced and able to let the constant distractions of life pass you by peacefully. You’ll skip the intermittent highs and lows, but if you just let the noise pass, then by the time you’re retired, your satisfaction will be greater than the ephemeral glory of winning any particular trade.

If you’re not a good poker player though, it’s still possible to play this game at a slower pace and improve mental health for it. For those making this effort, you’ll have to be able to trust your own judgment in very broad strokes. Where do you really think the gaming industry is going in say 10, 20, or 30 years out? If you can make that judgment and stick to it even in the face of extreme volatility, then chances are you’ll turn out just fine, more mentally balanced and able to let the constant distractions of life pass you by peacefully. You’ll skip the intermittent highs and lows, but if you just let the noise pass, then by the time you’re retired, your satisfaction will be greater than the ephemeral glory of winning any particular trade.

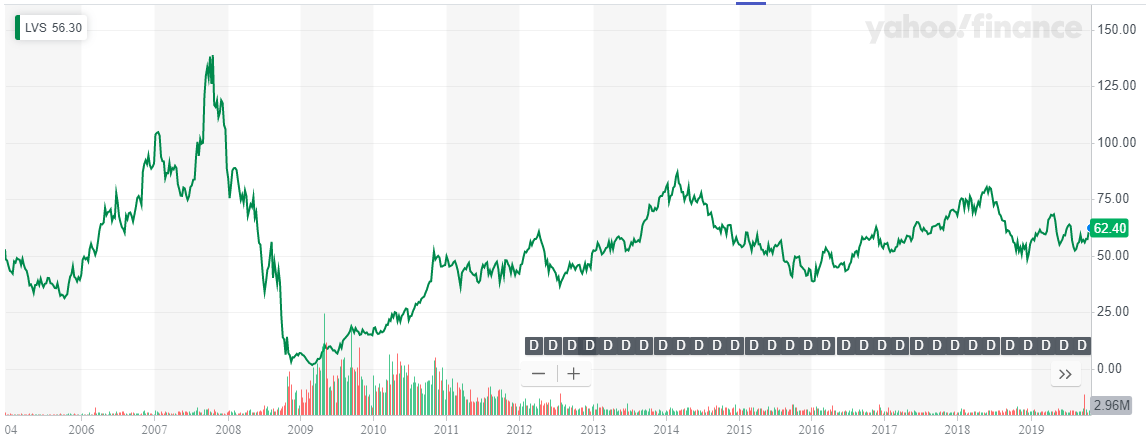

Here’s a concrete mainstream example that happens to be as extreme as extreme can get. Take a good look at this long term chart of Las Vegas Sands. We’ll use this one because it really is as wild as they come. It shows that even in the most volatile of markets, if you adopt the right investment worldview and stick to it, you’ll end up on top.

Above we have LVS, from IPO in December 2004 at $48 until now. Let’s say you make a very broad strokes general judgment that LVS will do well because Macau ill thrive in the very long term but you have no idea how much. So you commit to just a 10% position and you don’t budge. Committing to a 10% position in the realm of long term investing does not mean you buy a 10% position and leave it alone. It means that 10% of your portfolio will be LVS stock, rebalanced to 10% as market prices change and as your savings grow. This requires active management, but not frenetic buying and selling. Let’s say you check your portfolio just once a year for rebalancing. We’ll disregard savings and dividends just to keep it simple and assume 10% LVS and 90% cash. That’s it.

So say you buy a 10% position at around the IPO price of $48 a share in January 2005. Let’s say you have a $100,000 portfolio so you put $10,000 in LVS (208 shares) and keep $90,000 in cash. One year later in 2006 LVS is at $30. Your investment is now worth $6,250, and the rest is cash. You need to rebalance to $9,625 LVS to stay at 10%, so you buy $3,375 worth of LVS (113 shares), and you are back at 90/10, your portfolio down 3.75% overall.

So say you buy a 10% position at around the IPO price of $48 a share in January 2005. Let’s say you have a $100,000 portfolio so you put $10,000 in LVS (208 shares) and keep $90,000 in cash. One year later in 2006 LVS is at $30. Your investment is now worth $6,250, and the rest is cash. You need to rebalance to $9,625 LVS to stay at 10%, so you buy $3,375 worth of LVS (113 shares), and you are back at 90/10, your portfolio down 3.75% overall.

Now you have 320 shares of LVS, check back in January 2007 and the price is $90. You are now at $86,625 cash and $28,800 LVS, total $115,425. That’s 25% LVS and 75% cash. That’s too much LVS. You need to get down to $11,542 to maintain 10% positioning. So you sell 128 shares at $90 and you’re down to 192 shares, and $103,882 cash. January 2008 rolls by and LVS is still at $90. Nothing changes, so you don’t do anything.

Here’s where it gets interesting. The 2008 financial crisis comes and goes and you get clobbered. LVS has collapsed to $7 a share, but despite the volatility you stick to your guns and rebalance at 10%. With 192 shares you are at a measly $1,344 in LVS stock, and $103,882 in cash. Your portfolio remarkably is still up over 5% despite this, total value $105,226, so you need to buy 1,311 shares of LVS to get back to 90/10. You now own 1,503 shares.

Here comes January 1, 2010 and LVS is back up to $18. You’re at $27,058 LVS and $94,703 cash for a total portfolio balance of $121,761. You sell $14,882 worth of LVS at $18 to rebalance and you’re back down to 676 shares LVS and $109,585 cash. In 2011, shares are now $50, that’s $33,800 LVS, the rest cash, total $143,385.

We can keep going but you get the point. Volatility and rebalancing means buying low and selling high by default. No matter how volatile the market can get, if you believe in something as basic as “LVS will do well in the long run” but stay conservative at 10%, we see here your portfolio is up 43% in 6 years despite one of the biggest collapses of a casino stock in history. Here we’re not even counting dividends and adding savings to your portfolio.

Personally, I happen to believe that there are going to be serious problems for the global economy in the near future, and China could get hit particularly hard. But if you stick to this long term strategy it doesn’t matter. The only crucial thing is that the gaming stocks you invest in long term don’t go bankrupt, meaning they have to have a decent and conservative balance sheet. If so, there eventually will be a recovery. If you’re a long term investor, all you have to do is stick to your original position size, forget the constant trading and distractions and headlines and everything else and you’ll do much better than fine.