Online Gambling: Monthly Form Guide

Online Gambling: Monthly Form Guide

Apr 11

Summary:

April saw major online gambling regulatory events in the US and Germany. In the US, 11 individuals, including the founders of PokerStars, Full Tilt and Absolute Poker and several payment processors were charged with bank fraud, money laundering and illegal gambling. The FBI seized the websites’ domain names, although later returned pokerstars.com and fulltiltpoker.com to allow returns of cash to US players. All three have stopped offering real money play to US citizens resulting in significant drops in liquidity and PokerStars has begun to return cash to US players. In the short term we think the indictments are mixed for the prospects for federal US online gambling – charges of bank fraud at major operators do not add to the attraction of pushing for regulation for politicians, but we expect more grassroots pressure from US players now that most are unable to play. In Europe, 15 of Germany’s 16 lander announced proposals to allow online sports betting. The proposals include a 16.7% tax on stakes and would allow seven licences for private operators. A number of private operators said that the proposals would be unworkable, and Schleswig-Holstein, the remaining land, retains its plan to allow all online poker, casino and sports with a 20% tax on gross profits, and has said that it could pass legislation in July. In Spain, a bill to regulate online gambling could become law as soon as this month.

Poker Traffic update:

Poker traffic saw a big impact from the closure of PokerStars and Full Tilt to US players. It is difficult to measure the precise impact given seasonality (both weekly and annual) but PokerStars and Full Tilt appear to be running at 60-80% of their pre-indictment liquidity levels, while the European operators look to have had a benefit. PartyPoker’s liquidity in the week after the indictments was 8% above the week before, and it has seen a recovery in its year on year .com liquidity fall (.com liquidity has been impacted by the ring-fenced regulated markets in France and Italy) from around 20% at the start of April to less than 10% at the start of May. Bwin.party said that new player sign ups increased 33% in the first two weeks after the DoJ actions.

Source: Pokerscout, Morgan Stanley Research

Source: Pokerscout, Morgan Stanley Research

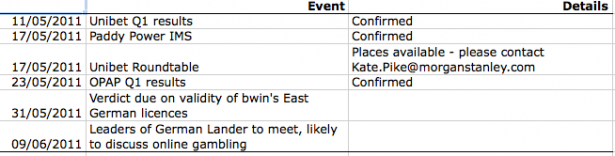

Ready to Roll:

We highlight some of the key forthcoming dates and events.

Biggest Pot:

April’s biggest pot was well below usual levels after the closure of PokerStars and Full Tilt to US players. The prize of $95,224 was won by Ben Sulsky, a 21-year old American player, on PokerStars. The pot was won on 14 April, the day before the indictments.

US Regulation and Prohibition

The FBI unsealed indictments which charged 11 defendants with bank fraud, money laundering, and illegal gambling offences. The defendants include the founders of PokerStars, Full Tilt Poker and Absolute Poker. The US also filed civil money laundering forfeiture complaints against the poker companies, their assets and the assets of several payment processors.

The indictments were reported to have been made possible by last year’s arrest of Daniel Tzvetkoff, who was charged with money laundering, bank fraud and conspiracy for processing $543m in internet gambling funds, but was bailed in August.

Rep. Barney Frank said that the indictments were ‘an incredible waste of resources’. Frank said he hoped the backlash from the crackdown would help build momentum behind his bill to regulate online poker.

European affiliates have stepped up marketing of non-US facing poker websites due to the uncertainty surrounding PokerStars, Full Tilt and Absolute.

The CEO of Caesar’s argued that the indictments present an opportunity to legalise and regulate online poker in the US. Caesar’s favours federal regulation over the legislation at the state level.

Alderney Gambling Control Commission, Full Tilt’s regulator, and the Isle of Man Gambling Supervision Commission, PokerStars’ regulator, released statements concerning the US indictments. Both said they would follow developments, and Alderney is undertaking its own investigation into the allegations.

With US players unable to take part, PokerStars reduced the amount of guaranteed prize money available in its Spring Championship of Online Poker to $25m from $45m.

PokerStars started returning funds to US players after making an agreement with the DoJ under which its domain name was returned. Full Tilt made a similar agreement, although has not started returning cash yet.

Iowa’s Senate voted to approve a bill that seeks a state report assessing illegal internet poker activity in the state and how best to regulate it. Senator’s voted 38-12 to pass the legislation.

According to a telephone poll Americans have mixed views on legalizing online poker, with 41% in favour and 42% opposed. More Americans would put more trust into a private online gambling site than a government-run one than the other way round.

Senator Jon Kyl, who helped draft UIGEA, said that he would consider carefully proposals to allow online poker in the US, provided they leave in place restrictions on online betting.

Moody’s said that the recent crackdown on online poker in the US could open the door to legalization at the state level, and that the land-based casinos should be beneficiaries.

Hawaii’s online poker bill will not be introduced. However, there were questions over its feasibility given it suggested a $100m licence fee and a 20% tax on wagers.

Washington DC could become the first jurisdiction in the US to allow online poker. Congress did not raise any objections to the council’s proposal to allow the district lottery to operate a poker website.

Sen Abruzzo’s bill to allow online poker in Florida looks unlikely to progress this year. Its companion bill failed to pass out of the Senate Criminal Justice Committee.

European Developments:

15 of Germany’s 16 federal states said that they had agreed to open the betting market for a pilot phase of five years and would allow private companies to bid for seven licenses. The proposals included a 16.7% tax on stakes and would not permit live betting.

bwin.party said that it believed the proposals would be unsuccessful and that they are not in compliance with EU law. It said the proposed model would fail to channel consumer demand, offer player protection and combat fraud.

A group of private betting companies announced that they welcomed the law drafted by the 16th state, Schleswig-Holstein, which proposes a gross profits tax of 20%. The operators said they would apply for licenses if the law passed.

Schleswig-Holstein could pass its own legislation in July if there is no change in the position of the other 15 lander before then.

Spanish gambling company Codere challenged bwin’s sponsorship of Real Madrid. It argued that bwin’s ‘aggressive’ advertising breach Spanish law.

Spain’s draft online gambling regulation bill could be passed by the end of May. Some Spanish regions are also considering their own regulatory regimes.

Greece’s draft bill to regulate online gambling and allow VLTs was challenged by MPs and was refused fast-track status by the European Commission.

Greek land-based sports betting monopoly OPAP is looking for a strategic partner to expand online. Management is reported to have been in contact with Playtech and 888.

Irish agriculture minister Simon Coveney, who has responsibility for horseracing, has said he thinks the betting tax rate may have to be doubled to two percent of stakes. The government has already said it will extend the current one percent tax to online betting.

Online sports betting in France dropped by nearly one third in Q1 2011. We believe this reflects a shift to unlicensed sites, rather than a decline in interest in France.

Sweden’s Christian Democrat party has said that it would consider changing the law in the country to allow private operators into the online market. Previously the party has defended the monopoly.

Governments can capture more activity and tax revenues by imposing a gross profits tax of less than 15%, according to a report by H2 Gambling Capital. The consultancy conclude that under a 5% tax 95% of a country’s market is likely to be captured by regulated sites, whereas at 20% this falls to 60%.