UK-listed gambling giant Flutter Entertainment says business is booming despite the lack of major betting sports, but that didn’t stop it from raising over £812m through a new share issue.

UK-listed gambling giant Flutter Entertainment says business is booming despite the lack of major betting sports, but that didn’t stop it from raising over £812m through a new share issue.

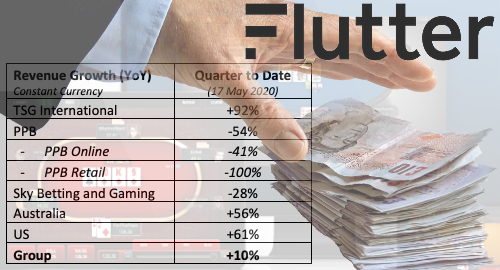

On Thursday, Flutter issued a trading statement covering April 1 through May 17. The enlarged company, which now includes the operations of The Stars Group (TSG), says revenue in Q2 to date is up 10% from the same period last year.

The gains were largely due to the predominantly grey/black market operations of TSG’s PokerStars brand, aka ‘TSG International’ under Flutter’s new brand integration strategy. TSG International revenue was up 92% year-on-year, while the combined Sportsbet/BetEasy online betting operations in Australia were up 56% and the US operations of TSG and FanDuel rose 61%.

Flutter’s UK- and European-facing operations were far less stellar, with Paddy Power Betfair brands down 54% (online down 41%, retail a complete write-off due to COVID-19 closures) and the online-only Sky Betting & Gaming falling 28%.

Flutter noted that having PokerStars under its umbrella has helped it offset the loss of major sports events due to the coronavirus, while its TVG race betting businesses in the US and the uninterrupted Australian racing sector have also done their bit to keep the lights on.

Online poker and gaming revenue got a boost from the dearth of retail options but Flutter noted that this segment’s growth has begun to “moderate” as retail begins to reopen, a trend that Flutter expects will accelerate.

FOX GOBBLES UP FLUTTER SHARES

One year ago, TSG entered into the US-facing Fox Bet joint venture with broadcaster Fox Sports. The 25-year pact gave Fox Sports a 5% stake in TSG and the right to increase its stake in TSG’s US-facing operations to 50% over the next 10 years. Following the Flutter-TSG union, Fox won the right to acquire an 18.5% stake in the US-facing operations of Flutter’s FanDuel brand.

On Thursday, Flutter revealed that Fox was increasing its Flutter stake by an unspecified amount, part of a move to place just over 8m new Flutter shares with institutional investors. Flutter didn’t specify how much money it hoped to raise, but the company said Friday that the sale had added £812.6m to its stack of chips.

As for what Flutter intends to do with that windfall beyond strengthening its balance sheet ahead of an uncertain future, the company suggested that the post-pandemic US market was in for some regulatory shakeups and Flutter would look to capitalize in every tax-hungry state that liberalizes its gaming market.