What a day yesterday. The Dow was down over 1,000 points before a buyer the size of the Incredible Hulk came in and bought everything 3 times over. As I write this the Dow is down 270, up about 800 points from its lows. Who knows where it will be by the time I finish. The Market Vectors Gaming ETF is down nearly 4%. Its top four holdings are Las Vegas Sands, Galaxy, Sands China, MGM and Wynn. It is essentially a proxy for owning Macau.

What a day yesterday. The Dow was down over 1,000 points before a buyer the size of the Incredible Hulk came in and bought everything 3 times over. As I write this the Dow is down 270, up about 800 points from its lows. Who knows where it will be by the time I finish. The Market Vectors Gaming ETF is down nearly 4%. Its top four holdings are Las Vegas Sands, Galaxy, Sands China, MGM and Wynn. It is essentially a proxy for owning Macau.

It can be tempting to look for a bottom here, but the – for lack of a better word – insane bounce yesterday morning off of a nearly 1100 point dump looks so unnatural that I doubt it was free market action. It smells like the Plunge Protection Team to me, and whenever they get involved, things get worse quickly. Short term, I see one of two possibilities. Either China crashes again tomorrow, bringing down the rest of the world again but without a big bounce, or China stabilizes and global stocks get a nice bounce for a few days. Then, at some point in the next week or two, China will crash again and what we saw today will repeat itself, but without the 900 point bounce out of the gate.

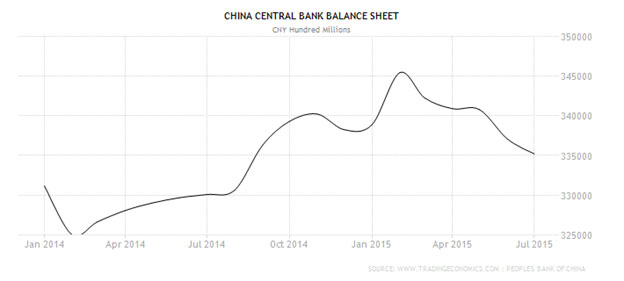

The reason China is crashing, again, is that its incredible money printing schemes are coming to an end. And when I say incredible, I really mean insane, but I just didn’t want to use that word twice in one article. Since January 1996, the Yuan supply has increased by a factor of 23. The Federal Reserve has “only” increased the money supply about a factor of 1.9 over the same time period, and look at the booms and busts it caused in the US when the printing temporarily slowed in 2008. We ain’t seen nothin’ yet in the People’s Republic. How do we know the money printing is over, at least for now? Because the People’s Bank of China balance sheet has been shrinking since February.

Unfortunately, there are no bona fide defensive stocks in the gaming sector like there are in other sectors. Even the most defensive gaming stock doesn’t get close to the capital preservation objectives of, say, AT&T or McDonald’s. But there are relatively defensive stocks that can be played, so if you are reserving a portion of your portfolio for the gambling sector, the three best that come to mind are 888 Holdings, Paddy Power, and surprisingly Las Vegas Sands, though not for the same reasons as the other two.

Sands is, of course, mainly a Macau play, and I am still of the opinion that Macau has not yet bottomed. Especially in light of today’s news that China and Macau have struck an even tougher “money laundering” deal. The reasons it is a defensive stock are the high dividend yield of 5.4%, its massive size for a casino stock, and its relatively conservative balance sheet. If you’re looking to go defensive, LVS is OK if you intend to buy it, not look at the fluctuations in principle, and just grab the income. It is a decent retirement play in that sense because the stock price is less important. LVS will feel more pain, but it’s not going away, and it will always make money. Alternatively, you can buy it and hedge with some out of the money puts, but that has to be managed and timed correctly.

The second is Paddy Power. Also a good dividend stock which last paid its shareholders €1.52 per share, and one that has been paying a lot more lately. Paddy Power also has zero debt, something rare in today’s environment, with an open-ended commitment to maintaining conservative finance. From its last annual report:

The Group has historically funded its operations through internally generated cash apart from the consolidation of debt within its majority-owned subsidiaries in Australia during 2009, 2010 and part of 2011. This debt has since been repaid. A strong cash balance has given Paddy Power financial strength and flexibility. The Group’s financing and capital structure is kept under continual review by the Board. Current market conditions allow for access to debt finance at attractive pricing; however the Board is committed to capital discipline and will maintain conservative leverage to keep flexibility for expansion organically or via acquisition.

Music to a defensive investor’s ears. It does indeed have a strong cash position as it claims, now £227M for a stock with a market cap of £3.26B. Paddy Power is not immune to further declines, but rising dividends and strong finances make a much better choice to a highly leveraged momentum stock with no dividend. Again, if you’re using it as defense, buy it, don’t look at price movements, tuck it away and collect your income. It will bounce back when this is all over.

Finally, there is 888 Holdings, which I’ve said in the past is perhaps the #1 defensive gaming stock out there. A good dividend yield of 3.7%, 888 has not collapsed too badly during the global selloff either. The merger with bwin.party may have some good things in store for 888, and though GVC is still trying to break the deal up, it is still unlikely to succeed.

If I had to rate the defensive quality of the three, I’d say 888 is first and best, followed by Paddy Power, with Las Vegas Sands a distant third.

Well there we go. I finished the article and we’re crashing again at 3pm EST, Monday, August 24. The Dow is now down 640 points. What a crazy crazy day. I wonder where it will be when this is published tomorrow.