The United Kingdom gambling sector has been doing pretty well since the start of the year. William Hill is up 20% not counting dividends since it became a long term hold back in April. Rank Group has been on a 56% tear since July, also not counting dividends. 888 has been stable. Rank and 888 have long gone hand in hand as the two adults in the room who haven’t risked their long term health with leveraged buyouts funded by loans that are themselves funded on the assumption that the waves of new credit will keep channeling themselves through the pipes without any clogs. While I am not saying that every company or even most companies that rack up debt for the sake of risky bets are corrupt, there is a good chance that somebody down the line in the credit circuits that may not even be directly related to any of these companies, is swimming naked. The reason that Bernie Madoff wasn’t caught until the very end is that few people really want to find those weak links. It’s more convenient just to ignore them.

The United Kingdom gambling sector has been doing pretty well since the start of the year. William Hill is up 20% not counting dividends since it became a long term hold back in April. Rank Group has been on a 56% tear since July, also not counting dividends. 888 has been stable. Rank and 888 have long gone hand in hand as the two adults in the room who haven’t risked their long term health with leveraged buyouts funded by loans that are themselves funded on the assumption that the waves of new credit will keep channeling themselves through the pipes without any clogs. While I am not saying that every company or even most companies that rack up debt for the sake of risky bets are corrupt, there is a good chance that somebody down the line in the credit circuits that may not even be directly related to any of these companies, is swimming naked. The reason that Bernie Madoff wasn’t caught until the very end is that few people really want to find those weak links. It’s more convenient just to ignore them.

While these three companies, William Hill, Rank and 888 continue to be long term holds fundamentally, there is one circumstance under which investors may want to buy some downside insurance in order to protect recent gains here. I’m not talking about Brexit for once, which I’m sure everyone is completely sick of already. I’m talking about WeWork, London’s largest real estate owner. Let’s take a step back for a moment though.

Back when Julian Assange was at the height of his infamy, he curiously said that the most frightening aspect of dealing with all of the Wikileaks state secrets was not necessarily the corruption itself, but rather that the bureaucratic machine that helped facilitate it had become so convoluted and chaotic that that there really was no single interest in charge of it all. It had become a thicket of power-hungry influencers jockeying for more power, an unkempt lawn of toxic weeds where many bad actors can hide out in plain sight without anyone being able to do much about it. The left hand of the system was (and is) essentially unaware of what the right hand was doing.

You can get the same sense from the new movie The Laundromat, based on the leaked Panama Papers back in 2016 detailing the offshore dealings of the world’s super rich and their efforts to evade taxes. The story is incredible, and shows how one enormous ring of corruption can collapse in on itself, sweeping away and crushing anyone accidentally caught in its wake. The movie closes with a direct quote from the still anonymous leaker of the Papers insisting on campaign finance reform, without specifying what the exact solutions are. There are two possible directions. One is streamline the tax code and lower taxes and regulations across the board, eliminating the temptation to set up shells. The other is leave the regulatory and tax regime as is and just close all loopholes, thereby eliminating the temptation for the same.

The problem is, the latter solution would effectively jack up the amount of money vacuumed away from the economy by the political class, leaving even less for people in the real economy and making the situation even worse. After all, superrich individuals are not the only people who take advantage of tax loopholes. Corporations do, too, and corporations have shareholders. This, of course, affects stock prices fundamentally.

WeWork is one of those firms down the line of the credit chain that was swimming naked. It’s not involved in the shell game of tax evasion (as far as anybody knows at least), but it was heavily involved in milking extremely low interest rates. Bailout discussions are ongoing now for London’s largest real estate owner. It acquired that lofty position in the space of only three years by essentially borrowing a whole lot of money at very low cost in order to buy a whole bunch of real estate and rent it out at a loss. This kind of thing is only possible when rates are totally out of whack. You borrow and sell at a loss assuming you can just borrow more later and value yourself at $48 billion because capital valuations are just off the charts everywhere. Perhaps there isn’t even any “corruption” here in the legal sense, because firms are just responding to market signals, however warped they might be.

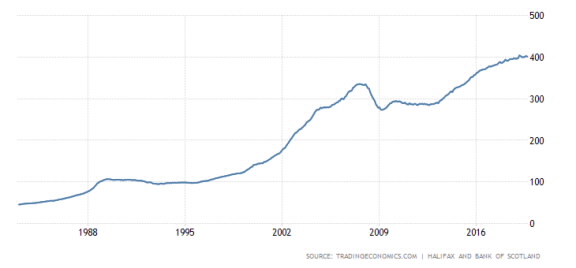

But what happens to the U.K. real estate market if WeWork, currently in discussions with SoftBank and JPMorgan Chase for a bailout package, goes bust? London’s largest real estate owner will have to start liquidating, pushing prices down in the London real estate market. The Halifax House Price Index in the U.K. looks like it’s about to turn down for the first time since broad recovery began in 2013. An event like the folding of WeWork could tip the scales. See the U.K. real estate chart below.

No doubt mortgage-backed securities underpin the U.K. real estate market, and the entire European banking system is still very weak. If WeWork falls and London real estate starts falling with it, one or more banks down that credit line will probably be exposed, too. We could start seeing fast selling on the London Stock Exchange, even for companies with stable balance sheets like William Hill, Rank and 888. If a company is fundamentally healthy the downside should reverse, but with WeWork on the brink, some temporary downside hedging could be prudent here, just for the sake of keeping emotions in check.