This week in gaming markets around the world: Sweden flattens the curve while gaming stocks surge above pre-virus levels. Las Vegas prepares to reopen, but to what crowds? Hong Kong and Macau discuss a travel bubble that would make quarantines unnecessary. Meanwhile, William Hill is finally recovering in the United Kingdom but the Bank of England is printing money at an all time record pace.

Sweden

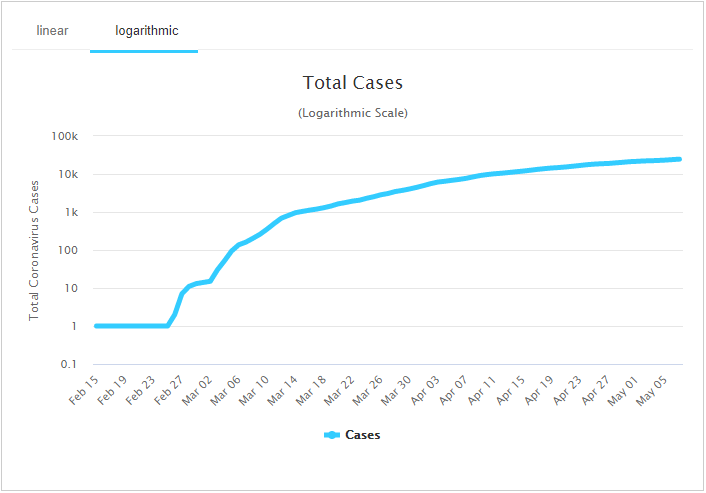

Betsson and NetEnt are performing spectacularly as expected, while Sweden has flattened its coronavirus curve without locking down the country. This raises serious questions about the necessity and effectiveness of lockdowns, and it’s certainly good news for Betsson and NetEnt.

Betsson and NetEnt are performing spectacularly as expected, while Sweden has flattened its coronavirus curve without locking down the country. This raises serious questions about the necessity and effectiveness of lockdowns, and it’s certainly good news for Betsson and NetEnt.

Betsson is up 130% since bottoming, and has surpassed pre-virus levels. NetEnt is doing even better, up almost 150%, and surpassing highs all the way back in February 2019. Continue to hold these stocks and reinvest dividends, but no need to add more at these levels. Both companies are still at risk generally from monetary conditions. If gold keeps climbing to new records as it has been against the Swedish Krona almost every day now, then profits in these stocks will have to be locked in, unfortunately, and moved mainly into gold and some bitcoin (BSV) before the Krona collapses. The currency is looking very weak right now.

Las Vegas

The lockdowns are loosening up. The Nevada Gaming Commission has approved guidelines for the reopening of casinos. This is going to be tricky from a trading standpoint. I expect big but temporary upside moves in MGM particularly once it is announced that Las Vegas is reopening. Regional casino stocks like Penn and Eldorado should also benefit short term. However, the danger is that casinos are not patronized quickly enough and then hope fades into despair.

If I were on lockdown and short on money, the first place I’d go is to the beach or for a hike, something free and with open spaces and fresh air, not a casino. This is what is happening in Texas as the state reopens, with people flocking to beaches and parks and avoiding enclosed spaces like malls. The play here is that whenever Las Vegas opens back up to gamblers officially, sell into strength. Poor traffic at the Strip could make investors despair quickly. By the time they become hopeful again, the dollar may be significantly weaker, causing other serious problems.

Macau

Macau keeps climbing steadily, but we have already reached our sell target of $30-31 on the Macau ETF (BJK). There may be another leg up as a “travel bubble” is being considered between Hong Kong and Macau that would make quarantines for travelers unnecessary. Right now, returning Hong Kongers from Macau must stay quarantined for 14 days. This is obviously a big negative on casino traffic. As of now the quarantine policy is in force until June 7, but it may end sooner. If you have any minor position in Macau, I believe it is safe to hold a small position until travel opens up between Hong Kong and Macau. There could be a nice bump there, but long term Macau is not a good place to be invested, given escalating tensions again between the US and China.

United Kingdom

The U.K. money supply was up a whopping 10.5% according to the latest number for March. It’s probably growing even faster now. This is the fastest month to month growth rate ever. Given direct inflationary financing of the national budget, the money supply in Great Britain could climb faster than any other country, none of which have hit the nuclear option of direct financing of deficits yet. Dominic Cummings, who made a name for himself and built a fan base on his mistrust of government generally and leanings towards individual liberty, has now completely neutralized his appeal among his base while presiding over the fiercest lockdown against human activity by government in history. Now he’s just a cantankerous irrelevant, as is the European Union itself, it appears.

Brexit now seems like a different world, as the European Union is crumbling all on its own. Germany took a shot across the bow of the Europan Central Bank this week in declaring its bond-buying programs illegal, ordering the Bundesbank to stop taking part in them. I don’t know if the timing of this ruling was coincidental or planned, but recall that Germany has a keen cultural memory of what hyperinflation is and the destruction that it leads to, for example the rise of Nazism. The Germans are increasingly unhappy with Brussels, and their protests are getting louder.

As the EU falls apart, my fear for the U.K. gaming industry is based on a fear of scapegoating, which is on the rise everywhere. Politicians are looking for someone to blame, and the gaming industry is always a good target. Online gaming revenues have been increasing since the lockdowns, and it won’t be long now before gaming companies get blamed for taking advantage of people in lockdowns while they’re bored and vulnerable. You’re poor? Blame gambling. Not us.

As for U.K. gaming stocks, short term over the last two weeks, William Hill is in the lead, and it’s about time. A 1-year chart shows William Hill as the laggard, the only gaming stock to underperform the FTSE 100 over the last year. Flutter and GVC are in the lead up 51% and 21% on the year respectively. On a long term chart, the hit that Flutter took on COVID-19 is barely even noticeable. True, Flutter has been more resilient than expected, but the fact remains that if people can’t generate wealth while locked down in their homes, then eventually they will not be able to afford betting on anything, especially when they can no longer borrow or depend on government bailouts to do so. Flutter’s strength is unjustified and shouldn’t last for much longer.

888 remains stable for the year, but the stock to concentrate on here is William Hill. Longer term, if Downing Street really starts cracking down on the gaming industry even harder in an effort to distract from policy failures, then it’ll be the smaller, more conservative companies that can capitalize when the bigger ones get hurt. Flutter specifically has a pretty decent balance sheet, but the company is so sprawling and huge that it’ll be hard to manage without breaking it apart again. Firms like William Hill or 888 could end up acquiring chunks of companies for relatively little, eventually.