With the Chinese New Year taking place on February 19th in two days, it’s a good time to review the now one-year-old Macau gaming stocks bear market and see where we stand. This bear market began on February 28, 2014 when Macau stocks topped out, incidentally three days before my very first Calvin Ayre column on March 3, 2014 entitled The China Bubble. There I introduced my money-supply-centric debt-focused macro analytical approach to trend forecasting and what I saw as an imminent Macau bear.

With the Chinese New Year taking place on February 19th in two days, it’s a good time to review the now one-year-old Macau gaming stocks bear market and see where we stand. This bear market began on February 28, 2014 when Macau stocks topped out, incidentally three days before my very first Calvin Ayre column on March 3, 2014 entitled The China Bubble. There I introduced my money-supply-centric debt-focused macro analytical approach to trend forecasting and what I saw as an imminent Macau bear.

Concession statement: The good timing from that article was entirely a coincidence. I have no exact timing tools, nor do I believe there are any real ones out there. That and the catalysts for the year-old bear have been different from what I cited there. While money supply slowdown has certainly figured in fundamentally speaking, catalysts for the recent downturn have been Chinese government crackdowns rather than rising interest rates. So arguably, I got it wrong, even though the call was right. What it also means is that the interest-rate induced fall is still ahead of us if and when it happens, and could happen at any time.

Short price review for four Macau stocks since March:

1) Wynn Macau Ltd. (WYNMY) down 37%

2) Sands China (SCHYY) down 40%

3) MGM China Holdings (MCHVF) down 41%

4) Galaxy Entertainment Group (GXYEY) down 43%

So where are we now, where are we headed for Chinese year 4713, the Year of the Sheep, and what should you do with your Macau portfolio? First of all, if you were crazy enough to listen to my first article back in March from a total unknown and go short Macau, cover at least half of your shorts and take profits. Even if a Greek domino effect reaches Macau’s shores in the next month resulting in a Zombie Apocalypse, it is almost a crime not to take at least some profits at this point.

Is it still OK to establish new short positions in Macau if you haven’t already? Yes, but not heavy ones. In the event that the Eurozone disintegrates in the next few months and causes a global financial meltdown, everything will go down. But if Greece somehow reaches a deal by the February 28 bailout expiration (coincidentally the exact one-year anniversary of the Macau bear market) , which is entirely possible if Greek Finance Minister Yanis Varoufakis gets fired for having a spine (see Exit Before the Grexit for reference), then all markets globally will have a brief technical relief rally regardless of fundamentals. As long as Varoufakis is in in the FinMin chair though, I’m confident in saying that no deal will be struck. So three possible short term strategies are:

1) Go short now, and cover if Varoufakis resigns or is fired

2) Stay on the sidelines now and go long if he resigns or is fired

3) Stay on the sidelines now and go short on March 1 if he’s still in office and the current bailout expires

Why am I so centered on this one guy? Simply because he is the only non-politician player in the whole Eurozone debacle who cares nothing for power, making him a total wild card and loose cannon, absolutely misunderstood by every German politician that surrounds him, who all think they can cut a deal with him when they cannot. When that kind of setup happens and you can center all trades on one variable nobody else gets, it is a gift from the trading gods.

Now, as for Macau itself, here’s what’s going on as seen from a perusal of recent headlines. First, we have this Reuters piece about Chinese government officials giving business advice to Macau casino operators, basically to cut down on baccarat and focus more on cultural entertainment fluff. This is obviously business advice coated in a thick candy shell of veiled threats including revoking licenses and opening up a can of regulatory whoopass for anyone who disagrees. Steve Wynn for one is playing the part of good obedient CEO:

“When you hear the central government and the Macau government urged operators to diversify the attractions of their facilities…they are preaching to the choir. We invented that idea,” Steve Wynn, founder of Wynn Resorts, told investors in a conference call on Feb. 4.

This whole push to cut down on gambling and ramp up on fluffy attractions is an attempt to cut down on “corruption” again and whiten Macau’s reputation from a grey money laundering bastion to a white Chinese cultural hub in order to polish the reputations of a few politicians. When governments give business advice, it is generally not good for earnings.

