Where have all the Macau VIP’s gone? How much debt is the West really in? Are there any governments in the world anymore that live within their means?

Where have all the Macau VIP’s gone? How much debt is the West really in? Are there any governments in the world anymore that live within their means?

These are questions that have been on my mind for a while. The answer to all three is a desert island continent on the other side of the world (from most of us), where summer is winter and winter is summer and the water spins the wrong way down the toilet. A former prison colony that very well may be the last bastion of pseudo-sanity in the Western world. The answer is Australia.

Not everything there is raindrops on roses and whiskers on kittens. Australia is more like the most stable patient in the global psych ward, one that has its bouts of insanity but it’s still possible to have a normal conversation with it, if you discount the occasional random bout of screaming out of context like a Tourette syndrome patient. Compared to everyone else that is drooling all over themselves catatonic, you definitely want to hang out with Australia and skip the forbidden upper floors where all the lobotomies and electroshock therapies take place.

And is it any coincidence that Australia, of all nations, has the highest gambling rate in the world at over 80%? Probably not, because on an individual level, someone who can enjoy gambling responsibly, or any other so-called vice like junk food or alcohol or marijuana or whatever it is without becoming addicted to it, tends to be a more balanced person than the ascetic. So, too, with a nation.

The average tax rate on casinos in Australia is about 10% according to Bloomberg, not any more than God Himself charges if you’re into the Bible and such. That’s encouraging. Macau’s rate is 40%. (For reference, the highest tax rate in the Bible is 20%, levied by Pharaoh against the Egyptians in Genesis 47:25-26.)

The low tax rate is attracting the junkets that used to be active in Macau. Two companies are really competing for them now, Crown Resorts and Echo Entertainment, with Echo pulling ahead of Crown as of last year. By many measures, Echo is the better company, faster growing and with more prospects. Crown has more assets, but it is still mired down in Macau with its share of Melco Crown, which I don’t believe has bottomed yet.

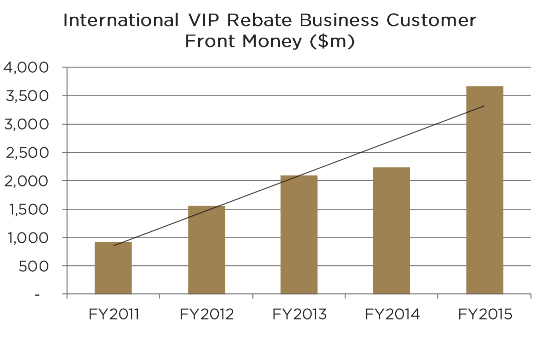

Taken from its annual report, here is how fast Echo’s VIP business is growing by customer front money. (Echo does not use the word “junket” in its reports because it has shady connotations. It prefers “International VIP Rebate Business”):

By volume, Echo’s VIP turnover was $46.2B AUD in 2014, while Crown’s was only $70.8B. Echo’s VIP growth was up 53% year over year, and Crown’s was down 6%. Echo is still half the size of Crown by market cap. Echo has also pulled away from Crown by net VIP revenue with $588M last year, past Crown’s 2014 total of $500M.

Just last month, Crown lost a bid to develop a casino at Brisbane’s Queen’s Wharf to Echo, which was probably a factor in Crown’s James Packer stepping down as Chairman last week in the wake of mixed financial results.

In terms of debt, Echo wins out as well. Echo’s net debt, which is total gross debt minus cash and derivative hedging, is $400M, down from $635M a year before. Total debt to equity is less than 20%. Crown’s debt picture isn’t too bad either at 29% if you compare it to many heavily leveraged blue chip companies in the US, and that’s the strange thing when you consider the fact that Crown’s corporate debt holders are already getting bit antsy about its debt levels at below 30%. This kind of thing is actually normal, believe it or not, when you have interest rates that aren’t zero for 7 years straight. Interest rates in Australia are still low at 2%, but not zero like the US, terrified to raise them even a quarter point. When you have to pay even a little bit of interest on debt, you take on less of it and investors get nervous even at reasonable numbers, and this is a good thing.

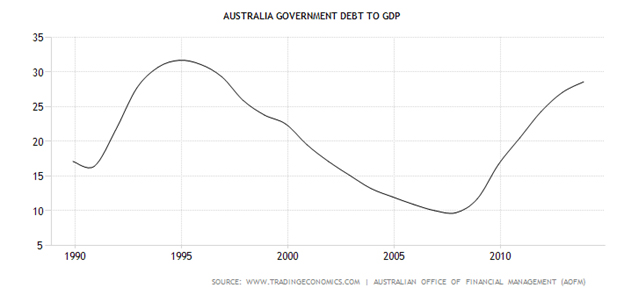

In fact, look at Australia’s public debt picture and it doesn’t look too monstrous either.

It seems that even government bond investors get nervous when debt to GDP levels rise above 30%, because that’s the highest that Australian government debt has ever been since 1990.

If you’re looking to invest in the Australian gambling scene, I would split capital 70-30% Echo-Crown. Crown is still a more stable stock with a better dividend so it deserves an allocation if you’re looking to invest in Australia. At this point though after a recent breakdown, I would wait to see if Crown can hold long term support at $12 a share because if not, a waterfall decline is possible and you don’t want to get caught in that. If it holds and bounces, then buy. If it breaks down, scale in slowly on down days.

Echo, while less liquid and smaller, has higher growth potential due to its recent win in Brisbane and could be a good buy now despite being at its highs. The downside is that it is heavily dependent on maintaining its VIP market share, which is not easy to do. If China’s government ever decides to take it easy on Macau junkets again (not likely in the near future), Echo will lose a lot of its new business, though the low tax rates compared to Macau may maintain some competitiveness even so because the junkets get a higher margin the lower the taxes.

Australia is a good place to put money in general though. While the rest of the world is ridiculously overleveraged, Australia may come out of any global meltdown with less bruises than most. It won’t escape everything, but at least it’s not catatonic in the upper forbidden floors of the psych ward about to get a lobotomy.