The US Department of Justice unsealed indictments against Costa Rica-based digital currency purveyors Liberty Reserve (LR) on Tuesday, charging the company and seven individuals with conspiracy to commit money laundering and operating an unlicensed money transmitting business. The move follows the arrest on Friday in Spain of site founder Arthur Budovsky. Five of the seven individuals are now in custody and are awaiting extradition to the United States.

The US Department of Justice unsealed indictments against Costa Rica-based digital currency purveyors Liberty Reserve (LR) on Tuesday, charging the company and seven individuals with conspiracy to commit money laundering and operating an unlicensed money transmitting business. The move follows the arrest on Friday in Spain of site founder Arthur Budovsky. Five of the seven individuals are now in custody and are awaiting extradition to the United States.

The indictment (read it here) accuses LR of acting as “the bank of choice for the criminal underworld.” Among the nefarious activities allegedly conducted through the use of LR were credit card fraud, identity theft, investment fraud, computer hacking, child pornography, narcotics trafficking and “unregulated gambling enterprises.” The case is being prosecuted by Preet Bharara, US Attorney for the Southern District of New York, who brought the ‘Black Friday’ indictments of online poker companies in April 2011.

Along with the arrests, the DOJ has laid claim to all funds in 42 bank accounts in Costa Rica, Cyprus, China, Hong Kong, Latvia, Morocco, Spain and the US, plus nearly $37m in three Australian accounts. The Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN) has proposed barring US financial institutions from dealing with international banks that dealt with LR.

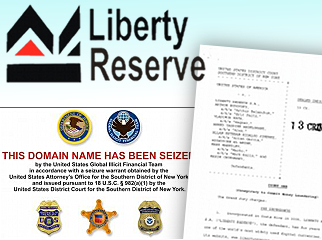

The DOJ has also taken control of six .com domains, including Libertyreserve.com and five affiliated sites. Interestingly, the agent affidavit attached to the indictment claims the investigation involved “one of the first-ever ‘cloud’-based search warrants, directed to a service provider used to process Liberty Reserve’s Internet traffic.”

COME FOR THE VIRTUAL CURRENCY, STAY FOR THE COCAINE

LR, which began life in 2006, is alleged to have processed over 12m financial transactions worth over $1.4b on an annual basis. Cumulatively, the site is said to have processed 55m transactions worth over $6b from 2006 through May 2013. The site had over 1m users, including 200k in the US alone.

LR performed little in the way of ‘know your customer’ research on its clients, requiring only a name, address and birth date, and even these weren’t vetted. An undercover federal agent testified that he opened a LR account under the name ‘Joe Bogus’ with an address listed as ‘Completely Made Up City, New York.’ For some of the transactions made between this account and another DOJ-established account, the agent wrote “for the cocaine” in the ‘memo’ field.

LR utilized a secondary method of data obfuscation by requiring their users to work through pre-approved ‘money exchangers,’ which were primarily based in Malaysia, Russia, Nigeria and Vietnam. These exchangers made bulk purchases of LR currency – either Liberty Reserve Dollars or Liberty Reserve Euros, the value of each pegged to their respective fiat currency – then sold it to individual users for a 5% commission, after which the users were allowed to trade using their LR’s before cashing out again into fiat currency via these exchangers, thereby avoiding a “centralized financial paper trail.”

VIRTUAL COLLATERAL DAMAGE

Not all LR users were child pornographers, and many are now complaining that they’ve become “collateral damage” in the DOJ’s crusade against the firm. EPay Tarjeta head Mitchell Rossetti told the BBC that “thousands upon thousands” of legit LR users “have committed no crime and want our funds returned to us.”

Tuesday’s indictment marks the second time this month that US federal agencies have acted against digital currencies. Two weeks ago, the US Department of Homeland Security seized funds belonging to a US subsidiary of the Tokyo-based Mt. Gox Bitcoin exchange over its failure to register with US financial authorities as a money transmitting business.