Volatility breeds attention, which breeds more volatility. Eventually positive feedback loops are exhausted of fuel and they settle back down. Every day now there is a new tidbit of news surrounding bitcoin that causes either panic buying or panic selling. This is merely a consequence of bitcoin being very young and suddenly making it mainstream, much like a new and young rockstar or sports star catapults to international fame overnight. He’s liable to do some very volatile and dangerous things when he first realizes that he is suddenly famous.

We can second-guess ourselves every day and try to day-trade bitcoin. Maybe on some days we’ll win a lot of money. But then we’ll be tempted to try it again and eventually we’ll end up losing it all. That’s day trading. It can be fun and exhilarating, or absolutely devastating and make you want to jump off a skyscraper. It can make you look like an absolute genius or a complete idiot, sometimes on the very same day.

We can second-guess ourselves every day and try to day-trade bitcoin. Maybe on some days we’ll win a lot of money. But then we’ll be tempted to try it again and eventually we’ll end up losing it all. That’s day trading. It can be fun and exhilarating, or absolutely devastating and make you want to jump off a skyscraper. It can make you look like an absolute genius or a complete idiot, sometimes on the very same day.

We see a piece of news, maybe about Jamie Dimon, maybe about China, maybe about something else, and we see a bitcoin price reaction, and then we weave these narratives in our heads about why bitcoin reacted to whatever piece of news it was. Then we convince ourselves that these narratives are so correct that we trade based upon the theories we concoct on our heads.

We’ll get to the latest news in a second, but before we talk about the latest cryptocurrency intrigue, it is important to keep the long game in mind. Governments are printing more and more money in order to avoid paying their debts, but one day soon those debts are going to be called in and fiat currencies and government bonds the world over will collapse. If bitcoin survives until that day (I believe it will), then it will climb to heights that seem inconceivable now (along with gold and other hard assets). That’s the long game, and that is the main fundamental reason to own bitcoin at all. With the US debt ceiling now gone, we may be in the final parabolic stages of government debt accumulation before the global pyramid scheme collapses.

This is what we should be focusing on primarily, but if day trading is too enticing for us to ignore, then we should reserve only a small percentage of our portfolios that we can afford to lose for the day-to-day intrigue and don’t go beyond that percentage. Just like when we go into a casino and plan to gamble responsibly. That’s what bitcoin trading is right now. It’s a casino, and that needs to be understood.

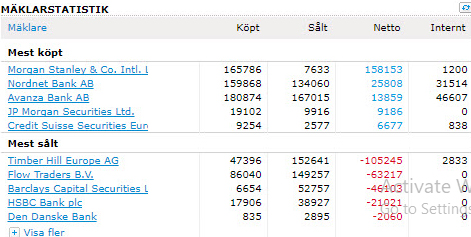

As for the latest news, apparently Jamie Dimon, CEO of JPMorgan Chase, the monarch of establishment megabanking and the man who epitomizes how to get crazy mega rich by cupping one’s hands at the spigot of Federal Reserve fiat money-creation, said that bitcoin is a fraud and that he would fire anyone at JPMorgan who traded it. And then, once again credit to ZeroHedge, it was found that JPMorgan has been a huge buyer of a Swedish bitcoin ETF, see below:

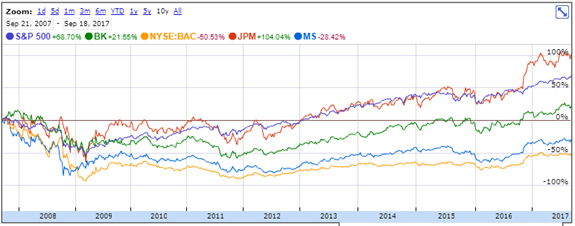

Before we “oooh and ahhh” over these buy and sell orders by megabanks (JPMorgan aside, Morgan Stanley seems to be a bona fide bitcoin addict these days), it is important to keep one other thing in mind. Banks are not prophets nor psychics. They are not even particularly good at trading. If they were, their own stocks would outpace the S&P 500 long term, since that is the quintessential point of trading against buying and holding an index. Most of them are underperforming the S&P.

JPMorgan actually is outperforming, but let’s not forget that the establishment crown megabank gets untold billions in cheap federal loans and bailouts every time there is a crisis because of the Too Big To Fail, Systemic Importance nonsense. With that kind of help from taxpayers, it’s not much of a challenge to outpace the S&P 500. All you have to do is buy the same stocks in the index and do nothing, and you’ll outpace just from Federal bailouts and dividends. Below is a chart of four of the biggest megabanks vs. the S&P over the last 10 years. JPMorgan was barely keeping pace with the S&P until late last year.

Bitcoin traders tend to be conspiratorial in their mindsets. Perhaps Dimon made these comments to shoot down the price and then buy the dip? I don’t think that’s the case. He was just shooting from the hip. He won’t fire anyone who trades bitcoin just for trading bitcoin. He doesn’t sign off on every trade his underlings make. He’s not a micromanager. He will only fire anyone whose department loses money.

The other piece of intrigue is an article from the Wall Street Journal about Chinese regulators perhaps about to ban peer to peer bitcoin trading. They have not done this yet and it is unclear if they will in the near future. I personally doubt it, because I suspect Chinese regulators own a lot of bitcoin. The only importance of this piece of news is just as a reminder that as fiat currencies fall, the fight against bitcoin will become more and more intense. The only time I think that the fight will get really serious is during a time of global hyperinflation. Bitcoin will of course be blamed, but at that point it will be too late to fight private digital currencies anyway.

Gold went through these phases also. From 1933 to 1977, private gold ownership was actually illegal in the United States. Despite that, or perhaps even partly because of it, its price is about 37x higher than it was in 1933 in dollar terms. We’ve seen the outlawing of private currencies before. It just doesn’t stick. The government can only fight the market so far. The market is much more powerful.

Bitcoin will go through some battles and its price will rise and fall, dramatically in both directions. If you want to trade that, go ahead, just don’t get addicted to it. But 10 years from now, by which time I expect government debt to be called in, bitcoin will be much higher than it is now.