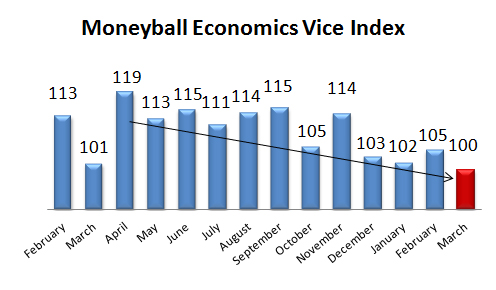

Moneyball Economics came out with a piece on its so-called “Vice Index” this week that tracks gambling, alcohol, drugs, and prostitute spending. It says that the Vice Index is trending down. Therefore the economy is in trouble.

Moneyball Economics came out with a piece on its so-called “Vice Index” this week that tracks gambling, alcohol, drugs, and prostitute spending. It says that the Vice Index is trending down. Therefore the economy is in trouble.

Economists are always looking for the perfect index to predict future trends. Not only is there no perfect index. Try as you might, there is no way to accurately index human activity and decision-making. All an index can tell you is how much of a certain activity the indexers were able to record in a certain month, which might tell you something if there’s a drastic and sudden change somewhere, or if the index is taken over a very long period of time, like 10 or 20 years. We can try to triangulate trends by using many different indexes, but even this is not an exact science. The bigger the number that the statisticians are trying to index and the wider range of activity it covers, the less precise it will be, and therefore the less useful.

That said, I can’t think of a less useful index than the Moneyball Economics Vice Index. This index attempts to jump two hurdles over what other indexes are trying to do. Most indexes try to track legal activities that people are not actively trying to hide. This itself is impossible to do 100% accurately, but at least more information can be gathered. But the Vice Index attempts to track the most elusive of activities – illegal vices like drugs and prostitutes, together with gambling and alcohol.

The Federal Reserve can’t even give you a scientifically accurate number of how much money is in the Federal Reserve System on any given week and warns that all numbers are estimates and can change. How then can a bunch of people at Moneyball Economics give anyone an accurate number of how much under-the-table cash is being transferred for drugs and hookers? Do the hookers and drug dealers report their revenues to them directly, making sure the phones aren’t tapped?

Even taking a look at the index itself there is not much here. Under 100 means contraction.

Well, March 2013 clocked in at 101, basically the same number as this past March. Perhaps something seasonal about March? One year is not going to tell us anything about a trend, especially for an index attempting to track the untrackable. Last April it jumped right back up to 119, the highest number on the chart. What does that mean? What does the trend line look like going back since 2008?

It’s also unclear exactly what the Vice Index actually tracks. With regard to gambling, is it volumes, revenues, or earnings? Earnings would be stupid, because factors that have nothing to do with a generally slowing economy affect earnings all the time. Revenues less so, but a casino can still earn less in a given year, especially a given quarter, due to lower hold percentages, jackpots, or whatever. Volumes would be the most appropriate. But from the language of the article, it sees the index tracks revenues rather than volumes.

Then there was this paragraph about how bad weather in February shut down previously growing local casino revenue in the US:

Long term downtrend? What long term downtrend? I only see a trend from barely over a year.

The reason economic forecasting should be based on Federal Reserve statistics instead of things like the Vice Index is that the Fed statistics, though they are not 100% accurate, tell you nothing about human action or human choices, but just offer dry numbers as to what exists or doesn’t exist. Look there and you can get a better idea of how much money is actually available for spending on whatever people decide to spend it on. You can never predict where the driver will take the car, but you can say how much fuel is left in the tank and based on that how far the car can go, more or less.

For example, instead of trying to track under the table cash vice transactions by who knows what means, just tell me about the trend of actual physical cash in the economy. Then I can actually tell you how much cash is circulating instead of being kept as deposits in the banking system, and from there I may be able to say more or less under-the-table cash transactions are happening.

So we look at table 5 here on the money supply release. It shows that since December, when the Vice Index started “crashing,” the amount of cash outside of banks increased by 3% ($1,291/$1,254 in trillions), while the amount of demand deposits inside banks decreased by the same ($1,191.2/$1,224.7). When people take cash out, they generally take it out of their checking accounts consisting of demand deposits. So the cash level of the money supply available for under the table transactions has actually increased compared to checking accounts, making more cash available for vice transactions.

The guys at Moneyball admit that bad winter weather has contributed to a decline in the index, and that an increase in local casino revenue is a good sign. They’re just not sure what will happen next month with hookers and drugs and they say we have to wait and see. I can tell you from the increased cash numbers that the index will fly back up, simply because more cash outside the banking system is available now than in December.

The Vice Index will jump in April just like it did last year if it’s at all consistent in its measurements month to month, and this slowing in vice spending is much ado about nothing.

Interestingly though, vice spending is a double-edged sword for the economy, because the more physical cash that exits the banking system, the less money there is in the economy by a factor of 10, which depresses the economy. For every dollar taken out of an ATM, there are 10 less dollars to lend out by banks. Of course, if everybody took cash out at the same time to buy drugs and prostitutes, the money supply would collapse. That’s not going to happen, but it’s interesting to see vice spending as a sort of cooling break on the economy, at least conceptually. If the government wanted to stop the depressing effect that vice spending has on the economy, it should legalize the activities, letting the money stay in the banking system.

The biggest threat to the US economy though is still contagion from the Eurozone. When the next economic decline comes, it will be fast, sharp, sudden, and hard, caused by a shock to bank balance sheets by an instantaneous liquidation of debt assets. It won’t be a soft gradual landing evidenced by gently falling vice spending, which I don’t believe is even happening anyway.