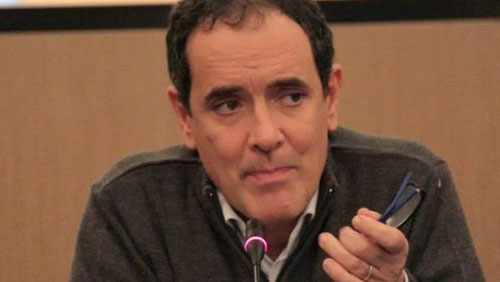

Representatives of the Italian gambling industries primary stakeholders, LOGiCO, have penned a response to the Italian Democratic Party Senator, Franco Mirabelli’s claims that a shared liquidity scheme opens a Pandora’s Box of pain and misery.

When the Italian Democratic Party Senator, Franco Mirabelli, looks at the scheme to share online poker liquidity with France, Portugal, and Spain he sees nothing but a car wreck. Representatives of LOGiCO, the gambling industry association created in 2016 to muzzle the barking from dogs like Mirabelli, vehemently disagree.

When the Italian Democratic Party Senator, Franco Mirabelli, looks at the scheme to share online poker liquidity with France, Portugal, and Spain he sees nothing but a car wreck. Representatives of LOGiCO, the gambling industry association created in 2016 to muzzle the barking from dogs like Mirabelli, vehemently disagree.

The pace of the shared liquidity between those prime European nations has spun as slowly as the wheels turning on the overturned cars in that wreck that Mirabelli observes. But in July, the French gaming regulator ARJEL announced that the quartet of countries had signed a shared online poker liquidity agreement, and poker players began blowing on their kazoos.

Here is a snippet of a joint statement made by the gambling regulators in the four countries at the time of signatory.

“The Italian, French, Portuguese and Spanish online gambling regulatory authorities will sign an agreement concerning online poker liquidity sharing on 6 July 2017 in Rome. This agreement will set the basis for cooperation between the signing Authorities in this context and will be followed by further necessary steps within each of the jurisdictions involved in order to effectively allow for liquidity poker tables.”

But one man disagrees with the move, and that man is Mirabelli.

The man who sits on the anti-mafia commission told the Italian press that he was going to make it his duty to approach the Minister of Economy and Finance, Pier Carlo Padoan, to thrust a very sturdy piece of metal into the wheel of the machinery.

Mirabelli called the agreement a tool of recycling which is Italian code for money laundering and fraud. The politician also believes that Italian poker players will be less protected if the boundaries placed to protect are widened to encompass four countries.

LOGiCO Bite Back

Over the weekend, an article appeared in the popular Italian poker media news site GiocoNews, claiming to be from LOGiCO representatives, the industry association chaired by executives from the likes of Paddy Power Betfair and PokerStars.

In response to Mirabelli’s view that shared liquidity would increase the opportunity for money laundering, because France, Portugal, and Spain’s systems aren’t as squeaky clean as the Italians, LOGiCO reminded him that all four nations have thoroughly verified the matter and comply with money laundering regulations.

The article noted:

“Legal practitioners use specialised teams and state-of-the-art technologies to ensure compliance with such measures, including the Know Your Customer (KYC) processes and financial flow analysis.”

On the question of fraud, LOGiCO believes the more prominent the system, the easier it is to identify fraudulent activities such as collusion. The Industry chiefs also pointed out that Italians currently play on unregulated shared liquidity sites where there is an increased likelihood of fraud because they don’t have the same thorough audits of a regulated site.

Can Mirabelli’s interventions result in a shared liquidity scheme seemingly bent in all manner of strange angles?

It would appear so.

In a clear sign of a win-win scenario, LOGiCO representatives make it abundantly clear that they don’t see the same car wreck that Mirabelli sees. However, if the Italian regulator does see it, then rather than trying to dismember the entire structure, they suggest proceeding on a trial basis with poker tournaments, leaving cash game players behind.

I can hear the collective thud as the kazoos drop to the floor.

*I read the article via Google Translate so if I have gotten any of this wrong I am blaming Larry Page and Sergey Brin.