More junkets are set to close after the February 19th Chinese New Year, according to GGRAsia. Keep in mind that the main purpose of a junket is not to pad the pillows of the superrich, though they certainly do that. It’s to skirt capital controls imposed by the Chinese government. Without junkets, it is much harder for the superrich to smuggle large amounts of capital to Macau to gamble with.

The Wall Street Journal reports that January gambling revenue fell 17% year over year, following a 30% December drop, in the face of a $23B collective spending spree expansion for 62% more gaming tables and 51% more hotel rooms by the of 2017. This is what Austrian economists call “malinvestment” caused generally by artificially low interest rates. Junket operators fell to 183 from 217 last year.

Chinese monetary policy remains tighter than most. We read about paltry stimulus bursts, but they are nothing compared to what’s going on in Japan, Europe, or the US. The latest lip service China has paid to expansionary monetary policy according to Bloomberg is to drop its reserve requirements for banks to 19.5% from 20%. That is still almost 10x the reserve requirements for Germany and the rest of the Eurozone, and nearly twice the 10% reserve requirements for most US banks. Getting into looney numbers, the money supply in Japan is nearing 1 quadrillion yen with a reserve ratio of 0.76%. No comment.

China is staying tight, but in today’s insane world, it’s all relative.

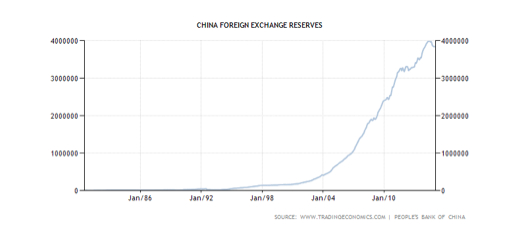

Let’s end it with a few charts. First, something is happening with China’s foreign exchange reserves. They’re dropping by the largerst margin since, well, ever. It’s a blip, but it’s a big blip and it’s noticeable. Someone over there at the People’s Bank of China is selling bonds, not good for maintaining low interest rates.

Chinese government debt to GDP continues to drop since peaking in 2011, which shows the general reluctance the Chinese government currently has for big spending and direct stimulus of industry.

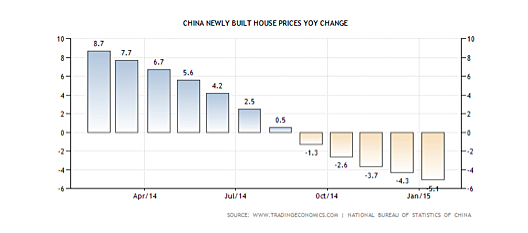

And perhaps the biggest tell that “The Big Crash” is ahead of us is the Chinese housing index, which tracks the prices for newly built houses.

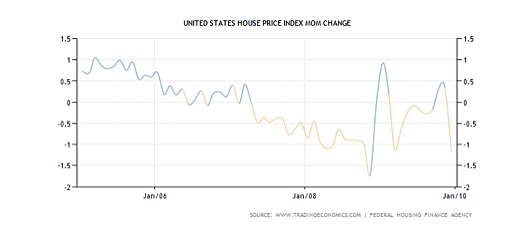

The Chinese housing market crossed the zero price growth theshold sometime in August/September 2014. We are now 5 months into declining housing prices. By comparison, here is that same index for the US before and after the great housing collapse.

The US crossed the zero growth threshold in early 2007. Eyeballing the above graph, say February. From there it took about 18 months for a systemic crisis to take hold. Will the same thing happen for China? No, not necessarily, but if you want to take a stab at timing, it may give some kind of ballpark.

Conclusion

The Macau collapse of 4712 was catalyzed by government crackdowns with some underlying declining Chinese economic fundamentals. This has not been the Big Crash I’ve been expecting, but will thankfully soften the blow when it does come by having deflated Macau from its highs before interest rates start to seriously rise.

In the short term, no Greek deal may very well bring on the full blown global crisis I’m expecting, while a Greek deal will trigger relief rallies everywhere.