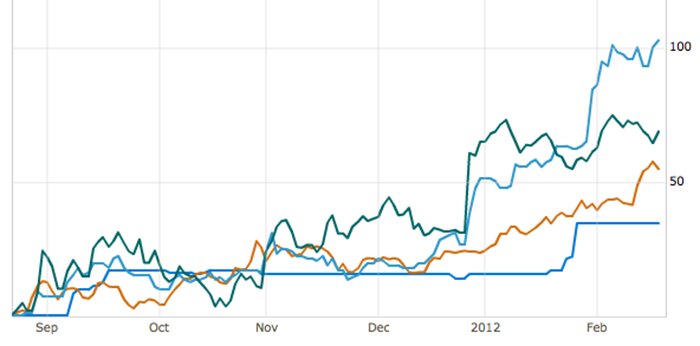

Online gambling stocks have performed strongly over the last few months, buoyed by the late 2011 Department of Justice opinion that appeared to legalize state-regulated online gambling in the US, and continued revenue growth in the publicly traded companies’ year-end reports. The expansion of online gambling into mobile devices represents additional revenue potential, and the prospect of future growth has resulted in higher valuations for stocks in the industry:

Six-month chart of 32Red (blue), Betsson AB (orange), 888 Holdings (light blue), Bwin.Party Digital Entertainment (green). Right y-axis represents percentage increase in stock price. Chart courtesy businessweek.com

Indeed, stocks in the sector have a lot to offer investors. The major European companies are all profitable, with cash on the balance sheets, and, in some cases, solid dividend payouts (Betsson AB’s yield, for instance, is a solid 5%, above all but a fraction of US stocks in any industry). Revenue growth has been solid, while new geographic markets in Italy and Denmark (and potentially, the US) and new methods of delivery, such as tablets and smartphones, offer added revenue streams going forward.

Of course, there are a host of challenges facing the operators as well. As Mike O’Donnell noted on this site just last week, publicly traded gambling stocks have historically been volatile, unstable investments. The most notable example of the sector’s unpredictability was the passage of the Unlawful Internet Gambling Enforcement Act of 2006 (UIGEA) in the US, which knocked down the then-traded stock of PartyGaming by some 70%, while severely impacting other online gambling stocks as well.

But government regulation remains a key issue, as the murky legal scene in Europe makes future earnings nearly impossible to decipher. In October, Spain’s advocate general opined that individual governments must allow cross-border gambling licenses, in accordance with EU law. Two months later, Portugal, obviously disagreeing with its Iberian neighbor, banned Bwin.party Digital Entertainment (BPTY.L) from advertising sports competitions in the country, claiming that the company’s activities were illegal. Elsewhere on the Continent, Belgium and Serbia are targeting and/or blocking unlicensed operators.

Taxation remains a key issue as well, as cash-strapped European governments look to raise revenue in any way possible to head off the potential sovereign debt crisis there. Operators in Greece must hand over 30% in gross profits to its bankrupt government; the rate is 17% in Germany, while France’s taxation and return laws are so restrictive that the head of the country’s own BetClic Everest complained that French gaming law “does not allow us to exist.”

The European Court of Justice (CJEU) has come out against such monopolies in Germany and Italy; but both verdicts came years after the regulation was passed and enforced, leaving the supposed victims to legally enter a market in which they have either a) previously operated in the black or “grey” market (as in the case of Bwin.Party in Germany) or b) must create a presence in an established market with dominant brands.

The above examples are just a small fraction of the regulatory and tax issues facing online gambling companies (a full accounting would require several volumes); but the end result is chaos, from an investment standpoint. It’s hard enough to choose among stocks in a given sector based on marketing power, leadership, valuation, and execution. Add in the political calculus required to assess the prospects in the 27 member countries of the EU, and the potential for regulation or judicial review at the federal level, and the average investor wants to just throw his or her hands up. As my colleague O’Donnell pointed out a week ago, the upcoming French presidential election is expected to have an impact on gambling regulation in that country (as it will likely do here in the US as well). Any parliamentary election – particularly in on a continent with revenue problems and a disgruntled populace – can equally change an operator’s business model, literally overnight. Ownership in online gambling stocks now seems to require a master’s degree in European politics, with an accompanying law degree focusing on the Treaty of Lisbon and its interpretation by the modern CJEU. This type of confusion hurts investors, lowers share prices, and requires that smart investors only enter in these companies at a discount to similar stocks in more stable, more traditional, and less government-reliant industries.

Unfortunately, the confusing European market is, with a few exceptions such as Australia, the only one available to investors. The US market, for all the New Year’s hype about the online poker “gold rush”, still appears set to be a fragmented, highly regulated, highly taxed, and slow-developing industry. Federal regulation still appears dead for at least 2012, and state movements have been delayed in California and reversed in the District of Columbia. There is also the matter of competition in the US; the partnerships between 888 Holdings (888.LN) and Caesars Entertainment (CZR), and Bwin.Party, Boyd Gaming (BYD) and MGM Resorts International (MGM) are not the only potential entrants into the US market. Facebook game producer Zynga (ZNGA) has signaled its interest in online gambling in the US. Slot maker International Game Technology (IGT) bought Facebook gaming company Double Down Interactive in January. IGT competitor Bally Technologies (BYI) recently released server technology for online gambling. And last week, racetrack operator Churchill Downs (CHDN) acquired Bluff Media, producer of poker content such as Bluff magazine and BluffMagazine.com. In its statement about the purchase, Churchill Downs noted that “the Company believes this acquisition potentially provides it with new business avenues to pursue in the event that there is a liberalization of state or federal laws with respect to Internet poker in the United States.” If and when the US (and/or individual state) markets open, it seems likely to face a flood of competition, which will likely require higher customer acquisition and retention costs, and thus profits perhaps below those expected by much of the market.

