Online gambling operator The Stars Group (TSG) posted a profit in the final quarter of 2019 as sports betting revenue eclipsed contributions from the online casino and poker verticals.

Online gambling operator The Stars Group (TSG) posted a profit in the final quarter of 2019 as sports betting revenue eclipsed contributions from the online casino and poker verticals.

Figures released Thursday by the Toronto-based TSG show total revenue of US$688m in the final three months of 2019, up 5.4% from Q4 2018. Adjusted earnings rose 4.1% to $249.1m but operating income rose by one-quarter to $92.4m and the company booked a net profit of $81.3m versus a $38.2m loss in Q418.

For the year as a whole, revenue was up nearly one-quarter to $2.53b, adjusted earnings gained 18% to $781m, operating income nudged up 1.6% to $264.2m and the company swung from a net loss of $109m to net earnings of $61.8m.

The Q4 revenue gains were credited to a strong showing by the UK-facing Sky Betting & Gaming (SBG) business and Australia’s BetEasy brand. Sports betting’s share of the Q4 revenue pie was up nearly five points to 39.1%, while online casino was up less than one point to 30.8% and the formerly dominant poker vertical plunged 5.3 points to 27.5%.

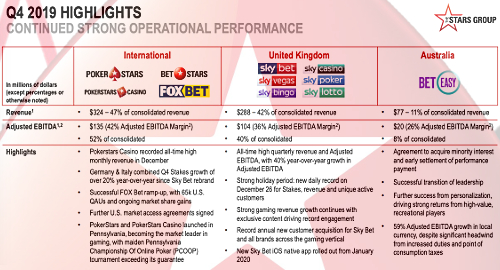

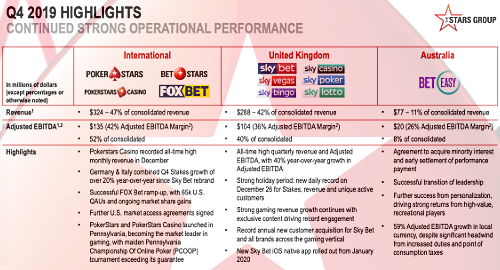

On a geographic basis, the International dot-com operations of TSG’s PokerStars brand reported revenue falling 8.8% to $324.4m and earnings fell by one-fifth to $135m. Poker revenue slid nearly 12% to $186.2m, gaming (casino) rose 2.4% to $114.8m while betting tumbled 26% to $16.1m. Quarterly active customers fell 9.5% although net yield per user was up 1.8%.

As usual, TSG blamed the dot-com declines on currency fluctuations and “continued disruptions and regulatory headwinds” in markets that are blocking payment processing and app downloads. The word ‘Russia’ doesn’t appear anywhere in TSG’s report, which claims somewhat disingenuously that the affected markets are “all lower-priority.”

The International unit also includes TSG’s US-facing Fox Bet joint venture with FOX Sports Network, which was credited with boosting sports betting stakes. TSG said it had 65k active US customers in Q4 and was growing this number by a compound weekly rate of 9% while the Fox Sports Super 6 free-play app boasted over 500k unique weekly actives.

In the UK, SBG’s revenue shot up 27.5% to $287.7m while earnings rose 41% to $41.6m – both new records – thanks to solid gains in both betting ($177.1m, +35.5%) and gaming ($96.9m, +15%), while poker remained an afterthought ($2.8m, -8.3%). Betting stakes were up 13%, margins enjoyed a two-point rise and SBG enjoyed an overall 8% rise in quarterly active users.

In Australia, BetEasy reported revenue up 6.4% to $77m while earnings jumped 45.3% to $19.9m. Betting stakes fell 9.4% as quarterly actives slid 14% but this was offset by margins rising 1.4 points as the brand shifted to a focus on “high-value, recreational customers.”

For the year as a whole, betting is now TSG’s top revenue generator with $871m, while poker’s $793m narrowly pipped gaming’s $792m. International dot-com operations claimed a 52% share of overall revenue, with the UK at 37% and Australia at 11%.

TSG’s braintrust once again opted against a Q&A session with analysts, citing the company’s pending merger with UK giant Flutter Entertainment as justification.