A lot has happened in the last 14 weeks; about a quarter’s worth of market activity since I began covering the gambling market here. Not every week have I made a specific call, nor do I intend to, but rather have noted trends I expect to take place over a longer term given the monetary environment and where various companies sit in terms of its shadow. Nevertheless, with a fiscal quarter’s worth of time behind us, we can review some of the more specific calls made here to see what has panned out and what hasn’t.

A lot has happened in the last 14 weeks; about a quarter’s worth of market activity since I began covering the gambling market here. Not every week have I made a specific call, nor do I intend to, but rather have noted trends I expect to take place over a longer term given the monetary environment and where various companies sit in terms of its shadow. Nevertheless, with a fiscal quarter’s worth of time behind us, we can review some of the more specific calls made here to see what has panned out and what hasn’t.

Bwin.party—A Wash

On March 11, I made a buy-the-dip call on bwin.party (BPTY) at a closing price of 122.6. My assumption was that expectations were so low for earnings and the company in such bad shape that the stock wouldn’t go much lower on any bad news. I was correct about the immediate aftermath of poor March 13th earnings, which didn’t bring the price down significantly. In fact, two weeks later it hit 130, but movement since then has been discouraging.

The two-day period from May 14–16 saw a tremendous 10 percent drop, probably on the rumor of a major shakeup in its board of directors, published in a press release on the 16th. This was of course couched in all kinds of positive languages, but I suspect that there was a big fight over those approved bonuses back in February by some major shareholders, which erupted in a big restructuring of the board.

As of now, the trade is a wash; but with new blood at the top now, a turnaround is still likely.

King Digital Entertainment —Down and Headed Lower

On March 31, I heaped scorn and sarcasm upon that naked King of Digital Entertainment (KING). The closing price was $18.19. I said that King could barely be called a company, as it has nothing to its name that a few geeky high schoolers couldn’t do playing hookie for a few days out of their moms’ respective basements. It decided to go public on the strength of a single game, Candy Crush, off which it makes about $1.9M annually, while the company still has a market cap of over 2700x that.

King is down 11 percent since then, and it will keep trending down until the point when someone notices that the emperor has no clothes and investors come to their senses following, which it will fall through the floor. No need to cover shorts here. King has a long way to fall.

Ladbrokes—A Good Bottom Pick, Take Profits

On April 7th I wrote the following on Ladbrokes (LAD):

The best course of action for Lad bottom pickers then is to wait about 6 weeks for money supply growth in the US to bottom out and reverse … It is possible that long term support in the £1.20 range for LAD will be hit within that time frame, at which point one may want to start scaling in. Around June Playtech could come through for World Cup time and Ladbrokes could surprise to the upside, given the extremely low near-term expectations they’ve been setting up for the investment community.

Money supply growth did indeed reverse in mid-May. On April 7th, Ladbrokes was at £1.36. Six weeks from April 7th is May 19th, when LAD hit £1.30, though not quite £1.20 as I had hoped. Since then, however, it has climbed 19 percent. Money supply is again slowing a bit, so at least some profits should be taken here for traders, if not all. David Cameron’s recent fit with the EU is another reason to be quicker on the sell button with British stocks right now.

Amaya – A home run, take profits, hold small position long term

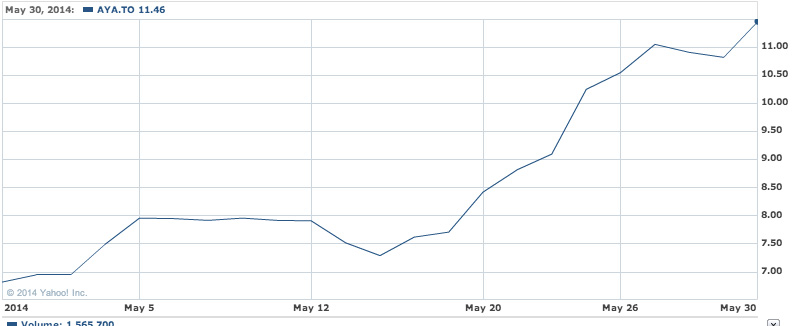

On April 29th, I sang the praises of Amaya for their scrappy-business plan that looked strikingly logical and doable. Despite recent losses, I thought it was a good short term pick for traders. Money supply was ticking up by then as well, adding to the positives. Since April 29th, AYA is up 60 percent, which is much more than I expected, and much quicker too. This is due to a combination of a good earnings report and good, old fashioned acquisition rumors adding fuel to the fire.

Part of buy low, sell high is selling high. That means sell when you’re happy. Amaya will trend higher over the long term, but short term profits should be taken here so as not to miss the opportunity. Save a small position long term, but take your trading money out.

Melco—Still a Good Short-Term Pick

On May 13, I considered Melco to be a good short-term pick considering its ability to serve customers well, though a dangerous hot potato with markets in monetarily unstable areas. I continue to believe that is the case. It has only been three weeks since then, and MPEL is up 7 percent. Traders can continue to hold here as long as the news out of Macau and the Philippines remains stable; Melco will continue to drift upward, though I wouldn’t push my luck beyond 15 percent gains. The monetary situations in both Macau and Manilla are dangerous. Melco just happens to be very good at running resorts, but even it won’t escape the downside of the business cycle.