While regulation and taxation should lessen the euphoria about the US online poker market, there is another key question facing potential operators here in the States: just how big is the market? Multi-billion dollar estimates have been thrown around regularly, but, over in Europe, the online poker market continues to decline. Betsson AB (BETSB.SS) saw poker revenue decline 7% in the fourth quarter [pdf], over double-digit declines in each of the three previous quarters. Bwin.Party, owner of PartyPoker, saw poker revenues fall 10% in the first half, and earnings before interest, taxes, depreciation and amortization (EBITDA) fall 40%. (The company has not yet released second half earnings.) Smaller operators such as 888 Holdings and Betfair (BET.L) have seen growth – nearly 60% year-over-year in 888’s case – but the overall market appears relatively stagnant in Europe. Here in the US, where the “poker boom” has come and gone, similarly low revenue growth may be expected. Figures on the size of the US market post-UIGEA are hard to estimate, given the unlicensed nature of the industry at the time, the fact that leaders PokerStars and Full Tilt were privately held (and thus not required to release revenue figures), and the unreliability of some of the market’s operators (we’re looking at you, Full Tilt.) But, as an avid player at the time, anecdotally I can tell you that the poker market in the US matured, and quickly. In 2005, as the boom started, participation was higher, and the players were far worse. By 2008, the games – even at lower stakes – consisted mostly of skilled players passing chips back and forth; many so-called “professional” online players were showing breakeven results at the tables, simply living off the bonuses and rakeback programs afforded to higher-stakes players. Liberalization in the US will likely lead to a quick burst in revenues, but longer-term, weak players will fade away – as they did in 2005-06 – and it seems unlikely that the poker market in 2015 will be noticeably larger than it was 2007-08, even given strong, reasonable federal regulation and safe, trustworthy payment systems. A questionable future of high regulation, widespread competition, high taxation, and lower-than-expected revenue growth would seem to mean that the US market will not be the salvation that many equity investors anticipate.

On the other side of the world, in Asia, publicly traded online gambling companies essentially have no presence, as our own Calvin Ayre pointed out last year. Given that internet gambling is still banned in most of the Far East, it seems unlikely that online gambling companies – whose executives have been pulled off airplanes and arrested at press conferences in the West – are likely to be as brazen in flouting Chinese laws as they have been in Germany or the US. That market seems likely to be the world leader – as it is for land-based casinos – but, as yet, offers no entrance of any significance to investors.

On the other side of the world, in Asia, publicly traded online gambling companies essentially have no presence, as our own Calvin Ayre pointed out last year. Given that internet gambling is still banned in most of the Far East, it seems unlikely that online gambling companies – whose executives have been pulled off airplanes and arrested at press conferences in the West – are likely to be as brazen in flouting Chinese laws as they have been in Germany or the US. That market seems likely to be the world leader – as it is for land-based casinos – but, as yet, offers no entrance of any significance to investors.

With all the uncertainty and all the challenges facing the sector, the recent bull run in online gambling stocks seems to have priced in the most optimistic scenarios about online gambling legalization in the US, normalization of the regulatory structure in Europe and the sector’s reliance on a European economy that is already struggling and faces a potentially severe economic crisis. Year-to-date, 888 Holdings is up 35%; Unibet (UNIB.SS) 17%; Betfair (BET.L) 12%; Betsson AB 25%. (Ireland’s Paddy Power (PAP.L) and Bwin.Party are the laggards, though both performed strongly in the second half of 2011.) The resulting valuations – most of the stocks trade between 15 and 20 times earnings, with BPTY and 888 actually having negative trailing twelve-month profits – look fairly attractive, given the growth profile at most of the companies (888 saw revenue rise 26% in 2011, while Betsson, for example, continued to expand both revenue and profits). But investors right now seem to be forgetting that the industry must trade at a discount to account for the uncertainty and volatility in their business models. Can any investor, anywhere, predict with any degree of precision what, for example, 888’s profits might be in 2014? How many markets will it operate in? How much tax will it have to pay? How many competitors will it have? The answer is: who could possibly know?

Within the sector, Betsson AB looks like an attractive play; its focus on the more economically and politically stable countries in Scandinavia and the aforementioned 5% dividend yield, both make the stock less susceptible to political and financial winds than its competitors. Mike O’Donnell recommended online casino game developer Net Entertainment (NETB.SS) earlier this week, which might be an interesting play on the supplier side. It is a bit pricy at 21 times trailing earnings but paid out a 3.14% dividend and is clearly taking market share from larger rivals Playtech (PTEC.L) and privately held Microgaming. Still, there seems to be no rush to head into these stocks – or any others in the industry. The focus on Europe means that volatility is almost certainly going to attack the sector’s stock prices, as fears of Greek default and weakness in the Continental economy persist. For right now, these stocks are trading at a premium. The market seems to have forgotten that the myriad challenges and pitfalls facing the industry require a discount.