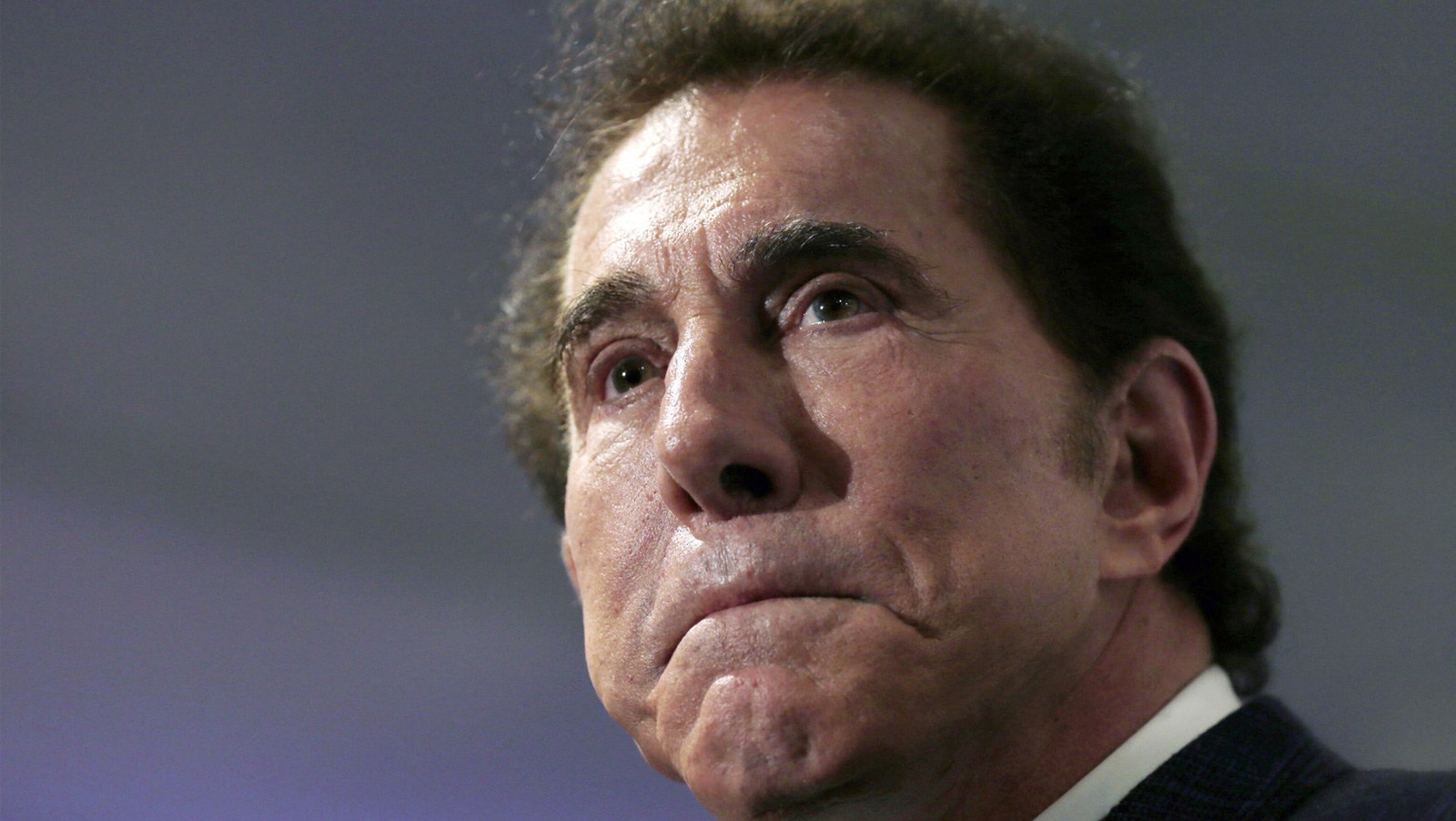

Another day, another billionaire gets #MeToo’ed. Buy the dip? No. Despite Wynn Resorts’ falling 18% since allegations were published in the Wall Street Journal of decades of systematic sexual predation by CEO Steve Wynn, the stock remains a sell. Shareholders should consider the fall a blessing in disguise, because things are going to get worse for gaming stocks this year across the board. Consider it a forewarning to get out of Wynn before the economic situation starts to markedly deteriorate.

