Traders who have played the markets for a very long time tend to believe that news does not move markets long term. Though I have not played this game for very long, I do believe that news is mostly irrelevant. News may wiggle markets, but unless it is some sort of enormous development like a world war or the discovery of cold fusion, capital markets will keep doing what they were doing before anyway.

The reaction to the news is what matters. It betrays the market mood, what traders’ plan B’s are. If a minor piece of news causes a 5% plunge, it means that positions are being held by weak hands, looking for an excuse to sell. If they’re all looking for an excuse to sell, you don’t want to get caught up in the stampede if and when it happens. That’s why last Friday’s 5% Macau plunge, though brief, was interesting. The excuse for the selling is yet again another crackdown on junkets. It’s getting boring already, repeating this same thing over and over. Suncity Group apparently warned its employees to be very careful moving money from mainland China to Macau. Traders panicked.

Fair enough, but don’t junkets say that every day? Be careful. OK. It’s not like Beijing is suddenly cracking down on junkets. They’ve been doing that since 2014. So why the 5% plunge on Friday? I believe two reasons. First, the difficulty in moving money may have something to do with the fall in bitcoin and other digital currencies. Moving money with bitcoin may be technically easy, but converting it back into Patacas or Hong Kong dollars is the hard part. That takes time, and time is dangerous when your currency is wildly fluctuating. As long as bitcoin is more or less stable, it can be used to move fiat money, whatever its fiat price may be. If it isn’t stable, it can’t. That may be partly why junkets are suddenly having a harder time moving money.

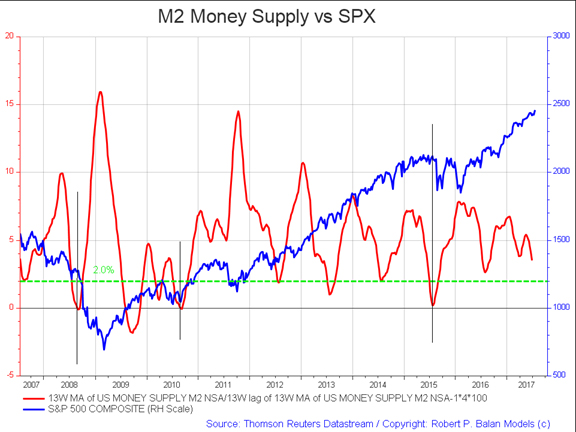

The second reason, which I believe to be the main reason, is that the money supply in the United States is about to collapse to zero growth for the quarter. It will happen in about 4 weeks. The last time it happened was in 2008/2009. It has not happened since. The closest we got to zero growth was in late August 2015. Stocks crashed globally, though briefly in the US. Chinese stocks generally still have not recovered. From June to August the Shanghai composite was cut nearly in half, 45%.

Macau though is a different story. Macau stocks have recovered since then, and could fall back down through August and September, especially if news triggers weak hands to cough up more shares. The BJK ETF is a good proxy for Macau stocks, because it holds mostly those securities.

I’ve looked at the numbers every which way for the past 3 weeks, calculating different possibilities. What I have concluded is that in 4 weeks, dollar supply growth is going to slow to between zero and 0.5% for the quarter, bottoming out on August 21st. This is worse than 2015. To see why, read here.

Here is a chart showing dollar growth rates vs. stock prices going back to 2008. You’ll see that whenever the 2% dotted yellow line is crossed for 4 weeks or more, stocks fall. The exception is 2009 since stocks were already so much lower than they were 10 years before that they couldn’t fall any more than they already had.

From there things will start growing again, judging by seasonal trends. The bottoming out process is very likely to cause some sort of flash crash in the US, similar to what happened in August 2015, and it will probably spread globally. Macau stocks listed on the NYSE or Nasdaq are likely to be caught in the storm due to margin calls and the like. Any more announcements about junkets or corruption arrests by Xi Xinping during that time will exacerbate the selling.

If you have any paper profits on Macau stocks, now is a good time to take them. Any profits in US stocks should be taken now, too, even more so. Penn, Pinnacle, and Boyd are all way up for the year. Profits like these should not be lost to greed.

The main gaming stocks lagging this past year have been the UK bookies. Too much political stress going on there. After September, these will probably be pretty good buys. Except for 888 and GVC, the main UK stocks are all laggards.

So here’s the plan. Scale out of all positions over the next 3 weeks, even good companies. Go back in if you see something like August 2015 happening again and you’ll get back in at much lower prices. It not, then by early October trends should resume. Emphasize UK stocks when reentering positions since they are laggards.

I don’t think the decline will last very long, so don’t miss the upcoming buying opportunity in 4 to 6 weeks or so.