A fresh wave of lockdowns appears inevitable in Europe, and they look like they could be especially severe in the United Kingdom with $13,000 fines for failure to self-isolate. These draconian measures could quickly spread throughout Europe. By most reports, Boris Johnson is about to close the country down again, and this on the verge of a final blowup in Brexit talks and no deal likely becoming inevitable in days. On top of this we have huge multi-trillion dollar scandals erupting out of UK systemically important banks HSBC, Standard Chartered, and Barclays, banks which were already in dire straits before this new bombshell.

A fresh wave of lockdowns appears inevitable in Europe, and they look like they could be especially severe in the United Kingdom with $13,000 fines for failure to self-isolate. These draconian measures could quickly spread throughout Europe. By most reports, Boris Johnson is about to close the country down again, and this on the verge of a final blowup in Brexit talks and no deal likely becoming inevitable in days. On top of this we have huge multi-trillion dollar scandals erupting out of UK systemically important banks HSBC, Standard Chartered, and Barclays, banks which were already in dire straits before this new bombshell.

Portending an imminent banking crisis, European commercial banks had a horrific day yesterday with the weakest showing the biggest declines on the day. Lloyds, a domestically-focused UK bank, is circling the drain and could be on the verge of being delisted from the New York Stock Exchange. Shares hit new all time lows yetserday at $1.17. Break the $1 handle and it could be delisted barring a reverse split. I can’t see how any of this can be interpreted as anything other than Europe coming apart at the seams.

A second lockdown in Europe is going to put the whole online gaming revenue surge angle into sharp focus. There are certainly economic forces directing revenue into online gaming thanks to lockdowns, but what I believe a second lockdown will show is that the surge will ebb as people become substantially poorer in real terms. While there could be another bump in online gaming revenue during this second lockdown, if we do see one I believe it will be a weaker bump than the first.

The biggest problem from an investment standpoint long term though is discerning a workable plan here. Locking down on every spike in cases is simply not workable, full stop. If COVID-19 is just another coronavirus like the common cold, which is a coronavirus, then it is probably here to stay like the common cold and we will keep seeing periodic spikes in cases every few months especially if lockdowns continue to slow or prevent herd immunity. Successive lockdowns means wholesale economic destruction with no end in sight. I simply do not see these conditions as even remotely investible. If gaming stocks keeps rising from here despite all this, I still have no interest in joining asset bubbles and certainly not advising others to do so. That would just be Russian roulette with your savings.

The one possible European exception to this is once again Swedish gaming stocks Betsson, NetEnt, and Evolution Gaming Group. Judging by how the country has handled the pandemic so far, we can be reasonably assured that Sweden will not be shut down and business will continue, more or less. I have always had concerns about the Swedish Krona, but a country that does not lock down its production will end up having a much stronger currency than ones that do. A stronger Krona will help Betsson, NetEnt, and Evolution directly, as well as indirectly by putting more purchasing power into the pockets of its domestic customers. I am not advising that people focus their entire portfolio on these stocks, as I am still very wary of continent-wide spillover effects, but if you want a European gaming allocation at this point, those three Swedish stocks are the safest bets in my opinion.

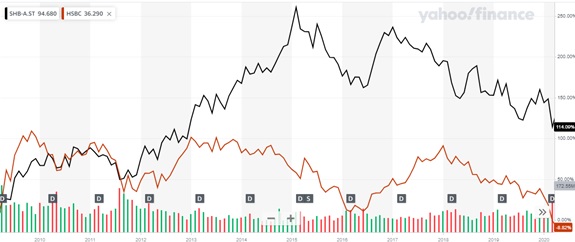

The Swedish financial sector seems to confirm this. Here is Sweden’s biggest bank by assets, Svenska Handelsbanken (black), versus HSBC (red) since the 2009 bottom:

It’s not like Swedish banks have thrived exactly, but at least Sweden’s biggest bank is still over 100% above 2009 lows, while HSBC looks to be in clear existential danger. If we do see a financial crisis develop in Europe soon, it looks like Sweden may be spared the worst of it.

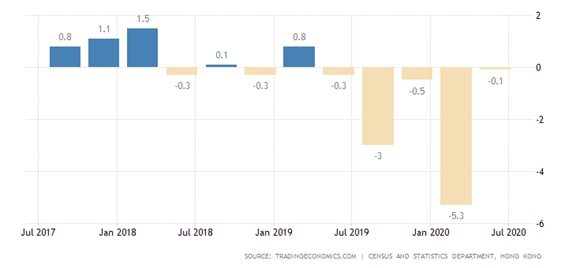

What about Macau? While it does seem that China has eschewed a repeated lockdown strategy for now, Hong Kong is still suffering from Chinese political crackdowns. Recall, Hong Kong’s problems did not start with COVID-19. They started back in 2018 with Beijing’s crackdown on Hong Kong’s independence and the resulting trade backlash from the United States. None of that has changed, as you can see from the Hong Kong GDP growth chart below.

Even if COVID-19 weren’t an issue at all, the political situation is still seriously hurting Hong Kong and by extension Macau. This is being clearly reflected in the Macau numbers. GGRAsia reports that average daily Macau gross gaming revenue was disappointing for September 14-20 despite a rising number of visitors. For the first 20 days of September, revenue is down 88% from the same time last year, even though it nearly doubled sequentially. To me this indicates that even though the Chinese are starting to relax and travel more, they still have less money to gamble with.

Chinese financials are also suggesting that China is on the verge of serious banking indigestion and possibly something worse, just like Europe. Take the Agricultural Bank of China, China’s 3rd largest bank by assets, skirting all time lows, not to mention that failing HSBC is just as much a Hong Kong bank as it is a European one.

My conclusion is that while Macau stocks may not be as dangerous as the UK at this point, since at least the Macau economy isn’t on a perpetually rolling lockdown, I don’t see much of a sustained recovery in Macau casinos fundamentally any time soon and the danger continues to be to the downside. I would advise staying very conservative here and focusing what little you are willing to risk on Betsson, NetEnt and Evolution.

To see my daily investment newsletter, check out The End Game Investor.