Most discussions on the current investability of Wynn Resorts are centered around the question of whether the casino chain can continue to perform as well without his guidance and business sense. It’s certainly a valid question, but it’s a bit beside the point. The main point is that Wynn is one of the most volatile large cap casino stocks in the world, its price fluctuating wildly with each successive crisis. As exceptional of a CEO as Steve Wynn is, he can’t stop his stock from falling spectacularly when a crisis hits. The Macau plunge that began in 2014 wiped away 80% of Wynn’s value from top to bottom, and the crisis of 2008 was even worse. From October 2007 to March 2009, Wynn shares were obliterated, losing a dizzying 90% of their value 1929 style.

Most discussions on the current investability of Wynn Resorts are centered around the question of whether the casino chain can continue to perform as well without his guidance and business sense. It’s certainly a valid question, but it’s a bit beside the point. The main point is that Wynn is one of the most volatile large cap casino stocks in the world, its price fluctuating wildly with each successive crisis. As exceptional of a CEO as Steve Wynn is, he can’t stop his stock from falling spectacularly when a crisis hits. The Macau plunge that began in 2014 wiped away 80% of Wynn’s value from top to bottom, and the crisis of 2008 was even worse. From October 2007 to March 2009, Wynn shares were obliterated, losing a dizzying 90% of their value 1929 style.

These remarkable nosedives happened without any connection to Steve Wynn’s sexual behavior, and when the market breaks, Wynn Resorts will be among the first stocks to signal it, just as it was in 2007. While the S&P 500 was still flirting with its all-time highs in December of that year, Wynn was already down 30%. In 2014, Wynn was among the first Macau stocks to signal that something was wrong, comparing price movements to the BJK gaming ETF. Just judging by the way the stock trades, it will probably be among the first gambling stocks to break in 2018, if it hasn’t signaled a fall already thanks to an unpleasant catalyst.

Regardless of whether the allegations against Steve Wynn are true or not, having to deal with them will take his attention away from his business considerably. Wynn is a CEO known for his attention to detail. He won’t be able to pay as much attention to detail since getting publicly tagged as a sexual predator. The mystique around him and fear of him are mostly gone now. His expansion plans into Boston could get hampered by the controversy since city and state politicians and regulators do not want to be seen as being friendly toward a disgraced Republican billionaire. Who knows how Macanese authorities are going to respond to this either. Schadenfreude can make regulators of all nationalities a lot bolder in their shakedowns, never good for business.

But even in the best-case scenario that Steve Wynn is able to go about business as usual as if none of this is happening, the best that can happen to shares is they recover highs, marginally break higher, and then fall with the rest of the global economy and stock markets. Given the historical volatility of Wynn stock, it’s just not worth it to bet on the best-case scenario.

What has me most worried that stocks across the board are about to get hammered is that US money supply is expanding at its slowest pace for this time of year since at least 1999, the first year that the Federal Reserve started logging the weekly money supply on its website. If we turn to China as a possible saving grace for Wynn since Macau revenues are typically more than twice those of Las Vegas every quarter, we find that China’s money supply growth is just as sluggish. According to Trading Economics, China’s M2 money supply is growing at its slowest annual pace since at least January 1996, as far back as the site has records for. This is not good for equities.

If you have any position in Wynn, sell over the course of the week and get rid of it. By the end of this year, Wynn could see yet another 70% drop or more. It has happened twice before and it can happen again. As I look at market futures, the Dow is down triple digits again and Wynn is down another 1.5%, the VIX just passed 14 and markets globally are under pressure. This could get markedly worse before the week is over. Thanks to Steve Wynn, many Wynn shareholders have already exited a few days early.

The Steve Wynn case almost certainly will not be the last of its kind. There will be more CEOs or otherwise high executives of many more companies who will be accused of the same sort of systematic abuse. Wynn’s, if true, has been ongoing for 30 years. On the bright side, workplace culture might finally change, though I admit I do not know how, given the nature of human alphas.