Note: As I was finishing up this piece, I was notified that gambling on credit cards will be banned by April. We will go into that next week. Just another factor to pile on here.

Las Vegas is under threat. It’s not enough that the enormous asset bubble across the United States and the entire world keeps expanding. Now state governments (*ahem* California) have to get in on it by legislating more and more pins that could prick it at any time. Not that pricking bubbles is necessarily a bad thing in itself, but when you see lawmakers running wild in the streets with scissors in their hands shouting “Justice For Workers” slogans and chucking water balloons filled with rusty nails at the bubble, you might want to consider getting out of the way before something predictable happens.

Las Vegas is under threat. It’s not enough that the enormous asset bubble across the United States and the entire world keeps expanding. Now state governments (*ahem* California) have to get in on it by legislating more and more pins that could prick it at any time. Not that pricking bubbles is necessarily a bad thing in itself, but when you see lawmakers running wild in the streets with scissors in their hands shouting “Justice For Workers” slogans and chucking water balloons filled with rusty nails at the bubble, you might want to consider getting out of the way before something predictable happens.

23% of all visitors to Las Vegas came from California in 2019. That’s down from 31% in 2018, and that number could come way down in 2020. That is, if California’s new gig economy law isn’t chucked out as unconstitutional by the Supreme Court or is otherwise skirted by technicalities. Hopefully it will be, so California’s politicians can score their political points for passing it without it actually doing anything. That we don’t know yet.

If the law ultimately stands and actually applies, California is going to see a massive exodus of newly-unemployed freelancers. This is because they will have to be reclassified as employees rather than independent contractors. That will subject their current employers to a flaming toxic waste dump of additional regulations, the withholding tax, health “benefits”, and whatever else lawmakers have piled onto the backs of businesses over the decades.

In the power-trip-induced nightmare fairy-tale land of Sacramento where all the politicians are tripping in Wonderland, this will result in every company complying fully, reclassifying all freelancers as employees and flinging a war chest of hoarded money at them. This will be followed by a bout of severe uncontrollable happiness across the entire California labor market and finally the mythical city of Eldorado will spontaneously shoot up from the bowels of the Earth in a massive earthquake, without injuring anybody, and spread its bountiful riches equally across the entire state. Then all freelancing Californians will join hands in a giant gender-fluid circle and throw roses at their politicians for making all their lives so much better.

This is the point where economists more doubtful as to the existence of Eldorado typically weave together numbers about how much money flows through this portion of the economy and how the earthquake won’t actually bring forth a magical city of gold, but rather an exodus and a void to be filled by scenes out of San Francisco’s tenderloin. Well, the numbers I found, cited by Forbes in an October 31 article with over 614,000 hits so far, are these, links included for those who want to get at the primary sources:

According to the Freelancing in America survey, there is a reported 57 million American freelancers contributing an excess of $1 trillion dollars to the economy each year. Recent data shows more than 75% of freelancers are working independently by choice. Due to the accessibility of apps and sites like Upwork, Instacart and Uber, to name a few, people can work on terms they prefer and accept opportunities that feel right for them.

I’m not sure what 75% of freelancers “working independently by choice” means, as I doubt 25% of freelancers are working under conditions of coercive slavery, but in any case you can pretty much see here how this law is going to change California if it is enforced, and with it, visitor flows to neighboring Las Vegas. We can hone the $1 trillion figure a bit more accurately to California by apportioning it with the state’s GDP relative to the whole country. California accounts for about 15% of 2019 US GDP, so that puts the dollar affect somewhere around $150 billion. Not all of that will be gone as I’m sure at least some freelancers will be reclassified as employees and stay in the state, but we’re talking about a whack in the economic noggin in the tens of billions at least.

Moving over to MGM, we’re starting to see volumes plateau as measured by game drop and slot handle. Combined figures are still heading higher, but the pace is slow. We will know much more with MGM’s next earnings release, but over the last 9 months table games drop is down 6.6%. The fall is made up for by a 2.5% rise in slot handle, so not terrible. But, EBITDA is down 3.2% in total Las Vegas operations over the same time. The region could already be getting sick. With iffy numbers like these a multi-billion dollar whack in at California’s head won’t help.

This may seem surprising, but MGM has been underperforming the S&P 500 since August 2013. The top came in late 2017, and the stock has not yet fully recovered from a poor 2018 for shareholders that saw the stock drop over 33% from high to low. With the Nasdaq and Big Tech frothing and bubbling out of control, institutions could start looking for slightly saner bargains, MGM among them, but betting on that is not so different from adding to MGM’s slot handle stats with your own coin.

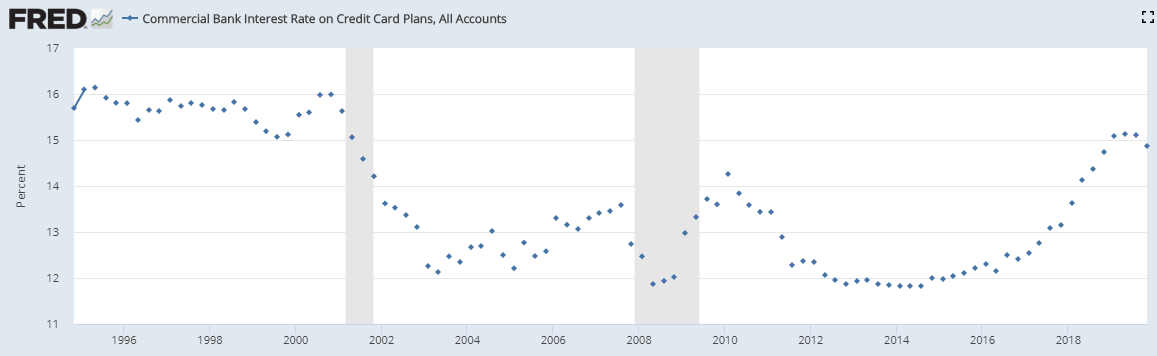

It all comes down to the question of how the real economy is actually doing. That’s always a tough question, but check this out. According to the Federal Reserve of St. Louis, interest rates on credit cards for all accounts are at highs not seen since 2001. See below. Worse, average rates for accounts that are actually paying interest on balances are at an all time high.

Meanwhile, rates on Californian municipal bonds for the next 22 years (yes, all the way out to 2042) are all below the accepted government-measured rate of inflation. Does this make sense? Absolutely, considering that public debt is backed by the printing press, still fired up on overdrive, and private consumer debt is backed by assets that are typically owned by banks in the form of securitized debt, fed right back into government-sponsored enterprises again. As Jim Rogers said in a recent interview with RT, “If you give me $100 trillion I’ll show you a very very good time! We’ll all have a wonderful time! Until it comes to an end.”

Well, it looks like the gig economy in California at least may be coming to that end. What happens next? No idea, but keep your eyes on Vegas.