Budget Proposals Causing Backward Steps

Budget Proposals Causing Backward Steps

With almost a week gone since George Osbourne announced his 2012 budget there has been numerous opinions voiced in iGaming with what effect, if any, it will have on the UK industry.

This was a budget which featured gambling much more heavily than most others in recent memory and as a result it has attracted considerable amounts of comment.

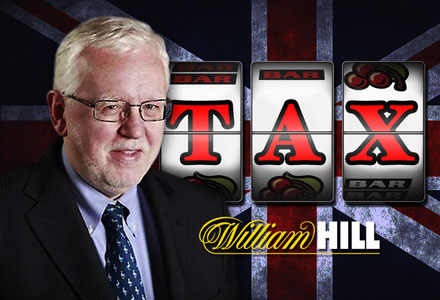

William Hill CEO Ralph Topping isn’t known for keeping his opinions to himself and true to form he had a number of things to say regarding Osbourne’s plan for the industry.

His most scathing comment was regarding the changes made on the taxation of gaming machines. Subtlety certainly wasn’t on the agenda either as Topping’s blog on the William Hill website regarding the changes was titled ‘Highway Robbery’.

The post referred to the industry being mugged, the treasury making large mistakes and suggestions that those involved on the government’s side may not have been particularly charitable with the truth as well their tax rates!

While the majority of words were regarding the gaming machines tax rate he did turn his attention to the online gambling regulation plans known as the Point of Consumption Tax (POCT).

Speaking about this tax Topping has argued that it won’t guarantee that all of the money in the industry will remain in the UK.

He explained: “Money will always find a way out. More people will go overseas or to fly-by-night, unregulated sites where the consumer is not protected. I hope the government sees the sense in this.”

Taking Backward Steps

Should these warnings come to fruition then the POCT tax could effectively cause the industry to regress. An increase in the number of unregulated sites and the closure of many smaller operators have been touted as just two of the possible negative effects this tax will have on the iGaming industry.

Topping isn’t the only operator CEO worried about what path the POCT may be putting the industry on. 32Red founder Ed Ware echoes the sentiments that the new system won’t necessarily change the industry for the better.

Ware describes the proposals as “a step back for everyone” and points to the fact that his company in particular have never even been based in the UK.

He explains: “We have not left the UK in order to avoid taxation – we have never been in the UK because when this segment of the industry started there were no licensing arrangements to accommodate online casinos in the UK.”

As a result of this it would be no surprised if Ware and his Gibraltar-based company feel fairly hard done by. This despite being questioned back in 2011 when the Treasury consultation took place. This was intended to be an attempt at understanding an industry which it’s more than likely none of the government officials involved will ever have been near. But given the insistence on changing the regulatory system it appears as if Ware’s arguments fell on deaf ears.

He describes the points that he put to the Treasury upon request: “Our paper outlined the dangers of closing an already open market and how introducing a new tax is very likely to make the current well-regulated and responsible providers in the UK uncompetitive.”

Now that the proposals have now officially been made Ware feels comfortable in predicting what will come should they come into action.

“The effect will of course be to drive many a UK customer into the hands of unlicensed black market operators based in far-flung jurisdictions who couldn’t care less about the things that we hold dear and that are very much in the interest of our players,” he says.

The iGaming Cash Machine

Warwick Bartlett, CEO of Global Betting and Gaming Consultants has also voiced his worries by questioning whether the government is beginning to use the gambling industry as a cash machine.

He added: “While the government reduced the 50% tax rate on top earners, it has left the 50% tax on casinos. GBGC agrees with the government that 50% tax is high on any sector of the economy, casinos included.”

The implication of this statement is clear and is likely to be one that even those from outside the industry who feel compelled to investigate will surely agree with.

The man known for so long as ‘the voice of Betfair’ has also had his say on the matter on his personal blog. Former Betfair public affairs boss Mark Davies explained that despite the new proposals companies that have moved offshore from the UK won’t regret doing so.

He defied common opinion by saying: “I can’t comment on whether the move offshore will prove to have made financial sense for Coral, whose relocation was announced last month. But I can tell you that from experience that companies that made the move before that are likely to be very happy with the decision they made.”

He goes on to explain that even though Betfair had been fairly late to move offshore, it’s likely that it still made financial sense. He adds that the company would have anticipated the arrival of a POCT tax and that they must have banked on it not coming in until at least April 2013.

If this was the case then Betfair will be relieved to have seen their call justified. There won’t be any time to rest on their laurels though as many UK operators will now take to determining how they will succeed in a POCT industry while others will be simply be working on how to survive.