Melco Crown (MPEL) is one of those companies that when you look at the chart and consider what was happening with it 5 years ago, you wonder why you didn’t just sink your entire brokerage account into it back then. There are still reasons why Melco remains a compelling short term hold, but its core markets are getting more dangerous by the day, as are its expansion plans.

Melco Crown (MPEL) is one of those companies that when you look at the chart and consider what was happening with it 5 years ago, you wonder why you didn’t just sink your entire brokerage account into it back then. There are still reasons why Melco remains a compelling short term hold, but its core markets are getting more dangerous by the day, as are its expansion plans.

The time to buy Melco for the long term was in April 2009. Of course, that’s easy to say just looking at the chart and considering recent stock market history. The reasons to buy back then, however, were not based on picking a broad market bottom which one could only see in retrospect. Nor would it have been possible to foresee how astronomically high Melco would go. There were two reasons to buy it back then.

First, while the global financial crisis was taking its toll on the bottom lines of companies all over the world, Melco’s revenues were growing at breakneck speed, from $36M to $1.4B from 2006 to the end of 2008. Yes, the stock was nevertheless getting clobbered along with all others, but Melco’s revenues were only improving at the time, and dramatically so. Clearly it was doing something right.

Second, April 2009 saw the release of Melco’s 2008 annual report. It showed that revenue had increased 300% from 2007, and more importantly that the company was finally closing the gap, nearing the economies of scale necessary to actually become profitable.

What about now? At $33.50 a share, is it worth some capital? In the short term, yes, but it must be watched very closely. This is no longer a buy and hold. Melco’s main business being the Macau market and gamers from mainland China (63.5% of its customer base), Melco is simply too heavily dependent on one source of business that could become unstable very quickly. Beyond that, its expansion plans in the Philippines are an ambitious, but dangerous choice. In order to understand why, this is what is happening in the Philippines right now on a macro scale.

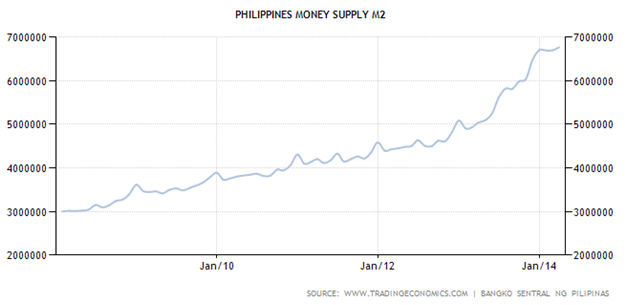

Since January 2008 until the end of 2012, the Philippine Peso supply increased at a moderate pace. Suddenly, beginning in 2013, the Philippine Central Bank went on a mad spree. This by itself creates the boom part of the business cycle and is a temporary boon for business while it’s happening. But as soon as it stops, there isn’t much time to get out. It seems from this chart that from the beginning of 2014, the peso supply has leveled off. What this means, it if continues for much longer, is that all the investments from the period of money expansion will not see the expected returns, AKA recession. The Philippines right now are at the top of the business cycle, about to experience the hangover part of the boom. Now is not a great time to invest there.

Further, Melco has also been boasting of its plans for Japan. In Melco’s words:

While its plans for Japan are nowhere near concrete yet, and that’s a good thing, Japan’s economy is far from healthy. The Yen is very weak, Shinzo Abe makes Janet Yellen look like a monetary hawk, and Japan just had the dubious honor of becoming the very first Western nation to owe over a quadrillion anything to anybody. Japanese national debt is now over a quadrillion yen. The only time that number should ever be used is regarding either molecules in the universe or kilometers in space. That, and Japan has had the highest debt to GDP ratio in the world for a very long time, the population is aging, birth rate falling, and who knows what’s going on with that Fukushima nuclear mess. When this debt bomb detonates and the economic clock and monetary clock resets, then will be the time to push hard in Japan.

I don’t find much favor in Melco’s near term plans either in the Philippines or Japan, but I cannot deny that they know how to attract customers and do it very well. Its upper management may not understand Austrian Business Cycle Theory at all, but they sure know how to run a casino while the money supply continues to flow. Net income is up 345% (page 10) year over year last quarter, a stellar start to 2014. Melco is also well protected against interest rate hikes, with 72% of its $2.54B debt fixed rate.

The real reason Melco is a short term buy at this point is that despite having an amazing start to the year, the stock is down 27% since the beginning of 2014. This is the same sort of dissonance that happened in April 2009, and it does signal that MPEL will probably rebound, perhaps even sharply. But this will only sustain itself so long as China is able to mask its failing economy, which is not long. No matter how great of a company Melco Crown is, any shake up in China will bring it down along with everyone else on the scene.

So MPEL will be a good play for the next few months, but this is a hot potato if there ever was one. Go long if you wish, but monitor it very closely, and get out at any sign of a Little Trouble in Big China.