Jim Rogers, at the peak of his investment career, was always insistent on actually visiting a place and seeing it on the ground before he invested in it or shorted it. While most of us do not have the resources to do that, it is certainly sound advice if you can afford it. On his trip around the world he embarked upon post retirement, he made sure to visit the most disreputable places on the planet to see if what everyone was saying about them was true. In most cases he discovered that they weren’t as bad as everyone was saying. This is why he frequently talks about investing North Korea and Myanmar of all places.

Jim Rogers, at the peak of his investment career, was always insistent on actually visiting a place and seeing it on the ground before he invested in it or shorted it. While most of us do not have the resources to do that, it is certainly sound advice if you can afford it. On his trip around the world he embarked upon post retirement, he made sure to visit the most disreputable places on the planet to see if what everyone was saying about them was true. In most cases he discovered that they weren’t as bad as everyone was saying. This is why he frequently talks about investing North Korea and Myanmar of all places.

What does this have to do with Macau and SJM Holdings? Only this: With Macau bottoming for now, SJM may be bottoming too, or at least leveling off. Among the large caps, it is the worst performing Macau stock since the 2014 top, which theoretically places it as a good contender for biggest bounce. Or, alternatively, it could just be the weakest casino company there, and any bounce that Macau may have from here may translate poorly to SJM. Here’s a Google chart comparing the falls of Galaxy (0027), LVS, Wynn, and Melco Crown since 2014. SJM (0880) beats them all in terms of pure fall.

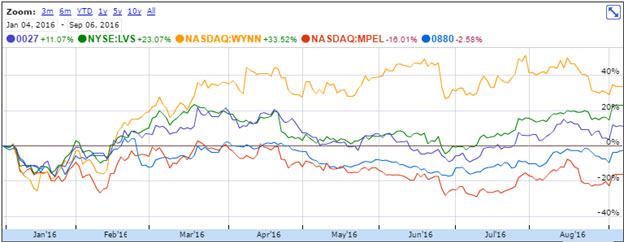

For some reason that is unclear from public records alone, SJM has had a very hard time recovering in comparison with other Macau stocks. This does not refer only to its stock price, which is also a laggard since the January 2016 recovery second only to Melco:

It is also a laggard with respect to the recovery of its top line. The question is why. To answer that, someone who has experienced all these places first hand would need to provide a detailed score sheet. Are SJM casinos just not keeping up with the competition? Are they just not as good as others in Macau? Or are they really amazing and it’s just bad marketing or poor decision-making by executives or just bad luck? Are they perhaps too conservative with their fiscal policy, which may be holding them back from aggressively competing? These are questions that must be answered by someone with on-the-ground experience before we simply assume SJM is oversold and ready to bounce with the rest of the Macau complex.

Financially speaking, in terms of its pure balance sheet, SJM is one of the strongest gaming companies in Macau. It has very little debt, lots of cash, and a generally conservative approach to capital expenditure. This makes it a very attractive stock in the event of a full blown fiscal or monetary crisis. So for example, if China goes through some kind of debt crisis tomorrow and interest rates skyrocket, the Yuan falls through the floor and GDP collapses (as bad as that measurement is), then SJM would be the company to buy when the dust clears. As long as the can keeps getting kicked down the road though and it’s at least sort of business as usual, SJM is not such a clear buy even at these levels.

It has had 9 months to recover along with the rest of Macau and has not done so. That increases the chances that any recovery will at best underperform the recovery for its competitors. This is also reflected in the actual numbers. SJM’s casino revenues are still 38% below 2011 levels, back when the VIP train was chugging along, junkets were living large, and Beijing wasn’t harassing the industry so badly. Las Vegas Sands casino revenue by comparison, is up from 2011 by 22% despite the VIP thrashing. Melco has more or less stabilized at 2011 figures, and Wynn is down 30% from that year.

Just taking these numbers as data points without considering anything else and taking a (brief) Macau recovery for granted, it seems that Melco is oversold, LVS is doing fine, Wynn is overbought and SJM’s price is justified as having the worst top line recovery. Its market share of total Macau gaming revenue is also shrinking from 23.3% in the first half of last year to only 20% in the first half of this year. That raises flags that maybe its casinos are just not as good as those of its competitors.

Going back to balance sheet though, SJM has an exceedingly tiny debt at less than 4% of market cap. This is its strongest selling point, but won’t be for long, because they are looking to borrow tens of billions to finance construction and renovation projects that in their estimation will cost HK$30B. They can certainly afford this given their credit, but they are caught between a rock and a hard place. On the one hand, in order to grow they must spend money on revamping and expanding. On the other hand, if they borrow all that money it would rocket their leverage to around 100%, at which point they are exposing themselves to problems they wouldn’t otherwise have if a fiscal or monetary crisis ensues.

Evidence suggests that if Beijing suddenly decides to lighten up on the VIP segment, which does not seem at all likely, then SJM will benefit the most. Nearly 70% of its casino revenues came from VIP back in 2012, which is why the stock has been destroyed ever since. But as a Macau play in the current environment, there is nothing particularly compelling about it except its healthy balance sheet, which will soon look like everyone else’s in the region. Best let sleeping dogs lie here, and look at it again when they’ve finished all their expansion projects to see where the stock is then, and where Macau is in general.