The fundamentals for SegWit1X (BTC) are deteriorating. Average transaction cost has broken above $20, and the median above $14, making it almost as expensive to transact as a bank wire. This, just as the Chicago Mercantile Exchange (CME) has added nuclear fuel in the form of futures trading to a market that is already blasting off at way beyond record speed, on the eve of the holiday season when families will be gathered around their Christmas, Hanukkah, Kwanzaa, and New Year’s dinner tables and the local family “crypto-expert” will be bragging about how much money he’s made in just a few weeks.

If BTC doesn’t collapse by New Year’s, it will probably go even higher into 2018 as the subject will be the holiday talk of nearly every family in the Western World, in a market that operates 24/7, inspiring other reluctant family members to buy in as well. If this doesn’t scare you, then you should probably stand up to charging rhinoceros for a living. In this case though, we all lack the depth perception necessary to determine when the rhinoceros will actually hit. We’re all just sitting there looking at it run towards us thinking how awesome and fearless we are.

If BTC doesn’t collapse by New Year’s, it will probably go even higher into 2018 as the subject will be the holiday talk of nearly every family in the Western World, in a market that operates 24/7, inspiring other reluctant family members to buy in as well. If this doesn’t scare you, then you should probably stand up to charging rhinoceros for a living. In this case though, we all lack the depth perception necessary to determine when the rhinoceros will actually hit. We’re all just sitting there looking at it run towards us thinking how awesome and fearless we are.

Heck, it feels like I just covered this yesterday, when in fact it was just one month ago, and BTC was below $6,000 at the time. It’s tripled since then. Yawn. But at current transaction costs, BTC is not the least bit conducive to retail transactions or anything at all close to it. Even those who use BTC debit cards are probably no longer able to use them, since in most cases the wallet providing the service sells your BTC for you and charges you the mining fee. If you can’t use it in small transactions, you can only sell in humongous chunks, which means when people want to get out, we may see an insane traffic jam triggering a breakdown of mining equipment and worse.

But it gets more ominous. The average transaction value as of December 11th is (!) $120,000. The median value is over $1,000, which means there are some enormous players out there selling millions of dollars in BTC at a time. At this point there is enough enthusiasm to absorb all that selling, but it won’t always be that way. How long will there be enough enthusiasm? Think of it this way:

For all intents and purposes, this is the first global speculative mania. I won’t use the term “bubble” here because it is quite controversial, but this is certainly a mania. The tulip mania of 1637 was limited mostly to Western Europe and inherently limited because transaction technology kept it from covering too wide of a swath. The gold mania of 1980 was limited to floor traders on Wall Street and other commodity trading pits around the world. It wasn’t “everybody.” The housing mania of 2006 was limited to those with enough capital to invest in real estate like banks, funds, and house-flippers with a few hundred thousand bucks to play with.

But this cryptocurrency mania has virtually no limit to who it can infect. Anyone on the planet with an internet connection and a smartphone, even someone with only $100 in physical cash to his name who literally lives on the street, can open a wallet at any exchange and buy $100 of BTC in cash on LocalBitcoins or something and watch it go up. Practically the only corners of humanity with no access to this mania are, literally, pre-civilization bushmen. That’s why there is no telling how high this can go, because we have never been here before.

As I am a libertarian obsessed with monetary trends in specific, I have known about cryptocurrencies for years, and of course I’ve been writing about them for over a year. Now, my inbox is being flooded with family members telling me about them as if I’m a newbie. It’s funny but it’s also worrying. One family member who works at the CME has even told me that “all funds” believe it will go to $100,000 before zero. This is a guy who was and is actively involved in the BTC futures launch.

As former President Obama use to say all the time, let me be clear. I’m not saying that cryptocurrencies are just a crazy epidemic and it will all end and that’s it. Housing didn’t end in 2006. Gold didn’t end in 1980 and tulips are still for sale all around the world. But if you want to stay in the crypto game while drastically mitigating risk, you’d be much better off buying a basket of digital currencies, with the lowest transaction costs and fastest and best network.

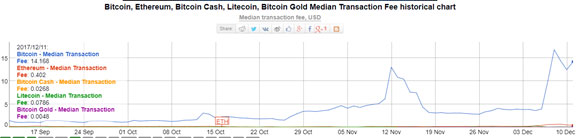

It may be a little hard to see in this chart above from Bitinfocharts, (see the color key on the left for a better look) but the average transaction fee for Ethereum, Bitcoin Cash (BCH), litecoin, and SegWit Gold (SWG) are so far below BTC (called bitcoin above) that it’s laughable. BCH and SWG especially are forked from the same blockchain for this exact reason. Fundamentally, they are just better products if the point of cryptocurrencies is to transfer money. It just takes time for the brand to catch.

When buying pressure in BTC is finally exhausted, the selling pressure in these other currencies will be much less intense. And don’t forget, we have seen BTC money flow directly into BCH before, which could even mean that selling pressure in BTC could end up as buying pressure in other cryptocurrencies in the future, at least partially.

As for the futures market on the CME, I believe the most significant aspects are three: First, it allows institutional money to pile in, obviously. Second, it creates the possibility of a short squeeze, which, on top of the wildest market in the history of mankind, could make it even wilder. Third is the flipside of the first namely that futures can also spawn a short attack, intensifying selling pressure beyond what it would normally have been when buying pressure is exhausted. Futures will just make everything more extreme and volatile.

What times we live in, indeed. Or this could all be a dream. At this point it’s really hard to tell.