Online Gambling: Monthly Form Guide

Online Gambling: Monthly Form Guide

Apr 11

Summary:

March saw significant progress on online gambling in the US at the federal level with a new bipartisan internet gambling bill introduced by Republican John Campbell and Democrat Barney Frank. While political support for the bill remains unclear, support from the Las Vegas casinos appears to be gathering momentum. Wynn Resorts announced an alliance with PokerStars with the aim of progressing federal regulation and ultimately running a US online poker website together. 888’s relationship with Caesars was approved by the Nevada Gaming Commission, and Full Tilt is reported to have formed a partnership with the owners of Station Casinos. Amongst the states, Nevada and Hawaii are also now considering online gambling legislation. In Europe a French parliamentary committee is investigating the new regulated online gambling market and changes to make licences more attractive look likely. Betfair won its case in the Netherlands where a judge ruled that the licensing system is in breach of European law, and the country now plans to regulate online gambling. Greece has now submitted draft online gambling regulation to the European Union which has separately released a green paper into the rules over cross border online gambling.

Poker Traffic update:

Poker liquidity on the .com sites was weak on most sites in March with the exception of PokerStars which took share as a result of its 60 billionth hand promotion. Three of the top 10 and nine of the top 20 pools of liquidity are now French or Italian ringfenced sites, underlining that .com liquidity is becoming less important to the industry.

Source: Pokerscout, Morgan Stanley Research

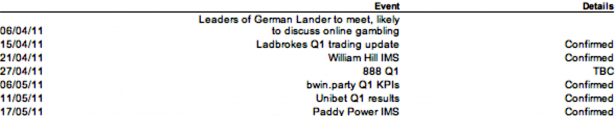

Ready to Roll: We highlight some of the key forthcoming dates and events.

Biggest Pot

Regular big pot winner Tom ‘Durrrr’ Dwan won the biggest pot of the month of $166,359 on Full Tilt Poker.

US Regulation and Prohibition

Republican congressman John Campbell and Democrat Barney Frank introduced federal a bill that would allow online gambling in the US. The bill is very similar HR 2267, Frank’s bill that was passed out of the House Financial Services Committee last year.

Wynn Resorts announced an alliance with PokerStars to push for federal legislation that will allow online gambling in the US. Once legislation passes the two companies would launch an online poker site together. The move demonstrates that Las Vegas land-based casinos are becoming more positive towards legal online gambling in the US.

Full Tilt Poker set up a similar partnership with the owners of Station Casino, as the Wall Street Journal noted in a piece on partnerships between casinos and online gambling companies.

888’s relationship with Caesar’s was approved by the Nevada Gaming Commission. It is the first relationship between a Las Vegas casino company and an online operator to have received such approval.

Nevada’s Assembly Judiciary Committee held a hearing on a bill that would allow online gambling. The committee heard that if Nevada captured 25% of the international market the state could raise $65m in additional annual taxes.

A bill was introduced to the Hawaii legislature that would allow licensed and regulated online poker. The move comes despite the current ban on gambling in the state.

Senator Ray Lesniak said he would introduce further legislation to allow internet gambling in New Jersey despite Governor Chris Christie vetoing his earlier bill. He said ‘I look forward to working with Governor Christie and his administration in order to get Internet wagering up and running as soon as possible.’

Gambling law Professor I Nelson Rose argues that the US could struggle to block poker operators that currently accept business from US citizens from any future regulated market. This would be in line with the French experience where proposals for a ‘time out’ for incumbent unlicensed operators were ultimately dropped.

European Developments

A French parliamentary committee is investigating the success of the country’s online gambling regulatory model. The committee will consider making French online licenses more attractive, including allowing higher payout ratios and sharing liquidity, although the country’s budget minister appears reluctant to lower tax rates.

Unibet described the opening of the French online gambling market as a ‘failure’. The company is delaying its entry into the market with no sign of taxes being lowered.

Betfair announced that it would start operating in the UK from a Gibraltar licence. The move will save the company around £19m in gross profits tax each year.

A Dutch judge ruled that the Netherlands’ gambling licensing procedure is in breach of EU law, as was that the decision to grant De Lotto its licence. The ruling was the result of a seven year old case brought by Betfair.

The Dutch government said that it wants to grant licences for online gambling. It argues that given hundreds of thousands of citizens ignore the current ban anyway, a change in the law would allow better oversight.

Greece submitted draft gambling legislation to the European Commission which would allow licensing of online gambling sites and VLTs. The latest draft does not include a black period which would have blocked incumbent operators from the online market. The legislation proposes a 30% gross profits tax.

The European Union released a green paper which reopens debate on regulation of cross-border internet gambling. The green paper was criticized by the European Gaming and Betting Association for lacking commitment to curb further fragmentation of the common market.

FIFA and UEFA are considering a ban on live betting. It is not clear whether they mean betting in running or markets such as the timing of throw-ins unrelated to the result of a game.

The 2000 Guineas to be renamed 2331 Euros. The change reflects EU currency harmonisation rules.